Revolutionizing Insurance Claims Processing with Machine Learning

If you’ve experience working with insurance claim processing, you might be familiar with the challenges that come with it:

The list goes on.

In today’s day and age, insurers aren’t as helpless as they were 20 years ago. The advent of automation technologies such as AI and machine learning is making waves in transforming the insurance claim processing system for good.

One of the core processes with insurance firms is claims processing. Claims processing manages policyholder claims, involving initial contact to case resolution tasks. It includes reviewing, investigating fraud, adjusting, and deciding on claim acceptance or rejection. Claims can be simple or complex, but legal and technical checks are necessary before approval.

Claims processing also involves time-consuming administrative duties that insurers may prefer to outsource.

To your advantage, Machine Learning (ML) is proficient in organizing structured, semi-structured, and unstructured datasets when applied using exemplary practices. Machine learning in claims processing has plentiful applications. ML has much to offer in automating internal processes, from self-service FNOL intake and document processing to damage evaluation and auto-adjudication.

The Chinese insurance industry has embraced technology, particularly AI, IoT, and big data, to revolutionize its services. Chinese tech giants have set a benchmark for pioneering insurance innovations. WeSure, emerging from the messaging app WeChat, celebrated a user base of 55 million on its second anniversary.

The main challenge for Chinese insurers is to move beyond traditional offerings and merge insurance with other financial services, thereby enhancing customer satisfaction. In contrast, the insurance industry in the US lags in customer experience metrics like Customer Satisfaction Score (CSAT) and Net Prompter Score (NPS), failing to meet rising expectations compared to other industries.

The claim-filling process is the most significant contributor to customer satisfaction. Therefore, let’s delve into the areas where you can implement machine learning in claims processing and the challenges you’d face while executing the same.

