How to Build a Personal Budgeting App Like Mint: Complete Guide

In 2025, the personal budgeting app market is booming like never before. According to a survey from Business Research Insights, the global personal finance app market is projected to reach $21.4 billion in 2025, with a stunning 20.57% CAGR from 2024 to 2033.

Smartphone penetration and digital banking adoption continue to fuel this surge. Meanwhile, AI-powered features and predictive analytics are rapidly shifting basic tools into intelligent financial advisors.

An application like Mint can be an excellent choice for businesses seeking to target potential clients with high income potential. Building an app like Mint today isn’t just about tracking expenses; it’s about delivering real-time insights, automation, and personalized advice.

Users now demand seamless integration with bank accounts, investment portfolios, crypto wallets, and built-in bill reminders. Gamification and voice-based assistance are also gaining popularity, particularly among younger generations seeking inspiration to save and remain financially vigilant.

This article guides you through the essential steps and innovative feature development to create next-generation budgeting apps. You’ll learn what users expect in 2025, the tech stacks that support intelligent financial UX, and how to design with scalability and security at the core.

By 2025, personal finance management apps are expected to evolve into comprehensive financial wellness platforms. Building a budgeting app like Mint today means tapping into a growing demand for more innovative, more intuitive money management solutions.

Here’s why it’s an idea worth investing in:

1. Market Trends

1. Market TrendsToday’s budgeting apps are no longer just about tracking expenses; they’re transforming into AI-powered financial companions. Features like automated savings, bill negotiation, and personalized investment advice are now standard expectations.

Additionally, with the rise of open banking and fintech APIs, developers can seamlessly connect users to their entire financial ecosystem, creating unified, real-time insights across accounts, cards, loans, and even crypto wallets.

Modern users expect apps to do more than record transactions. They want goal-oriented savings tools, automated reminders, subscription tracking, and gamified experiences to keep them engaged.

With over 65% of millennials favoring apps for managing all financial activities in one place, there’s a strong demand for holistic solutions

There are multiple revenue models, including freemium plans, premium subscriptions, in-app ads, affiliate partnerships with banks and insurers, and offering paid financial advice and tools.

Embedded finance trends also create opportunities for cross-selling loans, credit cards, and investment products directly within the app.

A successful budgeting app isn’t just about tracking expenses; it’s about empowering users to take control of their finances.

