AI & Machine Learning in Finance: Use Cases, Benefits & Challenges

Machine learning is revolutionizing finance by enabling institutions to process massive volumes of data and extract actionable insights in real time.

From automating credit scoring and detecting fraudulent transactions to powering algorithmic trading and personalized advisory services, ML enhances decision‑making, reduces operational costs, and unlocks new revenue streams, reshaping the competitive landscape of banking, insurance, and investment management.

Hey there! This blog is almost about 2400+ words long and may take ~9 mins to go through the whole thing. We understand that you might not have that much time.This is precisely why we made a short video on the topic. It is less than 2 mins, and summarizes how can Artificial Intelligence & Machine Learning be used in Finance? We hope this helps you learn more and save your time. Cheers!

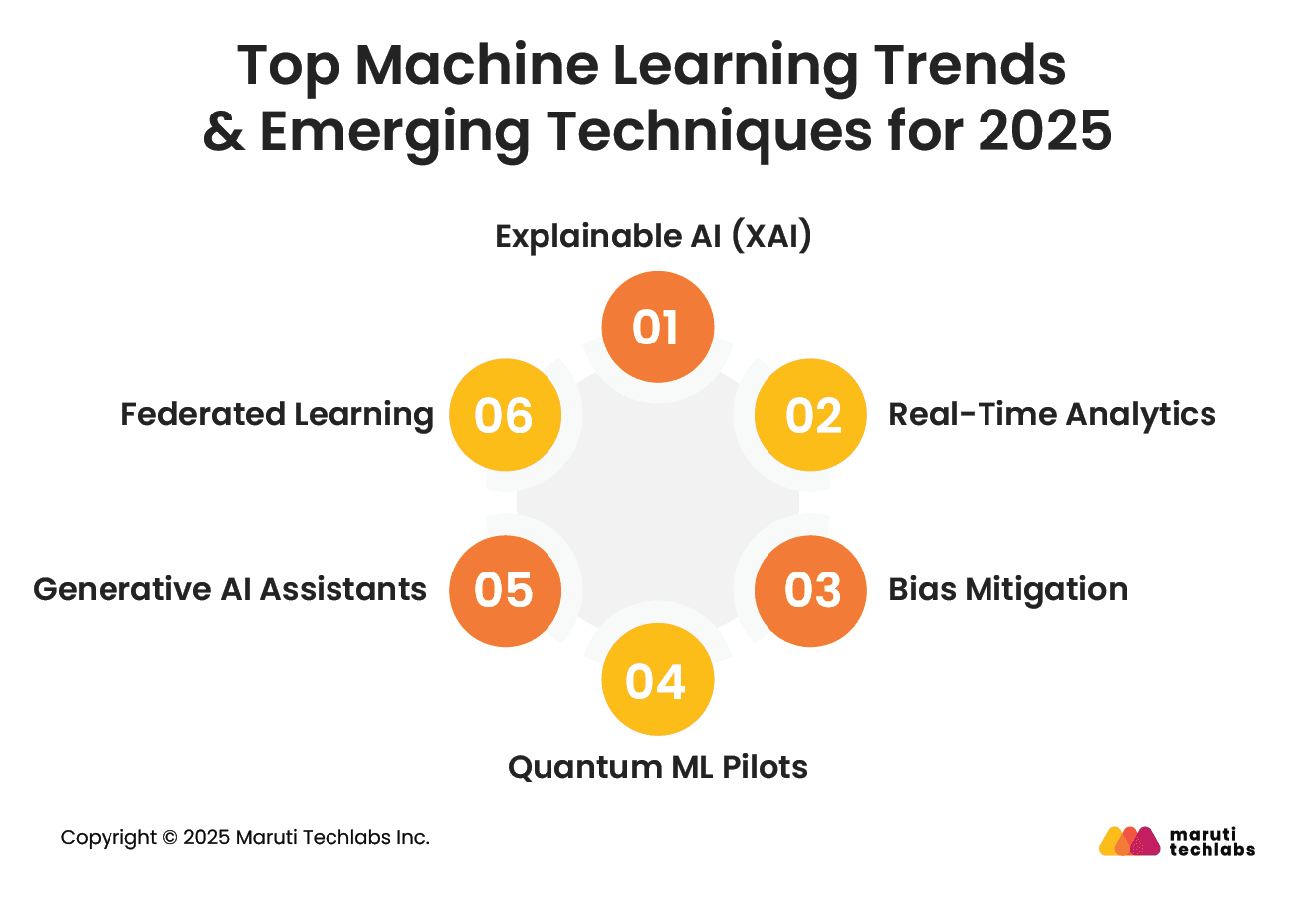

By 2025, the financial sector is embracing explainable AI for regulatory compliance, federated learning for privacy‑preserving collaboration, and real‑time analytics to respond instantly to market events.

Generative AI and quantum‑enhanced modeling are moving from experimental to pilot phases, offering speed, scalability, and predictive accuracy that redefine how institutions manage risk and serve customers.

According to a report by DDN, 70% of all financial services firms use machine learning to predict cash flow events, fine‑tune credit scores, and detect fraud, highlighting how deeply embedded ML already is in finance today

This article explores how machine learning is reshaping finance, covering emerging techniques, algorithms, and tools. It also addresses implementation challenges, ethical considerations, and bias mitigation strategies to help organizations deploy ML responsibly and unlock sustainable business value.

As finance matures in 2025, ML techniques are shifting toward transparency, real-time analytics, fairness, and cutting-edge innovation.

Regulatory scrutiny and customer trust have made explainable AI a necessity in financial services. Black-box models, while accurate, are no longer sufficient for credit scoring, loan approvals, or fraud detection.

Financial institutions now deploy XAI frameworks that provide human-readable model reasoning, enabling compliance with regulations like MiFID 2 and the EU AI Act. This transparency not only facilitates audits but also boosts customer confidence in automated decisions.