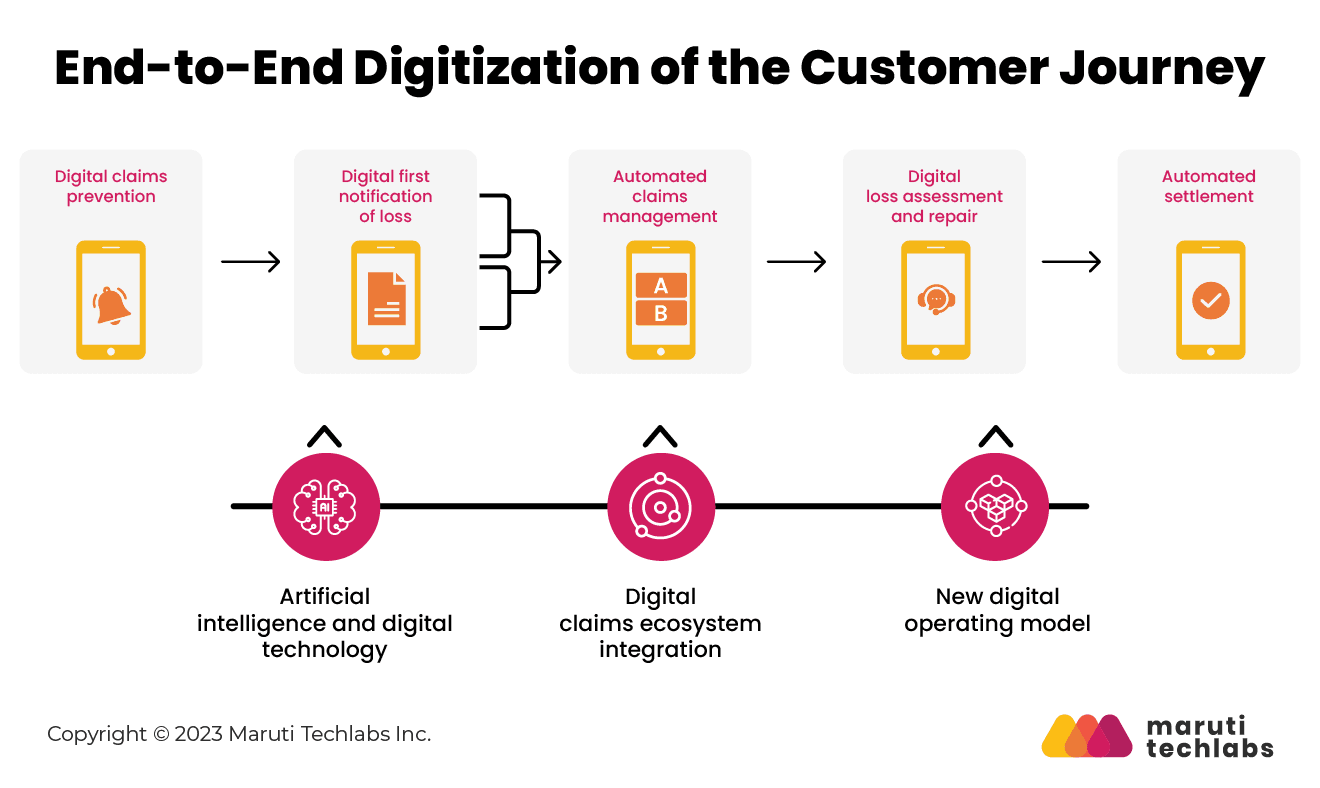

From claims registration to claims settlement, operational competence in insurance can be increased to a great extent by implementing machine learning in insurance claims.

It isn’t surprising that many companies have already introduced automated claims processing, enhancing customer experience while expediting their claims management process.

Machine learning in claims processing also offers the following advantages to insurers:

Tokio Marine, a multinational insurance holding company, is an evident example of AI-based claims document recognition system. They have implemented a cloud-based AI Optical Character Recognition (OCR) service to process handwritten claims documents.

With this initiative, the company reaped benefits such as reduced document overload, enhanced customer privacy and regulatory compliance, increased recognition rate, and quicker claims payments.

The insurance industry is adapting to insurtech to fully or partially automate particular tasks. For insurers, machine learning offers efficient and automated claims management, and advanced AI, when applied to big data sets, can denote new patterns and spot data trends.

To understand the contribution of AI and machine learning in claims processing, one must first learn the contributions of big data.

Earlier, due to the limitations in data storage, it was challenging to store volumes of information. However, it's no sweat for modern computers to store terabytes of data today. But how to find relevant data in such big data sets?

Only by using artificial intelligence and its subfields like machine learning can one extract sensible information from heaps of data. In claims processing, such abundant and meaningful data can be leveraged to examine claims more accurately while detecting subtle differences that aren’t visible to human minds.

Now, let’s look at how automation improves various aspects of claim processing. We’ll start with the first point of contact between the insurer and the claimant.

First Notice of Loss, or FNOL, is the primary report an insurance company receives that an asset is damaged, stolen, or lost. It’s a document that records the details of the incident and damages, followed by the customer’s narrative of what had transpired.

Many insurance firms still follow the traditional process of acquiring FNOLs via calls. But this process often demands numerous follow-ups to garner information from the insured.

eFNOLs are different from conventional ones. Here, the claimant doesn’t need to call the insurer or hand the documents in person. Instead, customers can try a chatbot or mobile app to fill in the required details, upload media files and document scans, and foster quicker and more accurate claims cycles for insurers.

These are the two main components of an automated FNOL intake system.

If you plan on investing in a modern claims management system for insurance, you can ask your provider which FNOL intake systems it integrates with. Few providers, such as Snapsheet and Guidewire, offer digital out-of-the-box FNOL interfaces. If their catalog offers nothing worthwhile, you can choose a third-party digital FNOL. Capgemini and Wipro offer digital FNOLs that can be integrated using APIs using your IT efforts.

If you’re working with a legacy system and don’t possess the resources or budget to modernize the same, you can still integrate digital FNOLs. You only need to connect with an older EDI connection, such as OneShield, and Netsmart. One of the other cheaper yet effective options is to design your own FNOL intake form congruent with your workflow.

eFNOLs also offer great assistance with enhancing customer experience. However, they might work differently for insurers that still follow their regular workflows, such as digitizing handwritten and photographic evidence, transcribing video and audio reports, and connecting with customers to learn missing information.

Advancement in technology does offer claims processing solutions to the limitations mentioned above. Let’s have a look at what those solutions are.

Optical Character Recognition (OCR) has been at the forefront when processing physical documents. It identifies handwritten and printed text to machine-encoded text.

Though efficient with converting typed text, OCR relies on manually created templates. Therefore, it sometimes makes mistakes with critical information such as name, date, or price. This would make the digital copy useless. And the files processed using OCR would have to be manually verified, contrary to automation.

A coherent substitute for OCR is Intelligent Document Processing (IDP), also known as Cognitive Document Processing (CDP), or ML OCR. This AI-based technology can better document quality, systemize documents, and extract unstructured data that can be revamped as meaningful structured data using natural language processing, deep learning, and computer vision.

One of the most common applications of IDP is in Robotic Process Automation (RPA), where it automates standard business processes using predefined workflows.

For instance, an RPA bot equipped with IDP can scan customer documents, extract relevant information from media and text, and share it for further processing, like fraud detection or manual verification, without human intervention.

When hit by cataclysmic occurrences or during prime season, insurers experience maximal claim intakes. They have to prioritize claims quickly, delegating them to the right person.

Claims triaging is classifying high volumes of claims swiftly. The same can be concluded effectively using predictive analytics.

Predictive analytics, as the name suggests, aims to determine the probability of future events. It does the same by applying machine learning and statistics to historical data. Insurance firms collect and structure data about accident carriers.

Applying predictive analysis to this data can yield results that help distinguish those that can be automatically accepted from the ones that need human intervention.

According to Genpact, here’s the stepwise representation of this process.

Conventionally, damage estimation for vehicle claims is done manually in a repair shop or through an adjuster examination at the accident site. This process is time-consuming as it takes days to obtain claim reports from the adjuster, which must be rectified by the insurance provider for corrections or unfair payouts.

Machine learning in claims processing can shorten this buffer period when implemented correctly. The model created can compare the uploaded smartphone images to its vast database of damaged car pictures to learn the severity and estimated costs of the damage.

Additionally, computer vision in claims processing can be leveraged to automate property claims. For instance, following a catastrophe, damaged homes need a thorough inspection.

Inspecting damaged houses' roofs can be unsafe, involving various departments and numerous types of equipment. Due to the cumbersome nature of the process, companies today are readily investing in drone inspection with automated damage detection. To conduct this process with utmost accuracy, drone inspection providers such as Kespry, Loveland, and IMGING offer image detection tools that observe precise roof wireframes, highlighting the damage on the image.

This solution can be applied to crop insurance. Though only some successful implementations are used for agriculture claim validation, we are confident that parallel datasets can support image detection models offering accurate loss estimations.

How Maruti Techlabs Transformed Image Recognition to Streamline Car-Selling

We've had our fair share of experience working with computer vision for one of our clients McQueen Autocorp.

Maruti Techlabs effectively addressed image recognition challenges for McQueen Autocorp, a prominent US-based used car-selling company. Facing issues with managing the influx of car images and identifying inappropriate content, Maruti Techlabs implemented a computer vision solution. This model classified images into car and non-car categories, allowing for efficient content filtering and eliminating the need for manual verification.

The system also cross-referenced vehicle models mentioned in user forms to detect discrepancies. Initially achieving 85% accuracy, the model's performance improved to 90% within six months through supervised learning and upgrades. This transformation streamlined the car-selling process, replacing time-consuming manual verification with an automated, accurate, and efficient image recognition system.

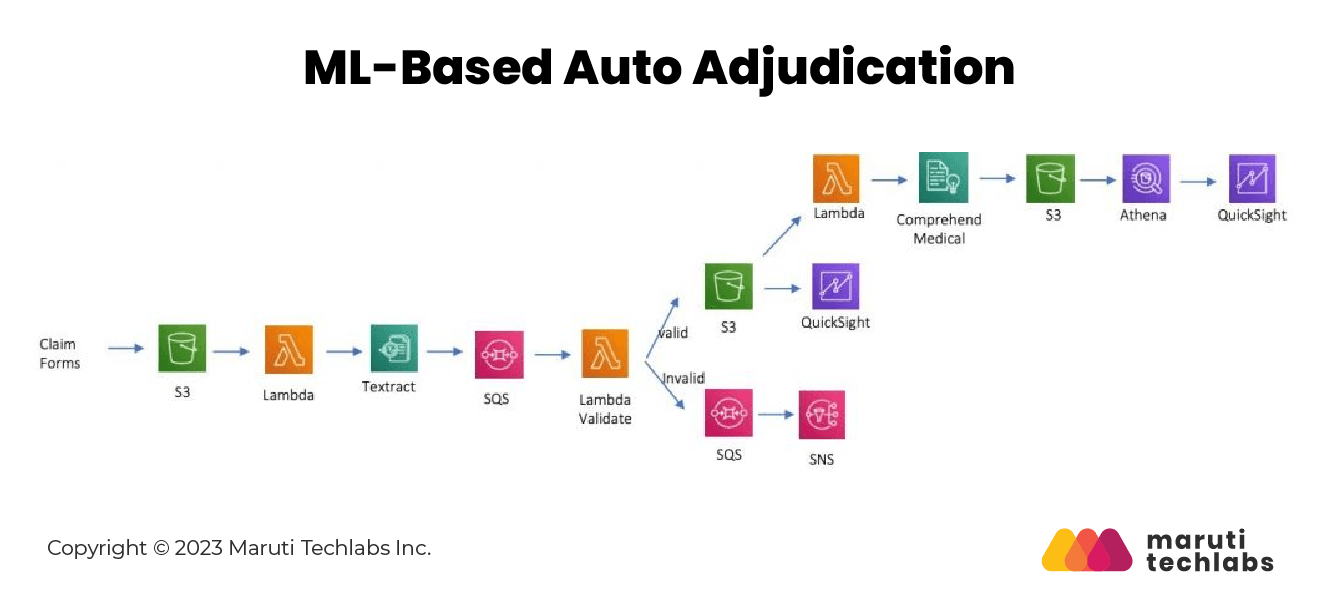

Claims adjudication refers to accepting or rejecting a claim by verifying the claim’s correctness and validity. The company staff does the adjudication process and comprises a variety of diagnoses and procedures with numerous other checks.

Many of these checks are repetitive and don’t require human assistance. Hence, there lies room for automation.

Here are the top two solutions that you can explore.

Every insurance business has its own claims processing system guarded by rules and regulations. These rules are then applied to compute a claim’s eligibility. The claims processed through these engines are validated based on predefined criteria, in-built datasets, and handling logic.

One can operate these engines seamlessly, but their functionality is limited to the business cases fed into the system. But to introduce a self-learning system, you must invest in advanced automation technologies.

Considering the nature of the claims management process, rules are bound to fall short. One can't define rules to examine non-standardized images and documents or to inculcate anti-fraud intelligence. It demands human intervention. Yet many of the underlying processes can be automated.

The foremost challenge with this model is image extraction. To decrease human involvement, an ML-based model equipped with computer vision and natural language processing can extract data and share them with the rules engine to conduct standard analysis. AI and machine learning in claims processing has enhanced the experience for both customers and adjudicators.

Insurance companies today know the benefits of machine learning in claims processing, such as supplementing better decision-making and expediting business processes.

A survey from Ernst & Young states that 87% of policyholders believe the claims processing experience impacts their decisions to remain with insurers.

Insurance companies that are willing to institute efficiency improvements in claims processing with AI should start their journey with minor but beneficial upgrades. Insurers can then invest in significant transformations by calculating the time and resources required and results tracked from these small automation upgrades. Although, you must brace yourself to tackle the obstacles encountered.

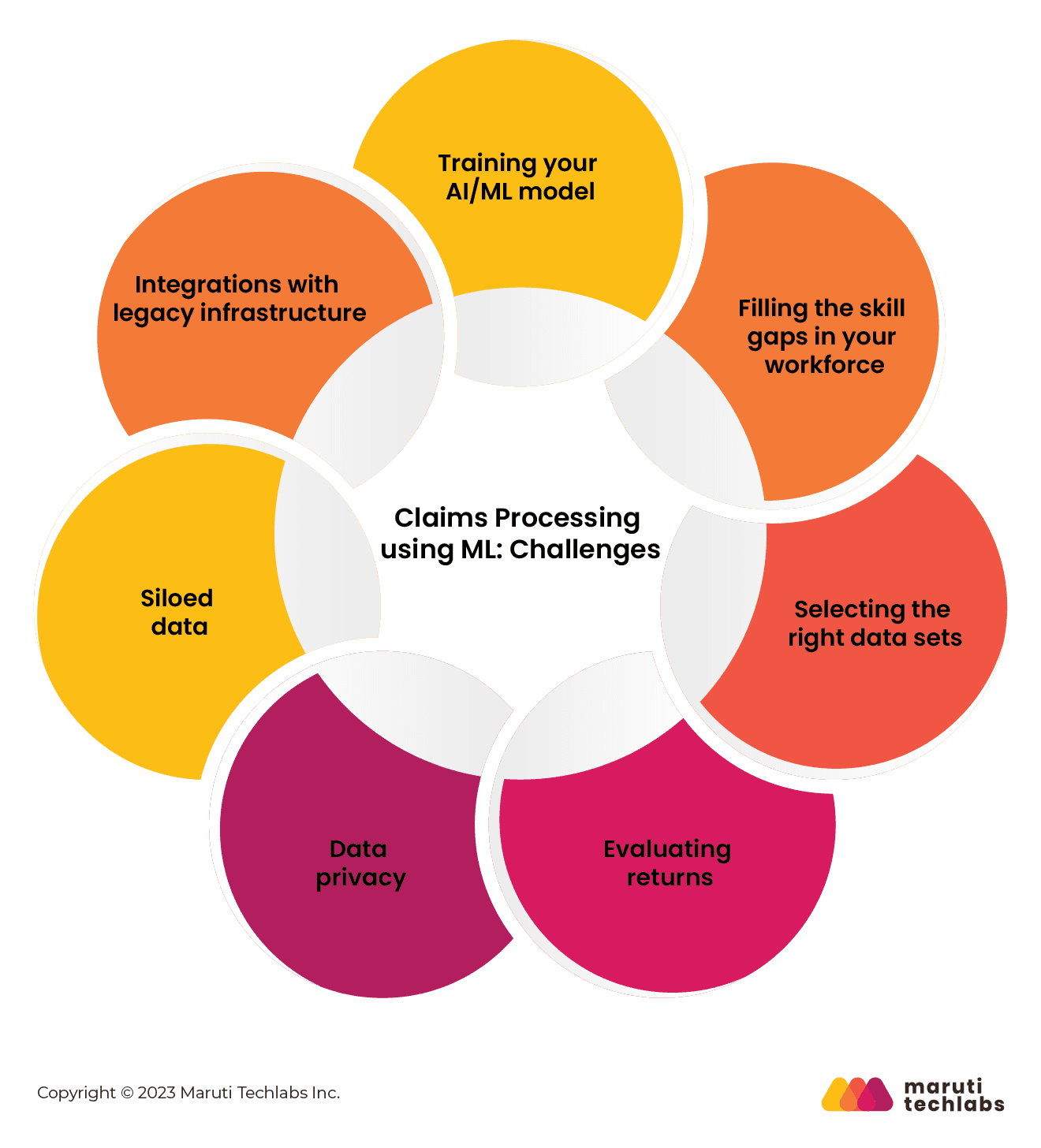

Here is a list of the common challenges you may encounter.

AI/ML-based intellectual systems are a collection of possible scenarios during customer interactions—for instance, FNOL submission or damage assessment.

These underlying processes need a dedicated training system, from which the model educates itself on what to look for while conducting a particular test or transaction. It requires extensive accumulation of all the prevailing occurrences in the claims processing workflow.

What good does automation do if you lack a workforce that isn’t ready for the change? Automation in the insurance industry poses maximum challenges for your operations workforce.

Suppose you don’t organize a systematic training program for your existing workforce. In that case, many employees might lose their jobs due to their incapability to adapt or lack of planning from the company.

How can you make this transition while retaining your employees?

Firstly, you must identify the skill gaps and try to train your people to fill these gaps or hire individuals with the essential skills. Per our experience, a mix of the above approaches can work wonders for your organization.

One of the biggest struggles for insurers is providing suitable datasets to train their AI model. With machine learning, the quality and quantity of data used to train predictive models hold equal importance.

The datasets fed into the system should be representative and balanced to avoid bias and paint the perfect picture.

When mapping change in your businesses’ primary workflows, tracking results is essential to any organization. But predicting outcomes when applying machine learning in claims processing isn’t that simple.

For instance, when experimenting with A/B testing to see what attracts your customers most on your webpage, you can use heat maps to learn their interactions. Furthermore, the evaluation depends on the extent of automation you want to introduce.

Additionally, pinpointing a specific budget for AI/ML-based projects can be challenging as the project scope may vary with new findings. Due to these reasons, insurers can feel skeptical about investing in claims automation.

When introducing machine learning in claims processing, one has to feed a mammoth amount of customers’ sensitive and financial information into servers or the cloud. It creates additional security risks for insurers.

Data breaches and leaks have recently become more common than they were a decade ago. What’s more worrisome is the confidential data falling into the hands of fraudsters. It risks your company and its clients while tarnishing your brand reputation.

Siloed data is a problem for organizations prone to 'doing business the old way.' It refers to information or data stored in isolated databases or systems, which makes it difficult to share or access.

Data silos can prevail across different/single departments or organizations. The underlying problem here might not be their unwillingness to do so but their lack of means to share data.

What gives rise to the silo problem?

It's when organizations fail to implement a company-wide data inventory, and departments use independent data management systems with supporting logic that only they understand.

You'd need assistance from data integration experts to develop a company-wide inventory, but it would lay a sturdy foundation for future data analytics.

Introducing machine learning in claims processing involves integrating legacy systems with modern automation models. Some well-known pain points include insufficient security, high maintenance, competitive disadvantage, and more. But what’s worse than the drawbacks mentioned above is stagnation.

insurance claim automation is the need of the hour, and ancient systems can no longer support such modern integrations. It can directly affect your business growth.

Concerning automation, one of our US insurance clients faced difficulty conducting their underwriting process. Realizing the need for a more efficient and streamlined approach, they decided to seek the expertise of a reliable IT outsourcing company.

Through this successful partnership, our client experienced the benefits of technology-driven automation, enabling them to handle claims more quickly and efficiently.

Implementing artificial intelligence and machine learning in claims processing is just the beginning of automation in administrative tasks. Many insurance firms have already managed to semi-automate small claims.

Now, firms plan to execute automation to even more complicated verticals to foster decision-making without human intervention.

Whether it's automated claims processing, damage evaluation using OCR, fraud detection with machine learning, or automatic self-service guidance, we at Maruti Techlabs have had our fair share of experience working on challenging projects.

We offer expert consultation on implementing Artificial Intelligence solutions such as Machine Learning (ML), Natural Language Processing (NLP), and Computer Vision.

Get in touch with us today!