Chatbots as your Personal Finance Assistant

As described in our earlier blog on “Here’s all that you need to know about Chatbots”, ChatBots are software programs that are present in our messaging apps to perform different tasks. How about having a Bot that tracks our daily expenses and prevents unnecessary spending? It sounds amazing, right? Fintech companies have already started their path towards this trend. As Bots can be programmed for virtually anything, it would be possible for financial service organizations to build a financial advisor bot, broker, investment manager and virtually any other bot.

Image Credits: www.aliexpress.com

Chatbots/ Virtual Assistants are going to change the way we live radically. Banks and Fintech have ample opportunities in developing bots for reducing their costs as well as human errors. Chatbots can work for customer’s convenience, managing multiple accounts, directly checking their bank balance and expenses on particular things. Customers can do payments and automated transactions directly through a Chatbot without downloading any App. With the rising bars of customer expectations, there is a need for faster, highly personalized and safer solutions in finance management. A personal virtual assistant which is just one message away has the potential to be the most favoured way of accessing data on personal finances and information on financial products.

According to Gartner’s prediction by 2020, consumers will manage their 85% of the relationships with the enterprise without interacting with a human. Truly a great mandatory step to start thinking about Chatbots implementation now.

Some of the Finance areas where Chatbots are entering are listed below. They can act differently to serve the customers in a better way.

Financial Advisor

Chatbot can be programmed as a Financial Advisor. A finance bot can be your personal financial guide giving you advice on anything from investing your money in properties to buying a new car. This bot can be life-saver and the first step to organizing your life. A finance bot can also turn complex finance terminology into layman’s language, saving your time and reducing your pain.

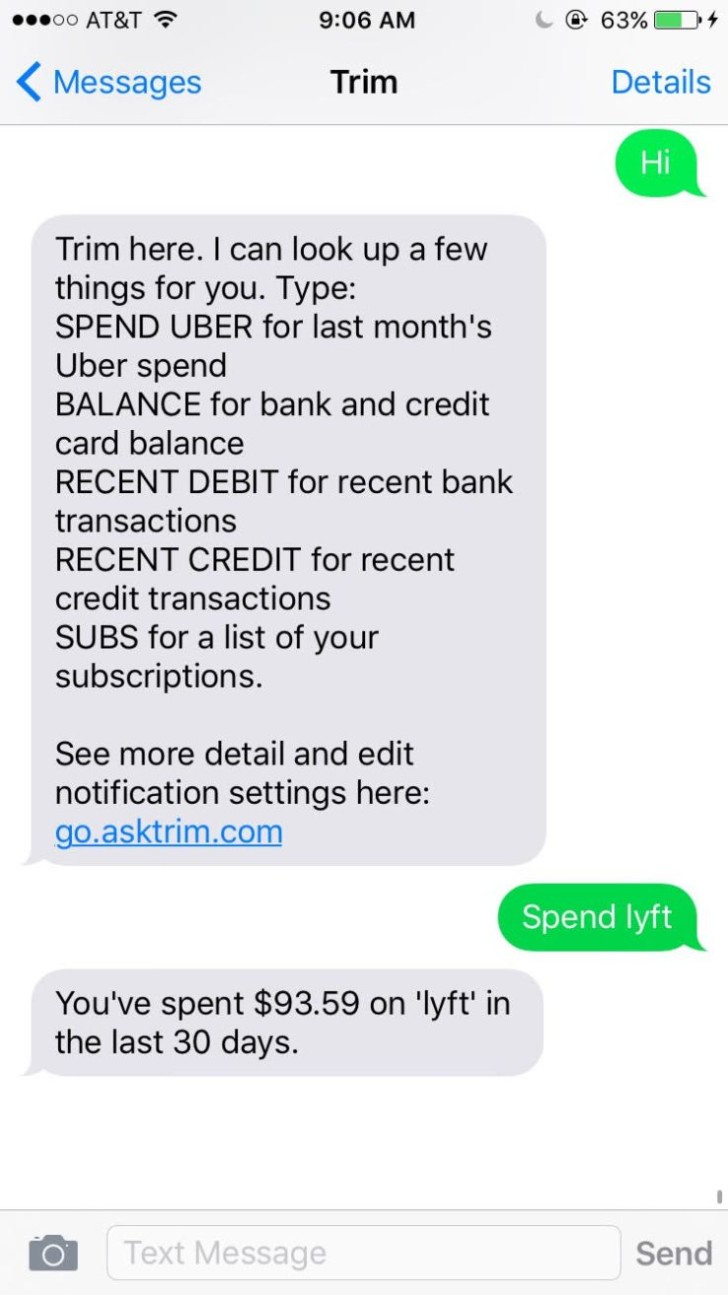

Expense Saving Bot

Expense Saving Bots help you save and cut down extra spending in your day to day life. One of the Expense Saving Bot examples is “Trim”. Trim is a Finance Chatbot that helps you manage your extra subscriptions, check out bank balances and set up spending alert. Trim can be found in SMS or Facebook messenger like other Chatbots and not in any app. Trim has helped users save $6,322,896 in total.

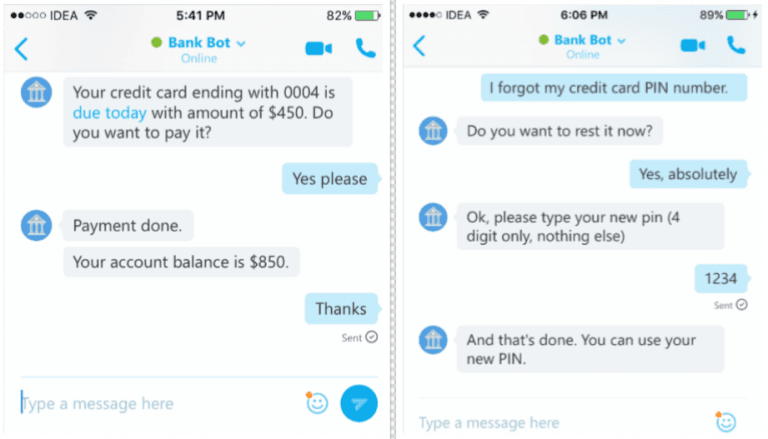

Banking Bot

Conversational Banking and messaging are turning out to be convenient ways to access your finances. Kasisto’s Artificial Intelligence platform is going to power a mobile-only bank in India, where all kind of customer requests will be handled by Chatbots. Kasisto trained its Finance Bot “MyKai” with millions of questions asked by customers during their banking experience. With a Banking Bot “MyKai” you are allowed to track expenses, manage money, and analyze spending across multiple accounts, all over Slack, Facebook messenger or SMS. MyKai is one of the examples of Banking Chatbots. My Kai is also now integrated with TradIt which will allow the bot to monitor the user’s investment portfolio, and follow market dynamics with the help of AI. TradeIT works with Nasdaq, Etrade, and other major brokers. MyKai as a Trade Stock Bot has been programmed to predefined questions about financial terminology and the user’s personal finance, to answer questions like What are my top holdings? How many shares do I own? Etc. Tasks such as Customer Alert, Money Transfer, Deposits checks, Inquiries, FAQs and search, Content Delivery channel, Customer Support, offers, etc can be easily achieved by banking bots.

Image Credits: http://www.veloxcore.com/chatbot-banking-sector-disruption-is-coming/

Tax Bot

Tax bots can help you track expenses and save your tax. It makes it easy to keep track of your business expenses and help you deduct your tax expenses. It can provide a running tally of the potential savings that you are accruing by documenting your deductible expenses. Tax Bots can also provide Tax tips, it can be integrated with your banks, and what not. One of the already existing Bots is TaxBot.

Incorporating superior natural language processing and machine learning capabilities will have significant advancement in Bots. There are and will be more examples of Chatbots in personal finance and banking sector. From customer service to news, users can communicate with a Chatbot to get an immediate response. Fintech Businesses can consider these options for increasing their customer engagement. It will also increase convenience for both customers and businesses, and reduce labor cost as well as human errors.