With high-frequency trading, instant payment systems, and continuous fraud monitoring, the demand for real-time insights is at an all-time high. ML models now process streaming data from transaction logs, market feeds, and IoT sensors to detect anomalies and trigger instant responses.

Financial firms can flag suspicious activity within milliseconds, dynamically adjust credit limits, or execute trades automatically, minimizing losses while capitalizing on market opportunities.

As AI adoption accelerates, mitigating algorithmic bias has become a top priority. Credit scoring models trained on historical data often reflect systemic inequalities, creating compliance and reputational risks.

In 2025, financial firms are using fairness toolkits, debiasing techniques, and fairness-aware model training to detect and correct skewed outcomes.

Continuous monitoring ensures lending and insurance decisions are equitable across demographics, aligning with ethical AI principles and upcoming regulatory frameworks.

While still in experimental stages, quantum machine learning (QML) is emerging in portfolio optimization, derivative pricing, and high-dimensional risk modeling.

Quantum algorithms allow financial institutions to analyze exponentially larger datasets and explore complex asset relationships far beyond classical computing limits.

Early pilot programs aim to reduce simulation time from hours to seconds, paving the way for competitive advantage in the next decade.

Generative AI is moving beyond hype to real-world impact. Banks and asset managers are using LLM-powered assistants to summarize regulatory reports, generate client briefings, and automate document processing.

In trading and research, generative models synthesize market intelligence and produce scenario simulations, helping analysts and advisors make faster, more informed decisions. This shift significantly boosts employee productivity while lowering operational costs.

Data privacy regulations restrict sharing sensitive financial information across institutions. Federated learning addresses this by enabling collaborative model training without centralizing raw data.

Multiple banks or insurance firms can contribute to a shared model, improving fraud detection or anti-money laundering capabilities while remaining compliant with GDPR and CCPA.

In 2025, pilot projects show federated approaches improving detection rates while protecting client confidentiality, a significant step toward secure cross-institutional intelligence.

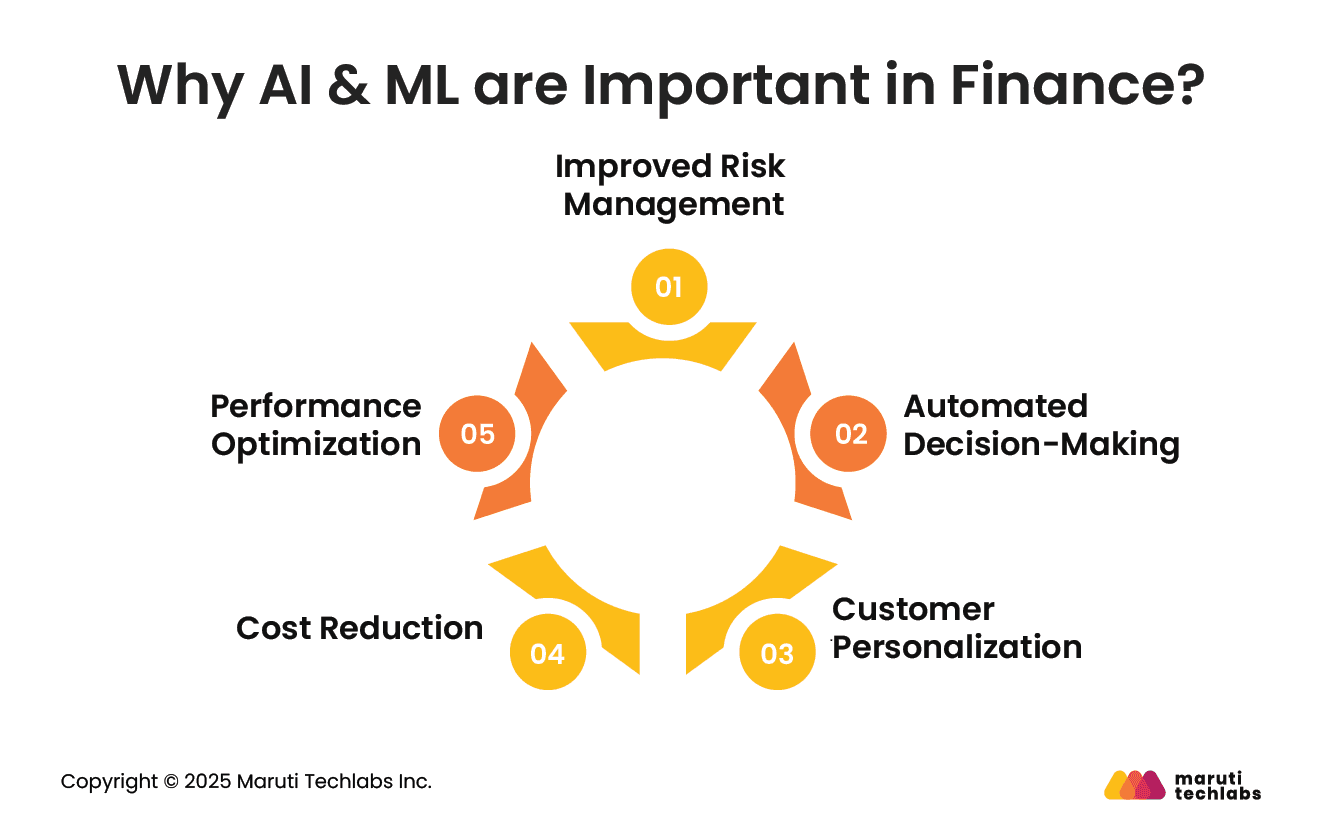

AI and ML elevate finance by offering predictive accuracy, automation, and strategic intelligence that transform risk evaluation, portfolio construction, and customer engagement. Here’s how it does it effectively.

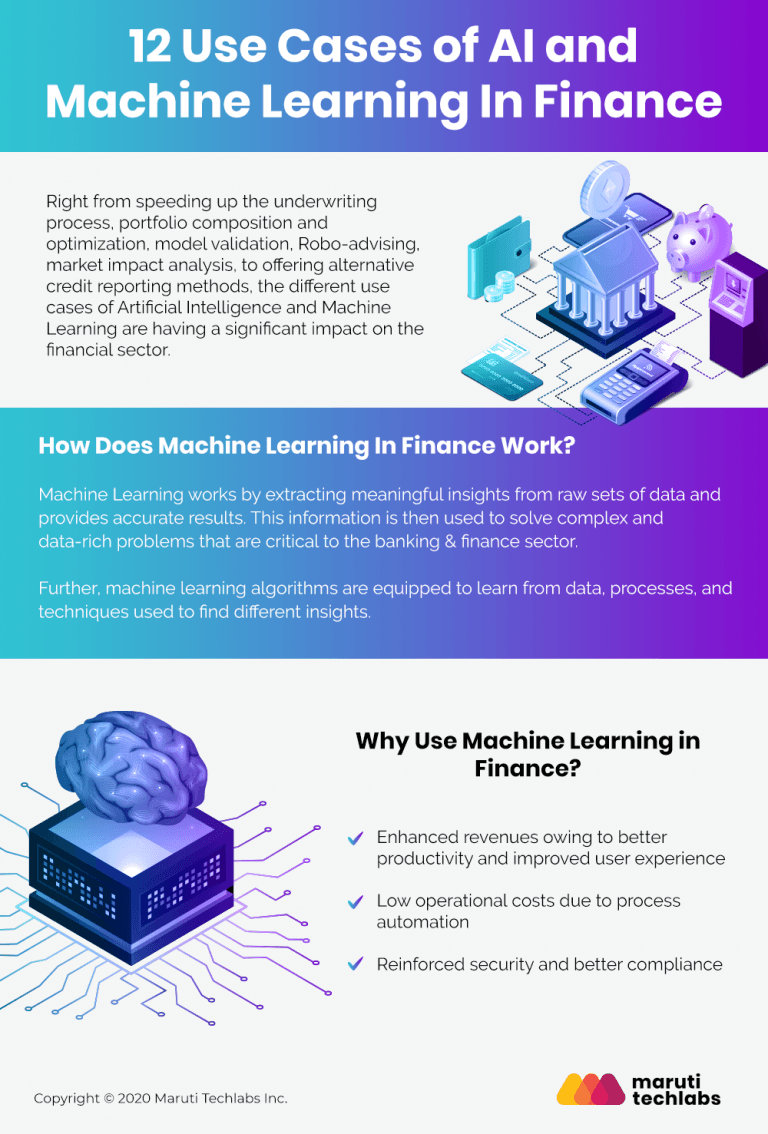

Machine Learning works by extracting meaningful insights from raw sets of data and provides accurate results. This information is then used to solve complex and data-rich problems that are critical to the banking & finance sector.

Further, machine learning algorithms are equipped to learn from data, processes, and techniques used to find different insights.

While developing machine learning solutions, financial services companies generally encounter some of the common problems as discussed below –

Financial services companies want to exploit this great opportunity, but they often fail due to unrealistic expectations and a lack of clarity on how AI in finance works (and where they need it).

Financial services companies often struggle with data management having fragmented chunks of data stored at different locations such as reporting software, regional data hubs, CRMs, and so on. Getting this data ready for data science projects is both time consuming and an expensive task for companies.

The combination of all such challenges results in unrealistic estimates, and eats up the entire budget of the project. This is the reason why finance companies need to set realistic expectations for every machine learning services project depending on their specific business objectives.

Here are some reasons why banking and financial services firms should consider using Machine Learning despite the above-said challenges.

Machine learning offers real-time solutions to time-consuming tasks by making complex decisions and accurate predictions. It also handles repetitive tasks, augments human capabilities, allows employees to perform other business functions, and increases productivity.

Chatbots and virtual assistants can offer fast and convenient services to customers 24/7. Additionally, personalized recommendations decrease the gap between decision and purchase. Plus, machine learning can be leveraged to predict customer needs and offer proactive solutions. These attributes help streamline the customer experience.

Once implemented, machine learning can perform many tasks that initially require a longer completion time while also decreasing the number of steps within the process. These aspects decrease the operational costs associated with different processes.

Machine learning can also learn user behavior and patterns of potential security threats and counter them with appropriate security measures. ML can prevent security breaches and suggest lapses within your system.

In addition, as financial organizations must adhere to many regulations to avoid civil and criminal penalties, machine learning can flag potential compliance issues and avoid reputational damage.