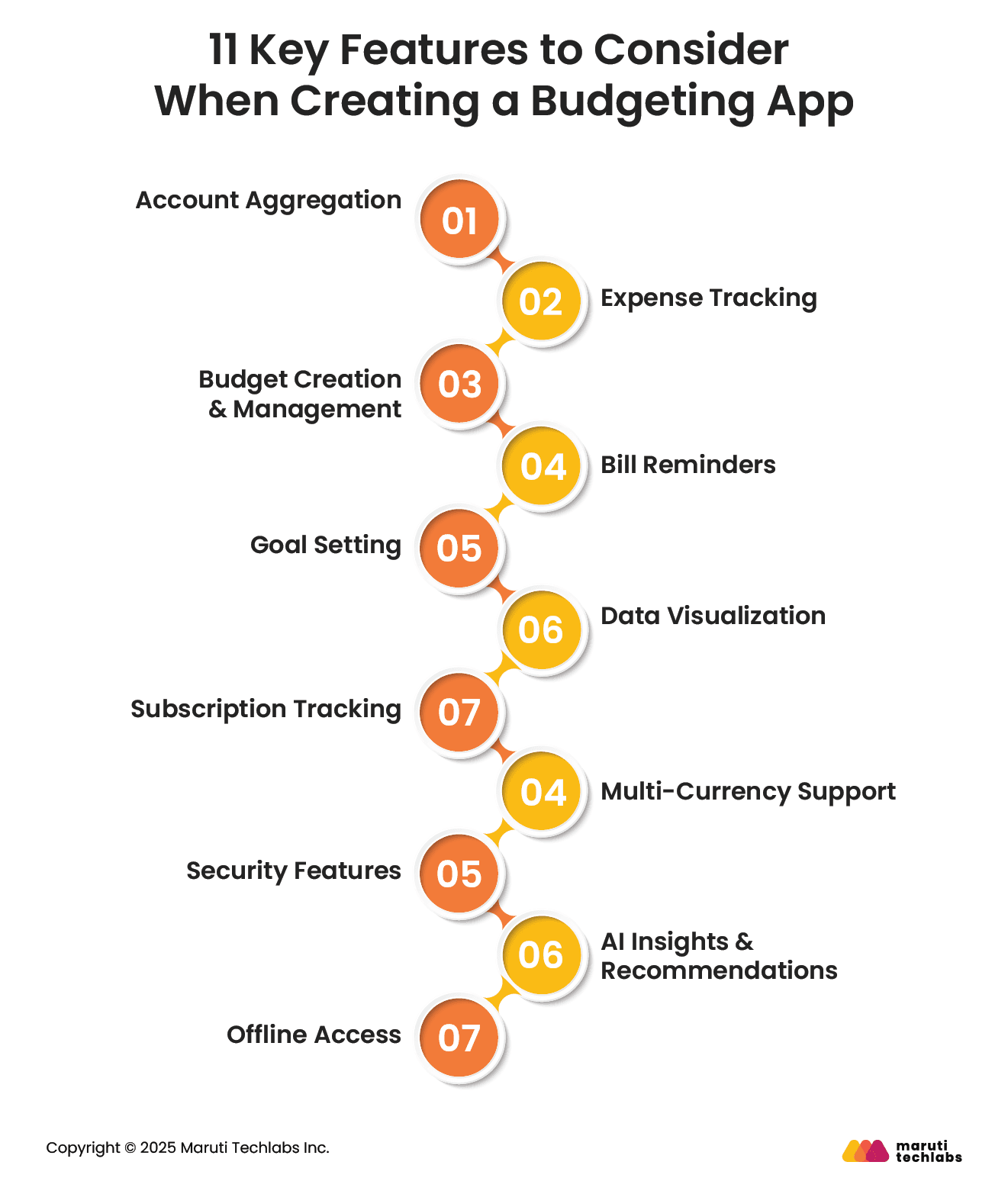

Here are 11 essential features and how they benefit users:

Connecting multiple bank accounts, credit cards, and wallets in one place.

Benefit: Gives users a unified view of their financial health.

Automatically categorizing and tracking all transactions in real-time.

Benefit: Helps users understand spending habits and cuts unnecessary costs.

Allows users to set budgets for different categories.

Benefit: Promotes disciplined spending and goal-oriented savings.

Send alerts for upcoming due dates.

Benefit: Reduces late fees and improves credit scores.

Enables users to set and track savings goals.

Benefit: Encourages saving for specific milestones like vacations or emergencies.

Offers charts and graphs for income and expenses.

Benefit: Simplifies understanding of financial trends over time.

Identify and manage recurring subscriptions.

Benefit: Prevents unnoticed auto-renewals and helps cancel unused services.

Supports international currencies for global users.

Benefit: Ideal for travelers and expatriates managing diverse accounts.

Integrate multi-factor authentication and encryption protocols.

Benefit: Builds trust by safeguarding sensitive financial data.

Provide personalized spending advice using AI analytics.

Benefit: Helps users make smarter financial decisions effortlessly.

Allow limited functionality without internet connectivity.

Benefit: Useful for tracking expenses anytime, anywhere.

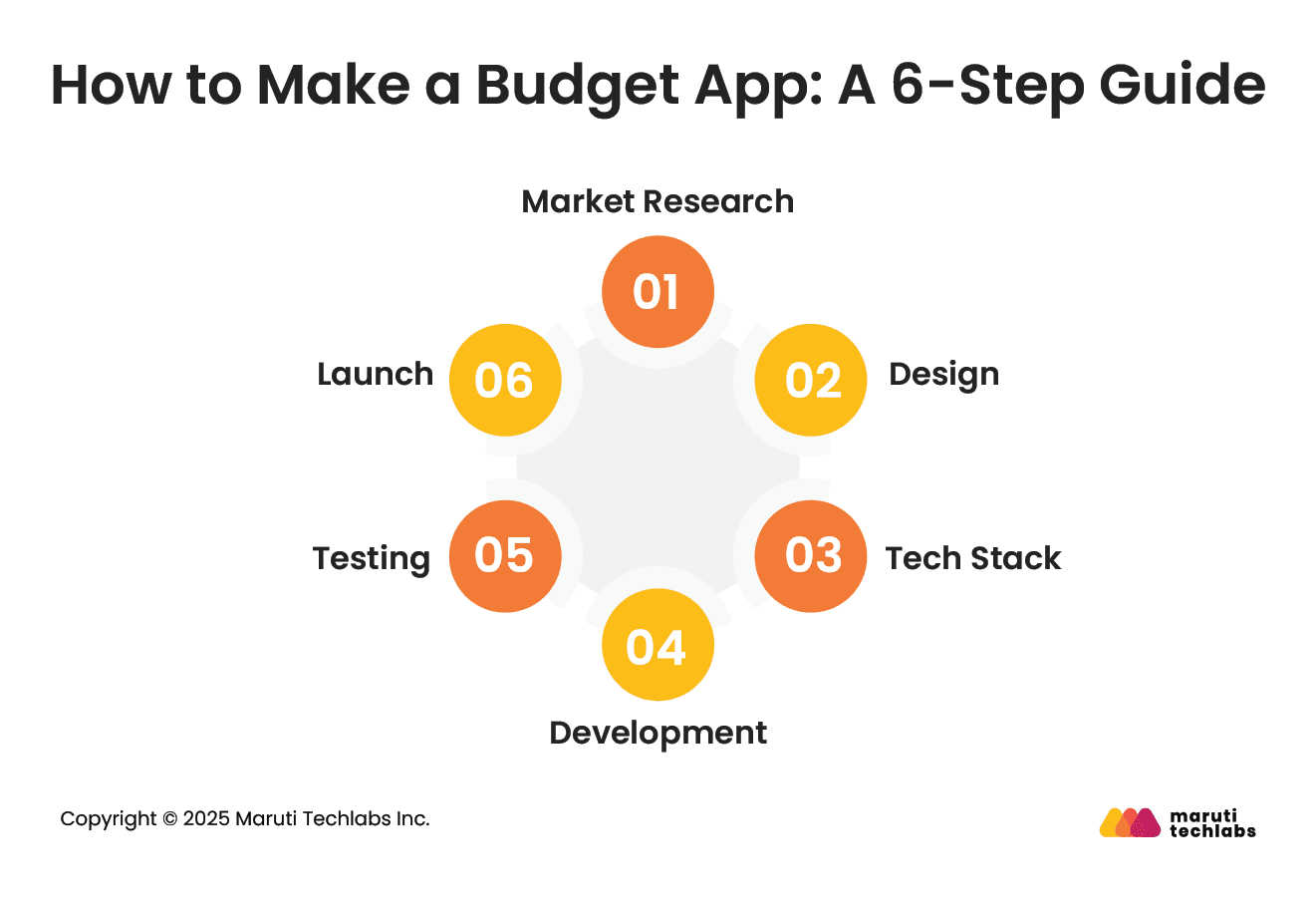

Building a budgeting app requires careful planning and execution to ensure it meets user needs and stands out in a competitive market.

Here’s a six-step roadmap to guide you through the process.

Conduct in-depth research to understand user pain points, preferences, and the offerings of competitors. Analyze trends in fintech, user demographics, and regulatory requirements. This helps identify unique features that will differentiate your app and align it with current user expectations.

Create an intuitive and user-friendly UI/UX that focuses on simplicity and engagement. Include dashboards, charts, and visualizations that make financial data easy to interpret. Ensure your design supports accessibility and works seamlessly across multiple devices and screen sizes.

Select a robust tech stack that prioritizes scalability and security. Consider cross-platform frameworks like Flutter or React Native, secure backend solutions, APIs for banking integration, and cloud services for real-time processing and storage

Start with MVP development to test core functionalities like expense tracking and account aggregation. Use agile methodologies for iterative development, allowing you to refine features based on early user feedback and market changes.

Perform rigorous testing to ensure reliability, security, and performance. This includes functional, usability, security, and stress testing across devices. Address bugs and optimize workflows to deliver a seamless user experience at launch.

Roll out the app with a soft launch to gather initial feedback. Develop a marketing strategy that focuses on app stores, social media, and partnerships with financial institutions. Post-launch, track analytics to optimize features and enhance user engagement.

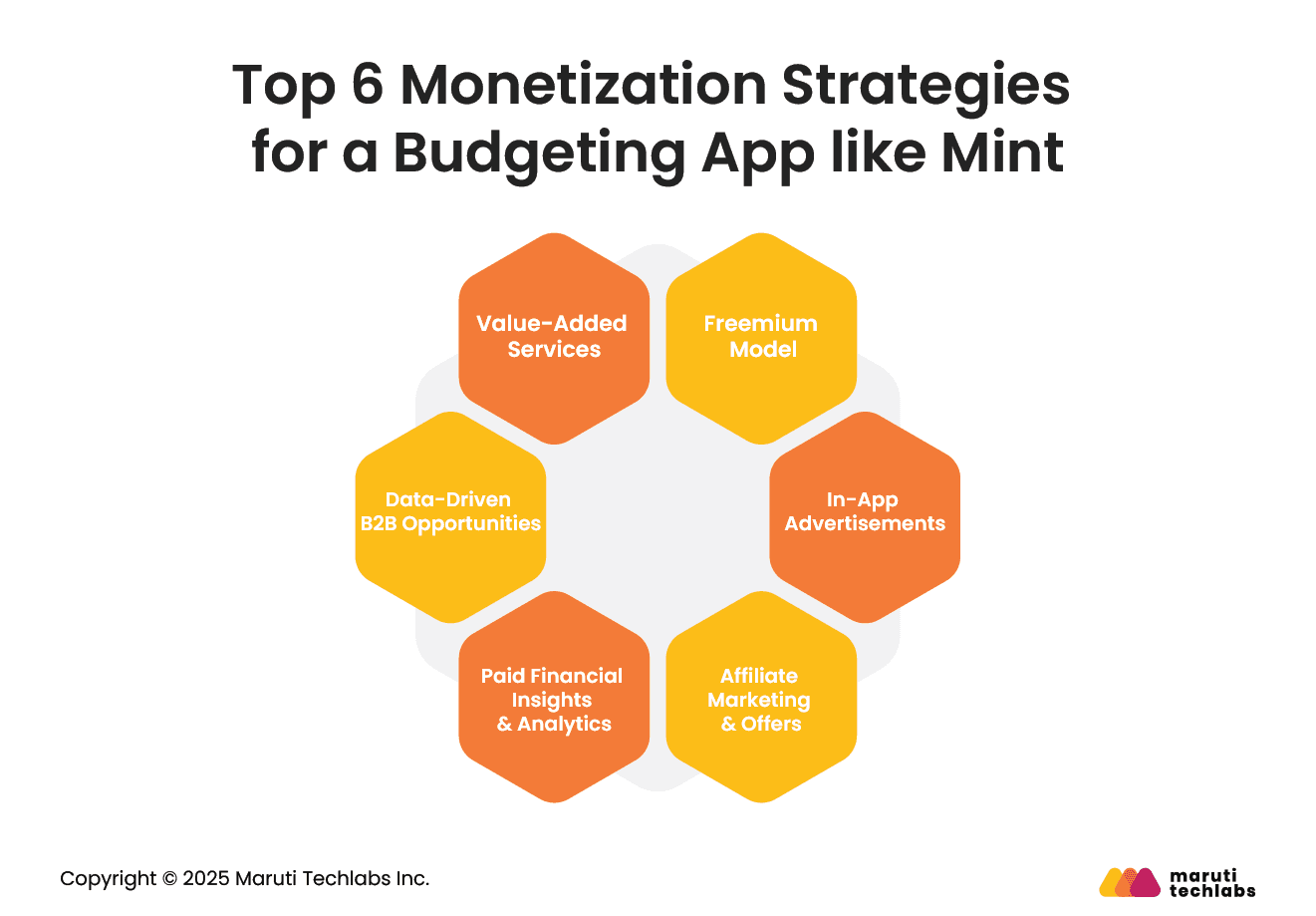

A budgeting app isn’t just a financial tool—it’s also a strong revenue generator when built smartly. From freemium models to data-driven insights, here are key monetization strategies to make your Mint-like app profitable and sustainable.

Offer core features for free while locking premium capabilities like advanced analytics, multi-account syncing, or financial coaching behind a subscription. This attracts a wide user base while converting power users into paying customers.

Display relevant, non-intrusive ads for financial services, credit cards, or insurance products. Contextual ads can enhance user experience and generate steady revenue without requiring all users to pay for premium features.

Partner with banks, investment platforms, or fintech services to promote their products directly in-app. Earn commissions for every user who signs up or completes a transaction through your affiliate links.

Provide AI-powered financial reports, forecasts, or tax optimization insights as a premium add-on. Users are willing to pay for data-driven recommendations that help them save money or achieve specific financial goals.

Offer anonymized, aggregated financial insights to businesses for market research. Ensure strict user privacy and compliance (GDPR, CCPA) while enabling brands to understand spending patterns and develop more effective financial products.

Integrate optional services such as credit score monitoring, loan comparison tools, or investment advisory services. Charge users per service or through a bundled premium subscription, adding recurring revenue streams to your app.

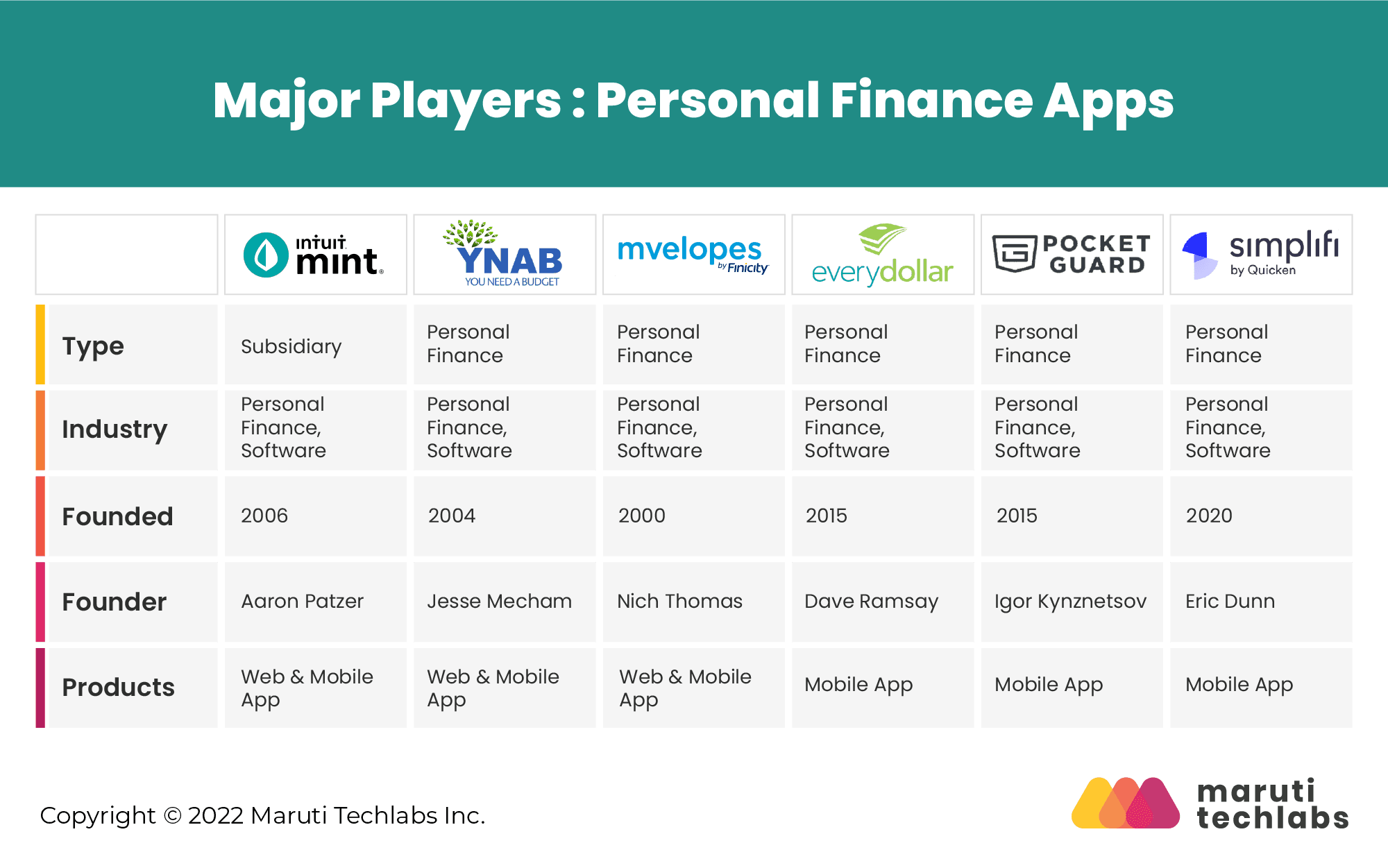

While Mint has long dominated the personal budgeting space, many users are exploring alternatives that offer more customization, modern features, and enhanced privacy. Here’s a quick look at the top 5 leading Mint competitors and what makes them attractive:

YNAB emphasizes proactive budgeting with a unique “give every dollar a job” approach.

Why Users Switch: More control over budgeting, hands-on goal setting, and stronger financial discipline tools compared to Mint’s passive tracking style.

A hybrid app that combines budgeting with wealth management features.

Why Users Switch: Better investment tracking, retirement planning tools, and net worth visualization—ideal for users seeking long-term financial planning alongside expense tracking.

Simplifies money management with its “In My Pocket” feature, showing how much disposable income remains.

Why Users Switch: Clean, beginner-friendly interface and intense focus on preventing overspending without overwhelming users with complex features.

Envelope-based budgeting app for those who prefer manual tracking.

Why Users Switch: Ideal for users who prefer to plan their spending upfront and opt for a simple, cash-envelope style system.

A modern alternative designed for real-time expense tracking and goal management.

Why Users Switch: Superior UI, real-time updates, and active support, attracting users frustrated with Mint’s occasional syncing issues.

While Mint continues to dominate the market, creating a mint budget app with more personalized features could provide users with an improved experience, positioning your app as a top Mint alternative. By focusing on user needs, security, and innovative features, you can create the best Mint alternative that offers a better budgeting experience. Partnering with a skilled development team will ensure your app is secure, scalable, and ready to compete in the growing fintech market.

Mint has become a household name in financial management, and we can learn a lot from its success when developing our app. As a product management company, we specialize in helping businesses like yours create intuitive layouts, easy navigation, and valuable features that enable users to make informed decisions. By focusing on what users need versus what's just nice to have, we can help you create a product that your customers will love and rely on.

The fintech sector is anticipated to be worth $500 billion by 2030, making it the perfect time to enter this industry. As with any business venture, building a scalable web application and mobile app requires technical expertise and a thorough market understanding.

Partnering with an experienced and reliable custom product development service provider is crucial to ensuring that your app will stand out from the crowd and occupy a prominent position in the app store. This is where we can help you!

Developing a new product is no joke—it can be a long and tedious process. However, your journey can be easier if you have the right tools and the right development partner at your disposal.

At Maruti Techlabs, we function as your end-to-end product development partner, helping you go through the entire process with the fewest hiccups. From UI/UX to development, product maturity, and maintenance, along with AI capabilities, we are a one-stop shop for SaaS application development services.

We start each project with a discovery workshop that will unveil the challenges and opportunities you can build upon. We’ll also help you determine what worked, what didn’t work, and why before moving on to the next phase of your product development journey.

We’re constantly working on adding more to our “Build An App Like” series.

Feel free to check out some of our other helpful App-like guides:

Our approach to product development is flexible and agile to adapt to changing needs while maintaining an efficient workflow throughout all phases of development. Our process enables us to seamlessly integrate with clients to create the products that matter most to their success.

Get in touch with our head of product development to get your great idea into the market quicker than ever.

Looking for a trusted mobile app development company Chicago businesses rely on? Maruti Techlabs is here to help.

Mint is a personal finance budgeting app that tracks spending and monitors bank accounts for fraudulent activity, shows aggregate expenditure by category, provides budgeting tools, and more to help your money go further. Mint operates by tracking a user’s income, purchases, and savings by syncing your bank accounts, credit cards, and retirement accounts and later automatically updating and classifying your costs.

There is no one right answer to this question. The app development cost for a budgeting app like Mint will vary wildly depending on its intricacy, feature set, development service rates, and app complexity. The more complex the app, the costlier it will be. It may cost up to $900K+ in North America, ~ $500K in the UK or Europe and somewhere around ~ $300K in Asia, specifically India.

Yes, Mint’s parent company, Intuit, uses advanced security and technology to protect its clients’ personal and financial information. Security methods include software and hardware encryption, as well as multi-factor authentication.

Mint is an outstanding personal finance application that has received several Editors’ Choice awards. It allows you to connect to your online banking accounts, check your credit score, and calculate your net worth, among other things. Even better, Mint is free!

Short answer – yes.

Yes, it is a budget-friendly app idea, as the initial investment on app development is very low. But one has to hire experienced developers and designers for designing the app.

Good question. Here is what’s in it for you when you consider Maruti Techlabs as your development partner: