Robotic Process Automation in Banking: Use Cases & Benefits

By 2025, Robotic Process Automation (RPA) has evolved from a cost-saving tool into a strategic pillar of modern banking. Financial institutions are no longer just experimenting with bots they’re scaling them across critical workflows like loan processing, compliance checks, fraud detection, and customer onboarding.

The trend is clear banks are prioritizing speed, accuracy, and scalability to stay competitive in an increasingly digital-first economy. A report from Accenture states that 36% of tasks in banking and capital markets can be automated.

Automation is more than efficiency, it’s transformation. RPA empowers banks to process millions of transactions with near-zero errors, reduce compliance risks, and free employees from repetitive tasks so they can focus on advisory and customer engagement. In a sector where trust and agility are paramount, RPA has become the backbone of sustainable growth.

In this blog, we discuss how RPA assists with different facets of banking and finance industries, most prominent use cases, and steps to deploy RPA in banking and finance.

Robotics in banking & finance is primarily defined as the use of a powerful robotic process automation software to –

RPA in the banking industry serves as a useful tool to address the pressing demands of the banking sector and help them maximize their efficiency by reducing costs with the services-through-software model.

To seize this opportunity, banks and financial institutions must adapt a strategic, and not tactical, approach. McKinsey foresees a second wave of automation and AI in the next couple years where machines & software bots will execute 10% to 25% of tasks across a myriad of bank functions, expanding the overall capacity and giving the workforce an opportunity to focus on higher-value tasks and projects.

The exponential growth of RPA in financial services can be estimated by the fact that the industry is going to be worth a whopping $2.9 billion by 2022, a sharp increase from $250 million in 2016, as per a recent report.

Over the last decade, banks and financial institutions are reported to have spent more than $321 billion on compliance operations as well as fines. Banks are estimated to disburse nearly $270 billion yearly, just on compliance operations. Almost more than 10% of a bank’s operating cost is attributed to compliance costs.

Rising operating expenses, compounded by regulatory fines along with fierce regulatory requirements slow processes down as well as influence and result in a poor customer experience. Throwing more people at the problem of finding new and better ways to manage compliance, while cutting down operational expenses is definitely not the answer.

Robotic Process Automation can enables banks & finance companies to reduce manual efforts, offer better compliance, mitigate risks, and enhance the overall consumer experience. Moreover, what makes automation most suitable for banks and financial institutions is that there are no additional infrastructure requirements coupled with its low-code approach.

Wondering how? Read on.

The primary aim of RPA in the banking industry is to assist in processing the banking work that is repetitive in nature. Robotic process automation (RPA) helps banks & financial institutions increase their productivity by engaging customers in real-time and leveraging the immense benefits of robots.

RPA is an extensive process, requiring robust employee training, structured inputs, and governance. However, once set up and implemented correctly, these RPA-based banking robots can take complete control of the system (mouse and keyboard) actions, including clicking & opening applications, sending emails, and copy-pasting information from one banking system to another.

Working in a similar fashion to the excel macro, these robots are made to work at the individual data field level across banking software systems for seamless functioning.

There are many banking related that can be automated leveraging technology. This primarily includes the KYC process, sharing specific documents, and customer service. Utilizing RPA these services can not only be automated increasing process efficiency but also offers significant cost and time savings. In addition, RPA when used with AI can aid with complex decision making processes like anti money laundering, compliance and fraud detection.

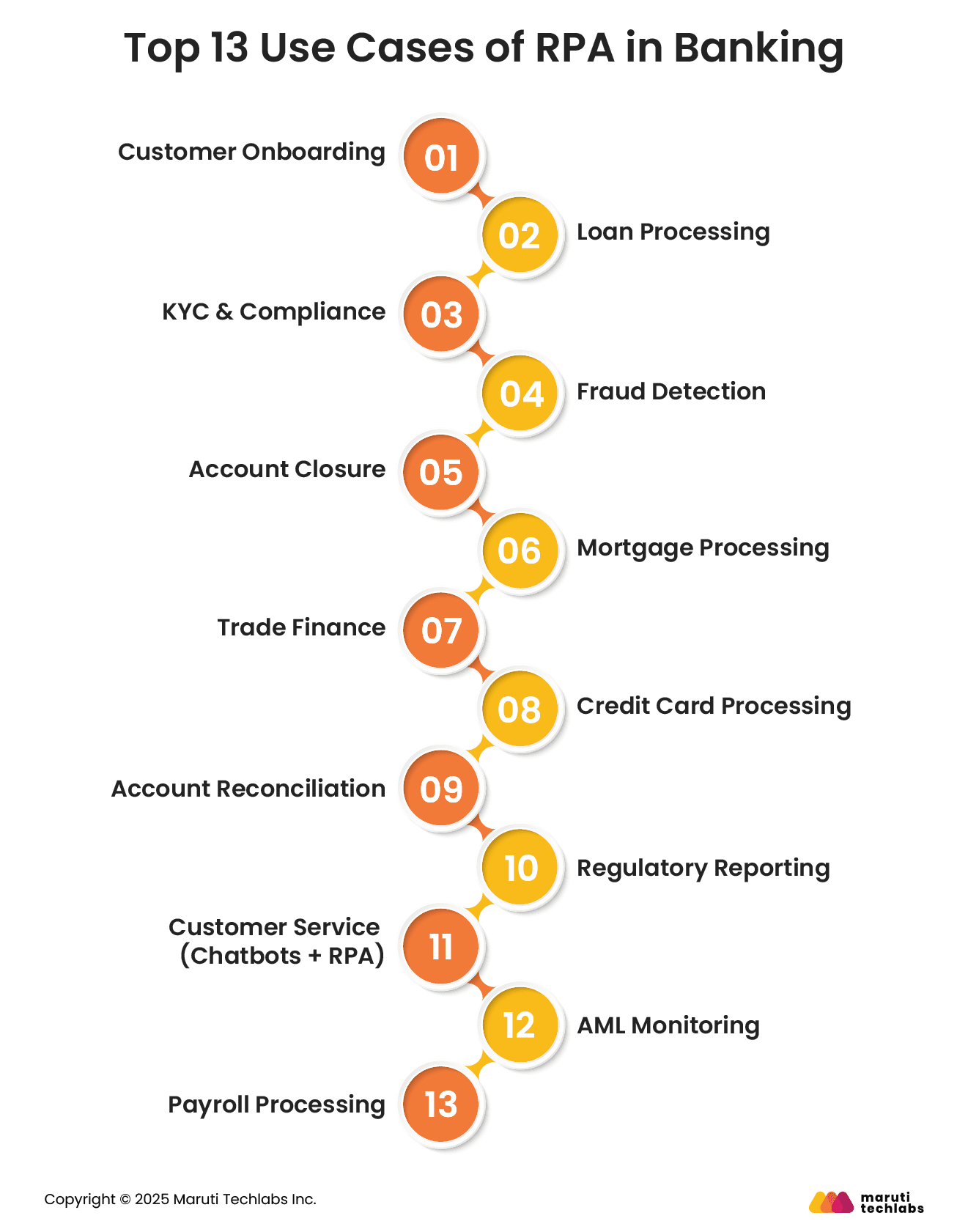

Here are the top use cases where RPA helps with numerous banking processes.

RPA automates KYC document collection, verification, and account setup, reducing onboarding time from days to minutes. This ensures compliance while offering customers a seamless experience, freeing staff from repetitive tasks and minimizing manual errors.

Bots handle application checks, credit scoring, document validation, and approvals, drastically reducing loan turnaround times. RPA ensures faster decision-making, minimizes human error, and improves customer satisfaction by offering near-instant eligibility checks and approvals.

RPA automates data collection, identity verification, and AML checks, ensuring regulatory compliance. This reduces compliance costs, avoids penalties, and maintains accuracy while enabling auditors to track every automated step with complete transparency.

RPA bots monitor real-time transactions for unusual patterns and flag anomalies. Integrated with AI, they strengthen fraud prevention by detecting risks faster, protecting customer accounts, and reducing reputational and financial damage to banks.

When accounts need closure, bots verify balances, ensure dues are cleared, and update systems across departments. This reduces delays, prevents oversight, and ensures customers have a smooth account termination experience without bottlenecks.

RPA automates mortgage data gathering, document checks, compliance validations, and approvals. What traditionally took weeks can now be processed in hours, improving efficiency, reducing paperwork, and providing customers with faster mortgage decisions.

Bots process trade documents, validate details, and check against sanctions lists. RPA accelerates letter of credit processing, reduces fraud risks, and enhances efficiency in handling international trade transactions for corporate clients.

RPA handles applications, background checks, credit scoring, and issuance quickly. Customers receive faster approvals, while banks reduce operational costs and enhance security by integrating fraud detection at the point of application.

RPA automates reconciliation of accounts across multiple systems, matching transactions, highlighting mismatches, and generating reports. This ensures accuracy, reduces audit risks, and drastically cuts down the time spent by employees on manual reconciliation.

Bots compile and format compliance reports by extracting data from different systems. This reduces reporting errors, ensures timeliness, and saves banks from costly fines while maintaining transparency and accountability with regulators.

RPA powers chatbots to resolve queries like balance checks, transaction history, and card reissues. This delivers round-the-clock support, reduces wait times, and lets customer service teams focus on complex queries.

RPA scans transactions against watchlists, monitors suspicious activity, and generates alerts. Combined with AI, it strengthens Anti-Money Laundering efforts, helping banks meet strict regulations while reducing manual workload and human oversight errors.

Banks also use RPA for internal operations like payroll. Bots handle salary calculations, deductions, and compliance checks accurately, reducing HR workload, preventing salary errors, and ensuring timely payments to employees.

Banking and financial institutions have always been known for their lengthy, manual processes affecting the overall productivity and customer satisfaction levels negatively.

Implementing RPA in the banking industry gives an excellent opportunity to automate some of the critical banking tasks listed below –

The volume of everyday customer queries in banks (ranging from balance query to general account information) is enormous, making it difficult for the staff to respond to them with low turnaround time. RPA tools can allow banks to automate such mundane, rule-based processes to effectively respond to queries in real-time, thereby reducing the turnaround time substantially.

One of the other time-consuming processes at banks is credit card applications, which typically take several days for validating the customer information before approving the credit card.

RPA, on the other hand, can help make quick decisions to approve/disapprove the application with a rule-based approach.

The number of account closure requests that banks have to deal with monthly is enormous. One reason is the non-compliance on the part of the clients in the submission of mandatory documents.

Robotic Process Automation allows the banks to tackle this issue by easily tracking all such accounts and sending them an automated notification & additional reminders for the submission of the required documents.

There are many benefits of RPA in business, including enhanced productivity, efficiency, accuracy, security, and customer service. Let’s briefly observe some of the benefits.

The fact that robots are highly scalable allows you to manage high volumes during peak business hours by adding more robots and responding to any situation in record time.

Additionally, RPA implementation allows banks to put more focus on innovative strategies to grow their business by freeing employees from doing mundane tasks.

Once correctly set up, banks and financial institutions can make their processes much faster, productive, and efficient.

Similar to any other industry, cost-saving is critical to the banking industry as well. Banks and financial institutions can look at saving around 25-50% of processing time and cost.

RPA in banking helps in generating full audit trails for each & every process, so as to reduce business risk as well as maintain high process compliance.

Whether you are looking to reduce manual errors or are achieving high accuracy at low cost, robots work 24×7 to complete the tasks assigned to them. Thus, reiterating the ever-present availability.

One of the benefits of RPA in financial services is that it does not require any significant changes in infrastructure, due to its UI automation capabilities. The hardware and maintenance cost, further reduces in the case of cloud-based RPA.

With RPA tools providing a drag and drop technology to automate banking processes, it is very easy to implement & maintain automation workflows without any (or minimal) coding requirements.

With RPA implementation, banks and financial services industry are using legacy as well as new data to bridge the gap that exists between processes. This kind of initiation and availability of essential data in one system allows banks to create faster and better reports for business growth.

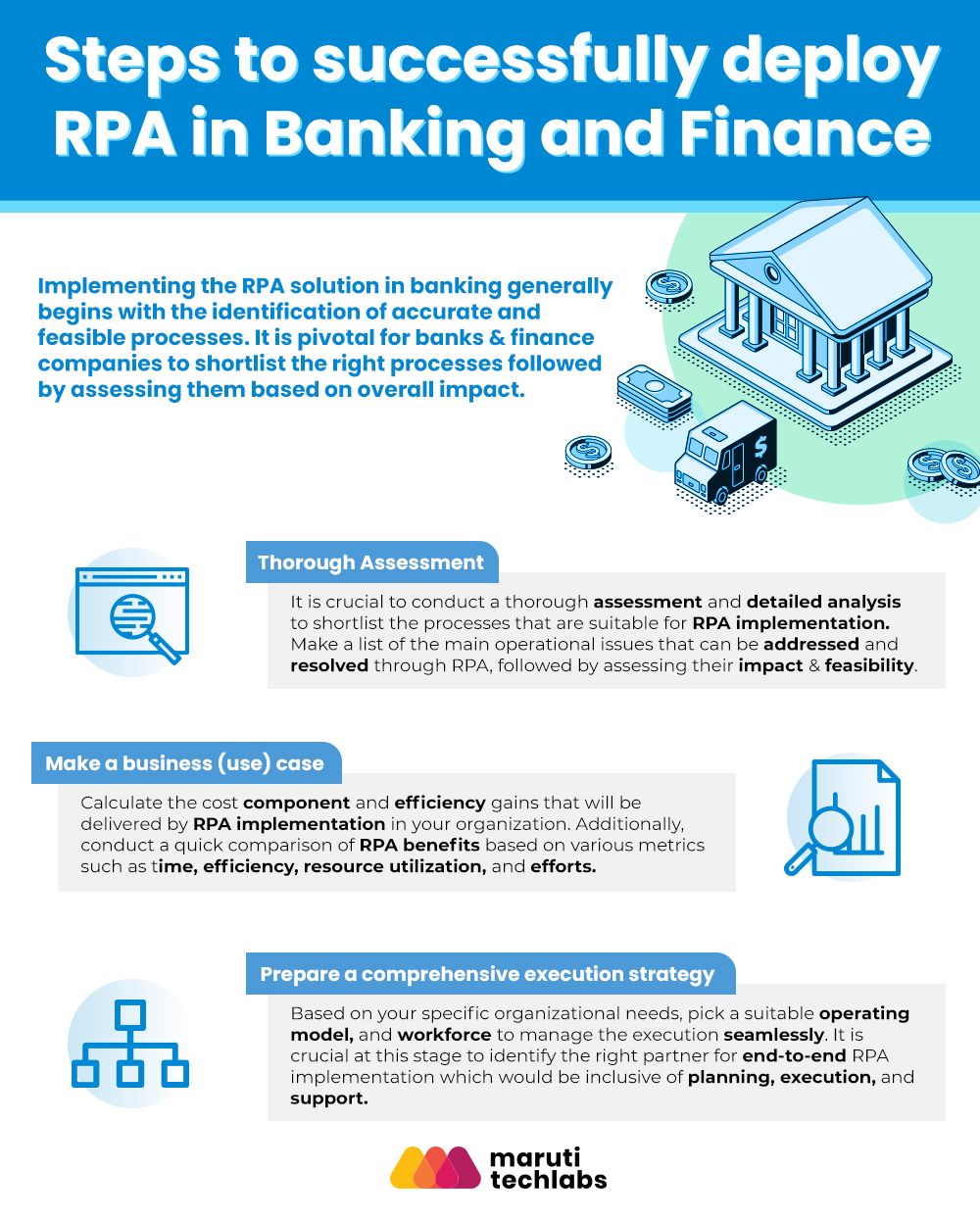

Implementing the RPA solution in banking begins with identifying accurate and feasible processes.

Here, we have outlined the important steps which help in successful RPA implementation –

First and foremost, it is crucial to conduct a thorough assessment and detailed analysis to shortlist the processes that are suitable for RPA implementation. Make a list of the main operational issues that can be addressed and resolved through RPA, followed by assessing their impact & feasibility.

In the next step, calculate the cost component and efficiency gains that will be delivered by RPA implementation in your organization. Additionally, conduct a quick comparison of RPA benefits based on various metrics such as time, efficiency, resource utilization, and efforts. Also, make sure to set achievable and realistic targets in terms of ROI (return on investment) and cost -savings to avoid disappointments due to misaligned expectations.

Based on your specific organizational needs, pick a suitable operating model, and workforce to manage the execution seamlessly. It is crucial at this stage to identify the right partner for end-to-end RPA implementation which would be inclusive of planning, execution, and support.

Remember that not all RPA vendors fit the specific requirements of an organization. Choosing the accurate RPA tool and implementation partner can be instrumental in impacting the final outcomes of the project.

Aspect | Traditional RPA | AI-Powered RPA | |

| Scope of Automation | Handles repetitive, rule-based tasks (e.g., data entry, form filling). | Automates both rule-based and complex tasks requiring judgment, interpretation, or decision-making. | |

| Data Handling |

| Can process structured, semi-structured, and unstructured data (emails, documents, images). | |

| Adaptability | Fails when processes change; needs reconfiguration. | Learns from data, adapts to changing inputs, and adjusts workflows automatically. | |

| Cognitive Abilities | No understanding of context; executes instructions as-is. | Uses AI/ML/NLP to understand context, intent, and patterns, enabling smarter decisions. | |

| Error Handling | Limited; struggles with exceptions or anomalies. | Detects anomalies, predicts potential errors, and self-corrects in many cases. | |

| Scalability |

| Scales intelligently by combining bots with AI models for dynamic workloads. | |

| Customer Experience | Improves efficiency but has limited personalization. | Enhances experience with personalized, context-aware interactions and predictive insights. | |

| Value of Business | Cuts costs and reduces manual workload. | Drives strategic value by enabling predictive, adaptive, and customer-centric operations. |

Some banks and financial institutions have already started implementing RPA in their operations, as they serve more like opportunistic and point based solutions that are quick & easier to implement, as compared to large scale transformations.

If implemented properly, Robotic Process Automation services can be genuinely transformative for the banking sector by automating manual, repetitive, and time-consuming tasks. The result of automating such mundane tasks would be seen in the form of enhanced productivity, a sharp reduction in the error rate, and an impressive turnaround time.

However, it is crucial to have a partner with proven expertise in RPA tools & technology throughout the process of implementation. Not only does this bring essential benefits to banks and financial institutions, but it can also guide them about when and how to transition from RPA to other next-gen tools such as AI, CPA (cognitive process automation) and beyond.

At Maruti Techlabs, we have worked on use cases ranging from new business, customer service, report automation, employee on-boarding, service desk automation and more. With a gamut of experience, we have established a highly structured approach to building and deploying RPA solutions. We work hand in hand with you to define an RPA roadmap, select the right tools, create a time boxed PoC, perform governance along with setting up the team and testing the solution before going live.

Interested in learning more about how RPA can serve you? Please contact us HERE.

Banks have to deal with huge volumes of data and human overseeing data is always prone to errors. As the stakes are high, a single error can result in legal cases of fraud or theft. This is where RPA can be used in banking where it offers assistance by monitoring transactions, mitigating potential risks, improve compliance by automated regulatory reporting, and more.

Robotic process automation can saves tons of money and time by removing manual errors, exponentially increasing process cycle time, enhancing data accuracy, allocation resources efficiently, and by streamlining compliance process.

RPA produces the most important commodity for finance companies - time. All the departments in finance function on analyzed and structured financial data to make quick and timely decisions. Employing advanced RPA can automate repetitive tasks, improve operational efficiency, and meet compliance mandates.

RPA improves efficiency of many banking processes. Here are its most prominent features.

Compliance activities in banking requires conducting rule based, repetitive tasks. Here are certain areas that can be automated with RPA.

Below is the list of criterias to keep in mind while choosing your RPA tool.

Here are a few things to remember when choosing a RPA implementation partner.

In 2025, RPA automates banking tasks like customer onboarding, KYC, loan processing, account reconciliation, compliance reporting, fraud detection, and credit card processing. It streamlines high-volume, rule-based workflows, reduces errors, accelerates decisions, and frees employees for customer-focused, value-driven work, making banking more agile and efficient.

RPA can potentially reduce finance operation costs by around 25–50%, depending on process complexity and automation maturity. Savings come from minimizing manual effort, reducing errors, and accelerating workflows. The actual impact varies, but most organizations see substantial cost optimization alongside productivity gains.