Until recently, only hedge funds were the primary users of Artificial Intelligence in finance. However, in the last few years, the applications of artificial intelligence solutions have spread to various other areas, including banks, fintech, regulators, and insurance firms, among others.

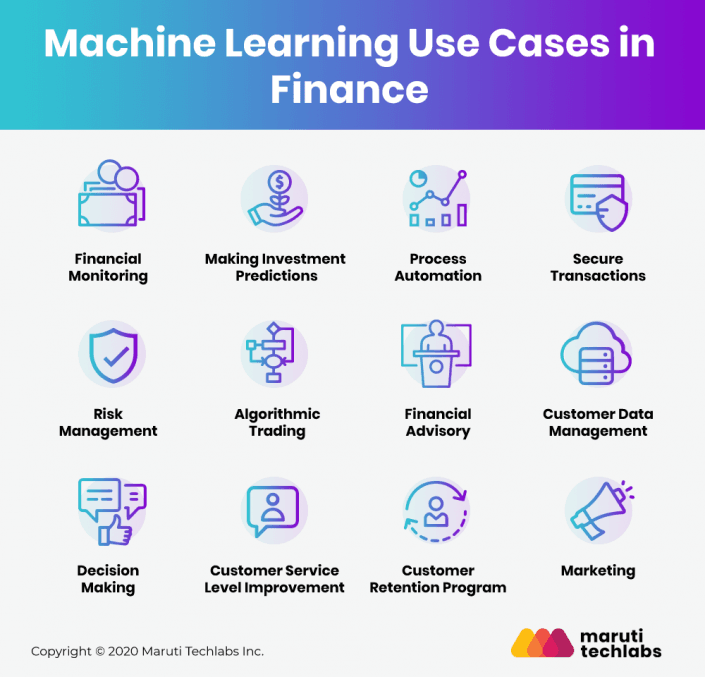

Right from speeding up the underwriting process, portfolio composition and optimization, model validation, Robo-advising, market impact analysis, to offering alternative credit reporting methods, the different use cases of Artificial Intelligence and Machine Learning are having a significant impact on the financial sector.

The finance industry, including the banks, trading, and fintech firms, are rapidly deploying machine algorithms to automate time-consuming, mundane processes, and offering a far more streamlined and personalized customer experience.

Here are a few use cases where machine learning algorithms can be/are being used in the finance sector –

Machine learning algorithms can be used to enhance network security significantly. Data scientists are always working on training systems to detect flags such as money laundering techniques, which can be prevented by financial monitoring. The future holds a high possibility of machine learning technologies powering the most advanced cybersecurity networks.

The fact that machine learning-enabled technologies give advanced market insights allows the fund managers to identify specific market changes much earlier as compared to the traditional investment models.

With renowned firms such as Bank of America, JPMorgan, and Morgan Stanley investing heavily in ML technologies to develop automated investment advisors, the disruption in the investment banking industry is quite evident.

Machine Learning powered solutions allow finance companies to completely replace manual work by automating repetitive tasks through intelligent process automation for enhanced business productivity. Chatbots, paperwork automation, and employee training gamification are some of the examples of process automation in finance using machine learning. This enables finance companies to improve their customer experience, reduce costs, and scale up their services.

Further, Machine Learning technology can easily access the data, interpret behaviors, follow and recognize the patterns. This could be readily used for customer support systems that can work similar to a real human and solve all of the customers’ unique queries.

An example of this is Wells Fargo using ML-driven chatbot through the Facebook Messenger to communicate with its users effectively. The chatbot helps customers get all the information they need regarding their accounts and passwords.

Machine Learning algorithms are excellent at detecting transactional frauds by analyzing millions of data points that tend to go unnoticed by humans. Further, ML also reduces the number of false rejections and helps improve the precision of real-time approvals. These models are generally built on the client’s behavior on the internet and transaction history.

Apart from spotting fraudulent behavior with high accuracy, ML-powered technology is also equipped to identify suspicious account behavior and prevent fraud in real-time instead of detecting them after the crime has already been committed.

According to a research, for almost every $1 lost to fraud, the recovery costs borne by financial institutions are close to $2.92.

One of the most successful applications of ML is credit card fraud detection. Banks are generally equipped with monitoring systems that are trained on historical payments data. Algorithm training, validation, and backtesting are based on vast datasets of credit card transaction data. ML-powered classification algorithms can easily label events as fraud versus non-fraud to stop fraudulent transactions in real-time.

Using machine learning techniques, banks and financial institutions can significantly lower the risk levels by analyzing a massive volume of data sources. Unlike the traditional methods which are usually limited to essential information such as credit score, ML can analyze significant volumes of personal information to reduce their risk.

Various insights gathered by machine learning technology also provide banking and financial services organizations with actionable intelligence to help them make subsequent decisions. An example of this could be machine learning programs tapping into different data sources for customers applying for loans and assigning risk scores to them. ML algorithms could then easily predict the customers who are at risk for defaulting on their loans to help companies rethink or adjust terms for each customer.

Machine Learning in trading is another excellent example of an effective use case in the finance industry. Algorithmic Trading (AT) has, in fact, become a dominant force in global financial markets.

ML-based solutions and models allow trading companies to make better trading decisions by closely monitoring the trade results and news in real-time to detect patterns that can enable stock prices to go up or down.

Machine learning algorithms can also analyze hundreds of data sources simultaneously, giving the traders a distinct advantage over the market average. Some of the other benefits of Algorithm Trading include –

There are various budget management apps powered by machine learning, which can offer customers the benefit of highly specialized and targeted financial advice and guidance. Machine Learning algorithms not only allow customers to track their spending on a daily basis using these apps but also help them analyze this data to identify their spending patterns, followed by identifying the areas where they can save.

One of the other rapidly emerging trends in this context is Robo-advisors. Working like regular advisors, they specifically target investors with limited resources (individuals and small to medium-sized businesses) who wish to manage their funds. These ML-based Robo-advisors can apply traditional data processing techniques to create financial portfolios and solutions such as trading, investments, retirement plans, etc. for their users.

When it comes to banks and financial institutions, data is the most crucial resource, making efficient data management central to the growth and success of the business.

The massive volume and structural diversity of financial data from mobile communications, social media activity to transactional details, and market data make it a big challenge even for financial specialists to process it manually.

Integrating machine learning techniques to manage such large volumes of data can bring both process efficiency and the benefit of extracting real intelligence from data. AI and ML tools such as data analytics, data mining, and natural language processing, help to get valuable insights from data for better business profitability.

An excellent example of this could be machine learning algorithms used for analyzing the influence of market developments and specific financial trends from the financial data of the customers.

Banking and financial institutions can use Machine Learning algorithms to analyze both structured and unstructured data. E.g., customer requests, social media interactions, and various business processes internal to the company, and discover trends (both useful and potentially dangerous) to assess risk and help customers make informed decisions accurately.

Using an intelligent chatbot, customers can get all their queries resolved in terms of finding out their monthly expenses, loan eligibility, affordable insurance plan, and much more.

Further, there are several ML-based applications which, when connected to a payment system, can analyze accounts and let customers save and grow their money. Sophisticated ML algorithms can be used to analyze user behavior and develop customized offers. For example, a customer looking to invest in a financial plan can be benefitted from a personalized investment offer after the ML algorithm analyses his/her existing financial situation.

Credit card companies can use ML technology to predict at-risk customers and specifically retain selected ones out of these. Based on user demographic data and transaction activity, they can easily predict user behavior and design offers specifically for these customers.

The application here includes a predictive, binary classification model to find out the customers at risk, followed by utilizing a recommender model to determine best-suited card offers that can help to retain these customers.

The ability of AI and Machine Learning models to make accurate predictions based on past behavior makes them a great marketing tool. From analyzing the mobile app usage, web activity, and responses to previous ad campaigns, machine learning algorithms can help to create a robust marketing strategy for finance companies.

Finance professionals rely on a core toolkit of ML algorithms and frameworks to power applications from credit scoring to anomaly detection. Here are the top algorithms and tools used.

Machine learning delivers tangible business value in finance, enhancing security, cutting operational costs, and boosting customer trust through data-driven insights and automated decision-making.

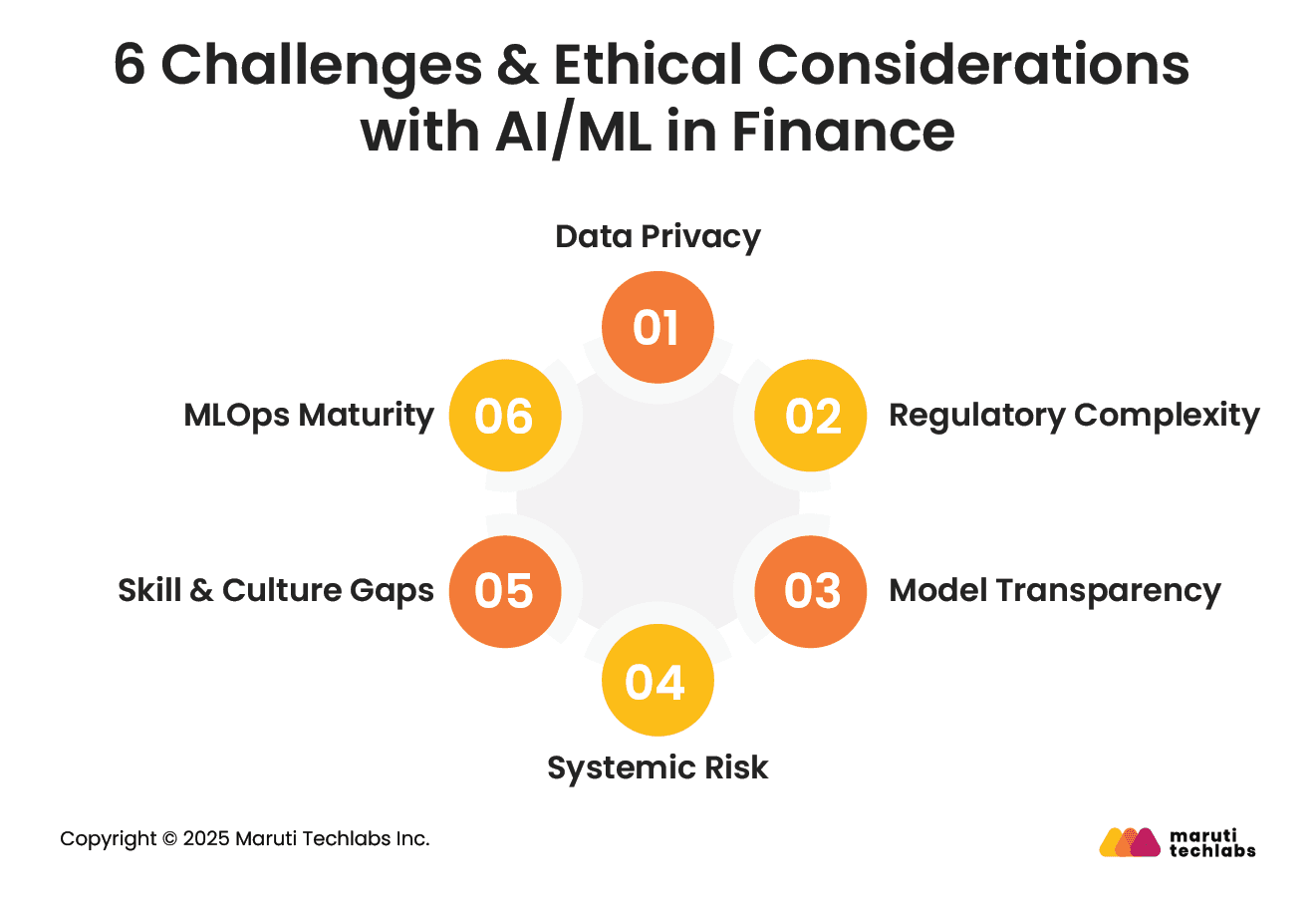

Adopting ML in finance brings challenges around trust, fairness, and governance that must be addressed responsibly.

While some of the applications of machine learning in banking & finance are clearly known and visible such as chatbots and mobile banking apps, the ML algorithms and technology are now being gradually used for innovative future applications as well, by drawing out historical data of customers accurately and predicting their future.

Apart from the established use cases of machine learning in finance, as discussed in the above section, there are several other promising applications that ML technology can offer in the future. While few of these have relatively active applications today, others are still at a nascent stage.

Although there are various applications of automated financial product sales/recommendations existing even today, some of them involve rule-based systems (instead of machine learning) where data still goes through manual resources to be able to recommend trades or investments to customers.

The future will see ML and AI technologies being actively used by insurance recommendation sites to suggest customers a particular home or vehicle insurance policy. Further, an interesting trend to watch in the future would be Robo-advisors suggesting changes in portfolios and a rapid rise of ML-based personalized apps and personal assistants offering more objective and reliable advisory services to the customers.

Data security in banking & finance is a critically important area. With all the information available online, organizations find it increasingly challenging to keep all the usernames, passwords, and security questions safe. The next few years will see a dramatic shift in this area where passwords, usernames, and security questions may no longer be the norm for user security.

Taking the security a notch higher, machine learning applications will transform future security within the industry with adoption of voice recognition, facial recognition, or other similar biometric data.

Adyen, Payoneer, Paypal, Stripe, and Skrill happen to some of the companies that have invested heavily in security machine learning.

Machine learning models can be of great help to finance companies when it comes to analyzing current market trends, predicting the changes, and social media usage for every customer.

Because human factors primarily drive the stock market, businesses need to learn from the financial activity of users continuously. Further, consumer sentiment analysis can also complement current information on different types of commercial and economic developments.

An increasing number of financial institutions are now prioritizing customer engagement for obvious reasons. Apart from helping them improve retention rates, it also helps them understand user behavior and their changing concerns and needs. An excellent example of this is the financial chatbots used for instant communication with the customer.

The future is going to see these chat assistants being built with an abundance of finance-specific customer interaction tools and robust natural language processing engines to allow for swift interaction and querying.

While this kind of specialized chatbot experience is not the norm today in the banking or finance industry, it holds great potential for the future. This is one application that goes beyond just machine learning in finance and is likely to be seen in a variety of other fields and industries.

Machine Learning today plays a crucial role in different aspects of the financial ecosystem from managing assets, assessing risks, providing investment advice, dealing with fraud in finance, document authentication and much more.

While ML algorithms are dealing with a myriad of tasks, they are constantly learning from the volumes of data, and bridging the gap by bringing the world closer to a completely automated financial system.

For most of the financial companies, the need is to start with identifying the right set of use cases with an experienced machine learning services partner, who can develop and implement the right models by focusing on specific data and business domain after thorough understanding of the expected output that is going to be extracted from different sources, transform it, and get the desired results.

At Maruti Techlabs, we work with banking and financial institutions on a myriad of custom AI and ML based models for unique use cases that help in improving revenue, reduce costs and mitigate risks in different departments. To learn more, write to us at hello@marutitech.com or get in touch with us, for a no-cost consultation and see how we can help you build and implement a long term AI strategy.

Not sure how ready your organization is to implement AI? Try our AI Readiness Calculator

to assess your current capabilities and identify actionable next steps for building a future-ready AI strategy.

Machine learning enhances forecasting accuracy due to its ability to observe nonlinear effects between scenario variables and risk factors, improving risk management.

2. What are the benefits of using machine learning for fraud detection?

Machine learning can identify suspicious activities on the spot by analyzing a large amount of data, including user behavior, device information, transaction history, and fraudulent patterns.

Machine learning algorithms can automatically discover patterns and insights from data, suggesting important investment options and strategies.

Machine learning encapsulates a wide array of data points with improved accuracy to offer an exact picture of the borrower’s creditworthiness. This results in precise credit scores and better loan decisions.

Customer services empowered with machine learning offer 24/7 accessibility and personalization, adding immense value to the consumer experience.

Challenges faced while implementing machine learning in finance include: