A Complete Guide to Medicare CRMs: Challenges, Benefits & Top Solutions

In 2025, the need for efficient customer-relationship management (CRM) systems in the Medicare sector will never be greater. As health insurers and payers navigate evolving regulations, rising enrollee expectations and the shift toward value-based care, a purpose-built Medicare CRM offers a strategic lifeline.

The global healthcare CRM market is projected to reach approximately US $20.78 billion in 2025, underscoring growing demand.

Yet, implementing such systems comes with distinct challenges, such as data privacy requirements, legacy system integration, and cross-departmental alignment. On the flip side, benefits include improved enrollee engagement, automated workflow efficiencies, and actionable analytics that support retention and compliance.

This guide explores key 2025 trends in Medicare CRMs and walks you through best practices for implementation, common pitfalls, and top solutions tailored for the Medicare ecosystem.

A Medicare CRM is a tool made for Medicare insurance agents to manage their work more easily. Unlike regular CRMs, it’s built specifically for the Medicare process to help agents manage clients, track contracts, and stay compliant with rules. These systems keep client data secure and ensure that all interactions follow regulations. This means less time worrying about compliance and more time focusing on clients.

With the right healthcare insurance CRM, agents can work smarter, avoid paperwork headaches, and provide better service—all while knowing their business is running smoothly and securely.

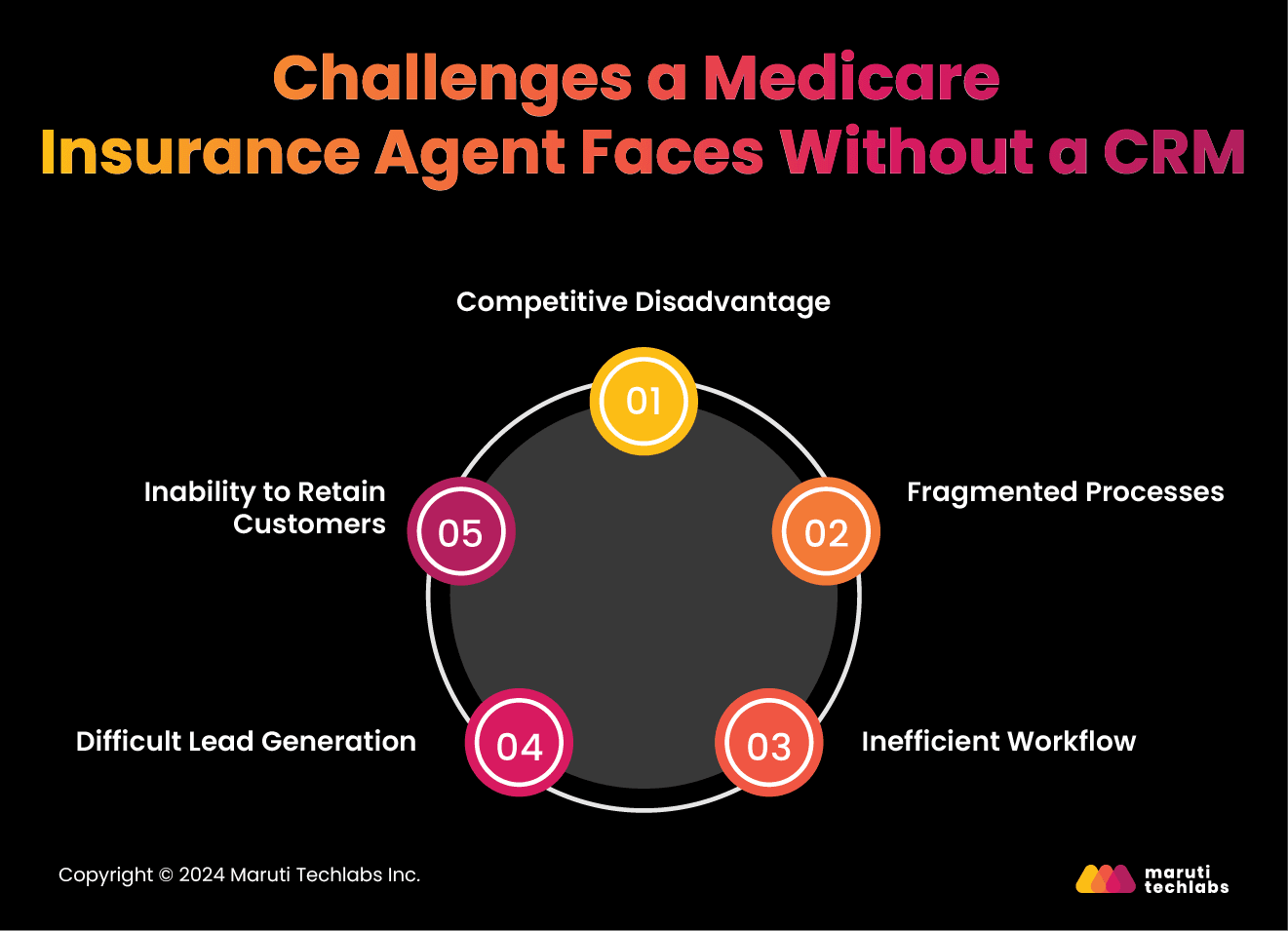

Medicare insurance agents operate in a highly competitive and regulated environment. Without a robust healthcare insurance CRM system, they struggle with various challenges that impact their productivity and customer relationships. Here’s how the absence of a CRM can create roadblocks:

The Medicare insurance market is crowded, with agents vying for the same leads. If a potential client inquires about a policy and doesn’t receive a prompt response, they are likely to move on to another agent.

Manual processes and scattered data make it harder to engage leads quickly, putting agents at a disadvantage. A healthcare insurance CRM streamlines communication, ensuring that no opportunity slips away due to delays.

Managing Medicare plans comes with juggling parts—client data, renewals, policy details, and more. But when you’re relying on spreadsheets and disconnected systems, information gets scattered, making it tough to keep track of client history or follow up when it matters most. This lack of organization leads to missed opportunities and frustrated clients.

A centralized healthcare insurance CRM helps keep everything in one place, improving efficiency and service quality.

From handling applications to tracking renewals and managing compliance, Medicare agents juggle multiple tasks daily. Manually managing these processes increases the risk of errors and slows down operations. With an automated CRM, agents can streamline tasks, reduce manual effort, and focus on selling policies rather than managing paperwork.

Finding new clients is one of the biggest challenges for Medicare agents, especially with strict marketing regulations in place. Without a healthcare insurance CRM, tracking leads and nurturing them effectively becomes a challenge. Many potential clients require multiple touchpoints before making a decision, and without a structured approach, agents may lose track of these prospects.

A CRM helps agents manage their pipeline, set reminders for follow-ups, and personalize outreach efforts to improve conversion rates.

Retaining clients is essential in Medicare insurance. Policyholders often need help with plan changes, renewals, and coverage questions. Without a healthcare insurance CRM, it becomes difficult to keep track of client interactions and provide timely support. If agents don’t follow up consistently, clients may switch to a competitor who stays more engaged.

A CRM enables automated reminders, personalized communication, and better relationship management, ultimately improving retention rates.

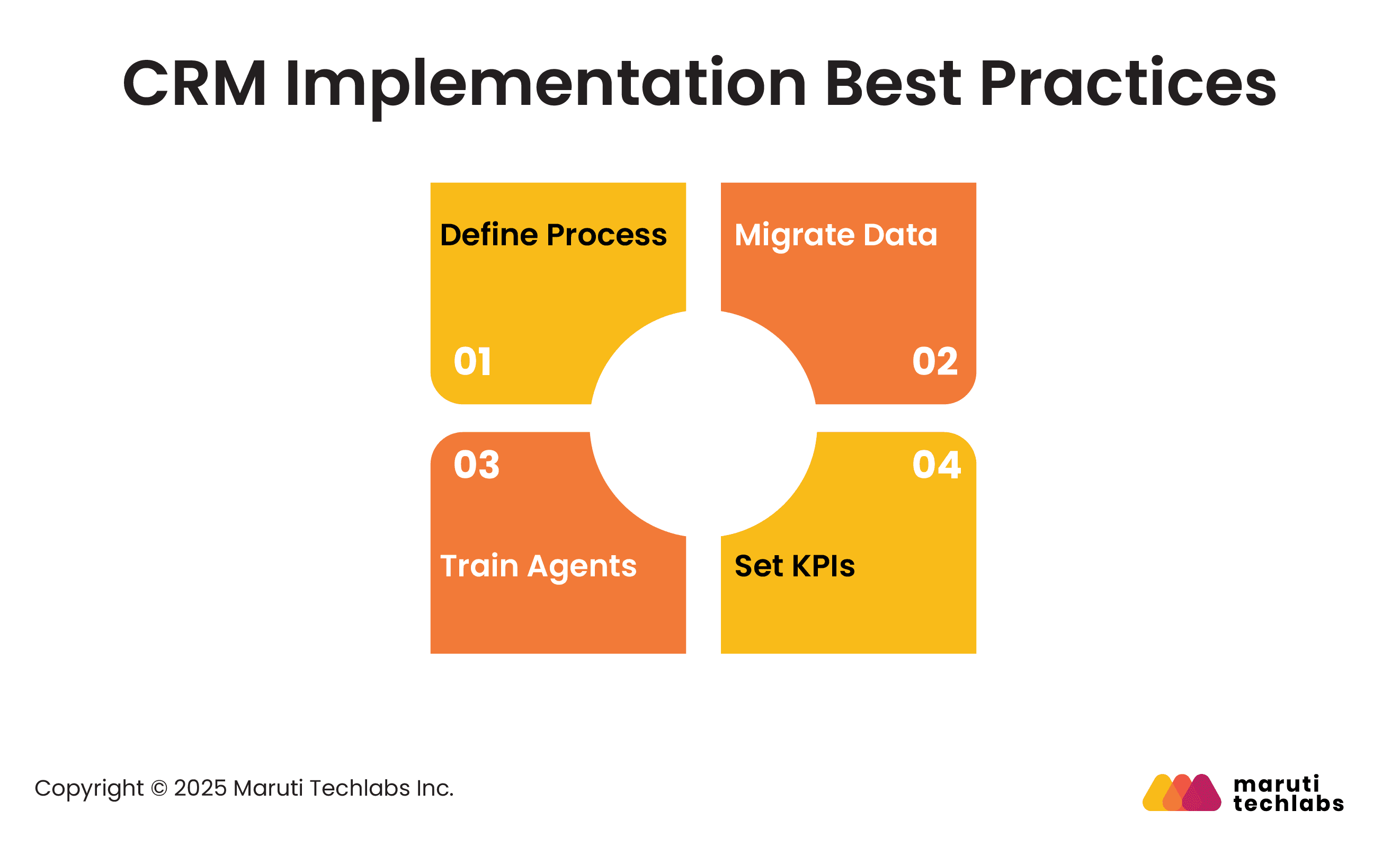

A successful CRM rollout requires more than technology; it needs strategy, structure, and adoption. Follow these four best practices to streamline implementation, enhance user engagement, and maximize measurable ROI.

Before implementing your CRM, map every stage of your sales and service workflow. Clarify how leads enter, how follow-ups occur, and when renewals trigger. Standardizing processes ensures consistency across agents, minimizes confusion, and enables automation. A well-defined process sets the foundation for accurate reporting and improved client satisfaction.

Data migration is often underestimated but crucial. Clean, validate, and structure existing data before import to avoid duplication or errors. Prioritize client records, policy details, and communication history. Involve key users to verify accuracy and relevance. Well-organized data enables smoother CRM adoption and smarter, analytics-driven decision-making.

User adoption defines CRM success. Conduct hands-on workshops and role-based training to help agents navigate features efficiently. Encourage practice through real case examples. Provide ongoing support, refresher sessions, and quick-reference guides when agents understand both the “how” and “why.” They use the CRM effectively and deliver stronger client engagement.

Define measurable KPIs that reflect your business goals, such as conversion rate, policy renewals, response time, or customer satisfaction. Use CRM dashboards to track performance in real time. Regularly review metrics to identify areas for improvement and celebrate wins. Linking KPIs to incentives helps maintain motivation and drives sustained return on investment.

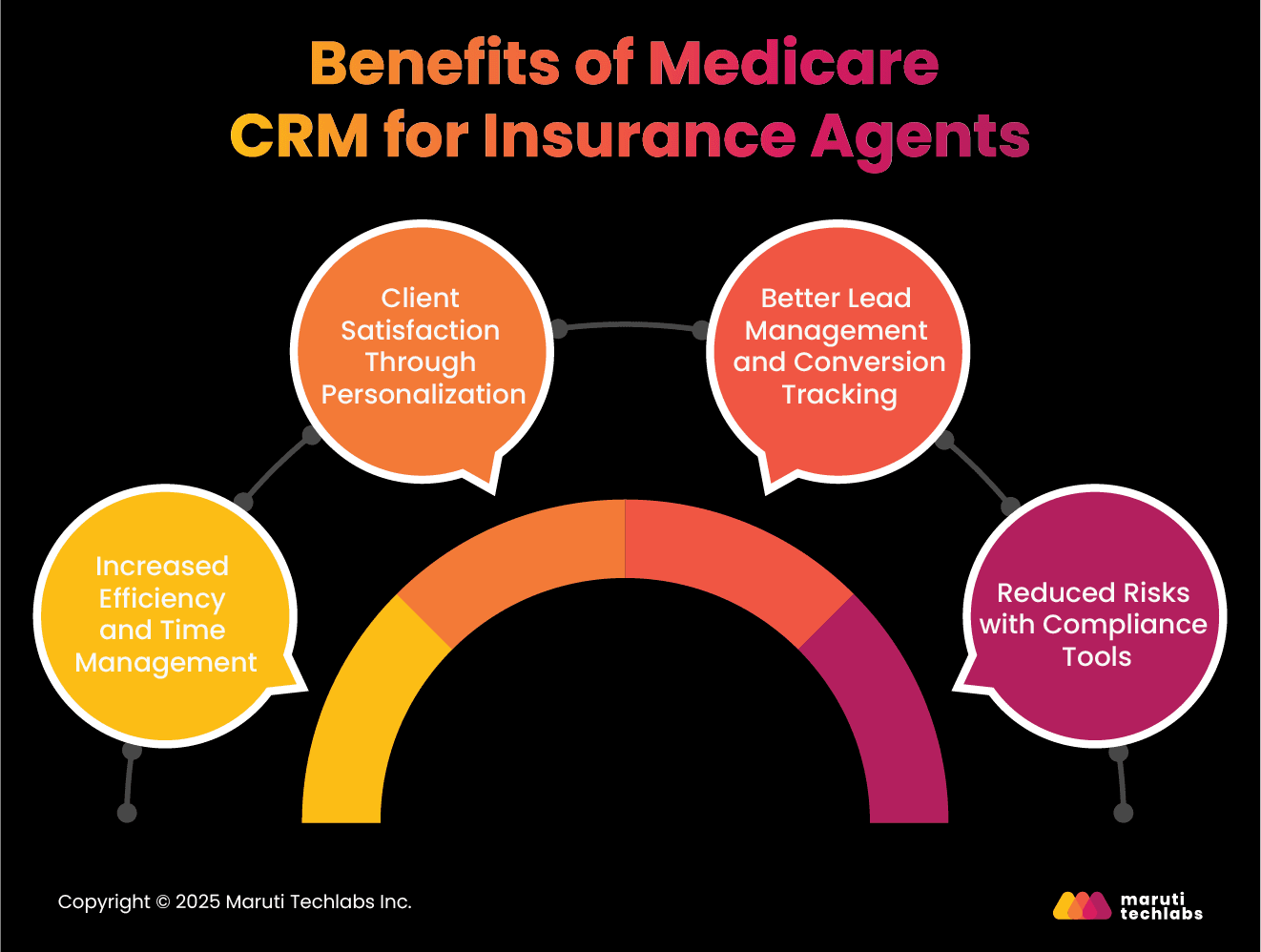

Using an advanced healthcare insurance CRM system can make a big difference for Medicare insurance agents. It helps them work more efficiently, provide personalized service, track leads better, and stay compliant with industry rules.

Manually handling client information takes up a lot of time. A Medicare CRM makes it easier by letting agents register clients, update records, and track interactions right from their phones or computers. This automation reduces paperwork and routine tasks, giving agents more time to focus on client relationships and grow their business.

Clients appreciate personalized service, and a CRM helps make that happen. It stores plan details, past conversations, and preferences so agents can easily access important information during follow-ups. This helps them provide thoughtful, customized support, making clients feel valued and more likely to stay with their current provider.

Turning prospects into clients requires a structured approach. A Medicare CRM helps agents organize and track leads through every stage of the sales funnel. Automated reminders and follow-up tools ensure no opportunity is missed, leading to higher conversion rates and increased sales.

Following the regulations is important in Medicare insurance, and not doing so can lead to penalties. A CRM helps agents stay compliant by securely managing client data and tracking interactions as per industry standards. This reduces legal risks and keeps all processes in line with the rules.

By using an advanced CRM, Medicare insurance agents can save time, improve client relationships, and grow their business while staying compliant with industry rules.

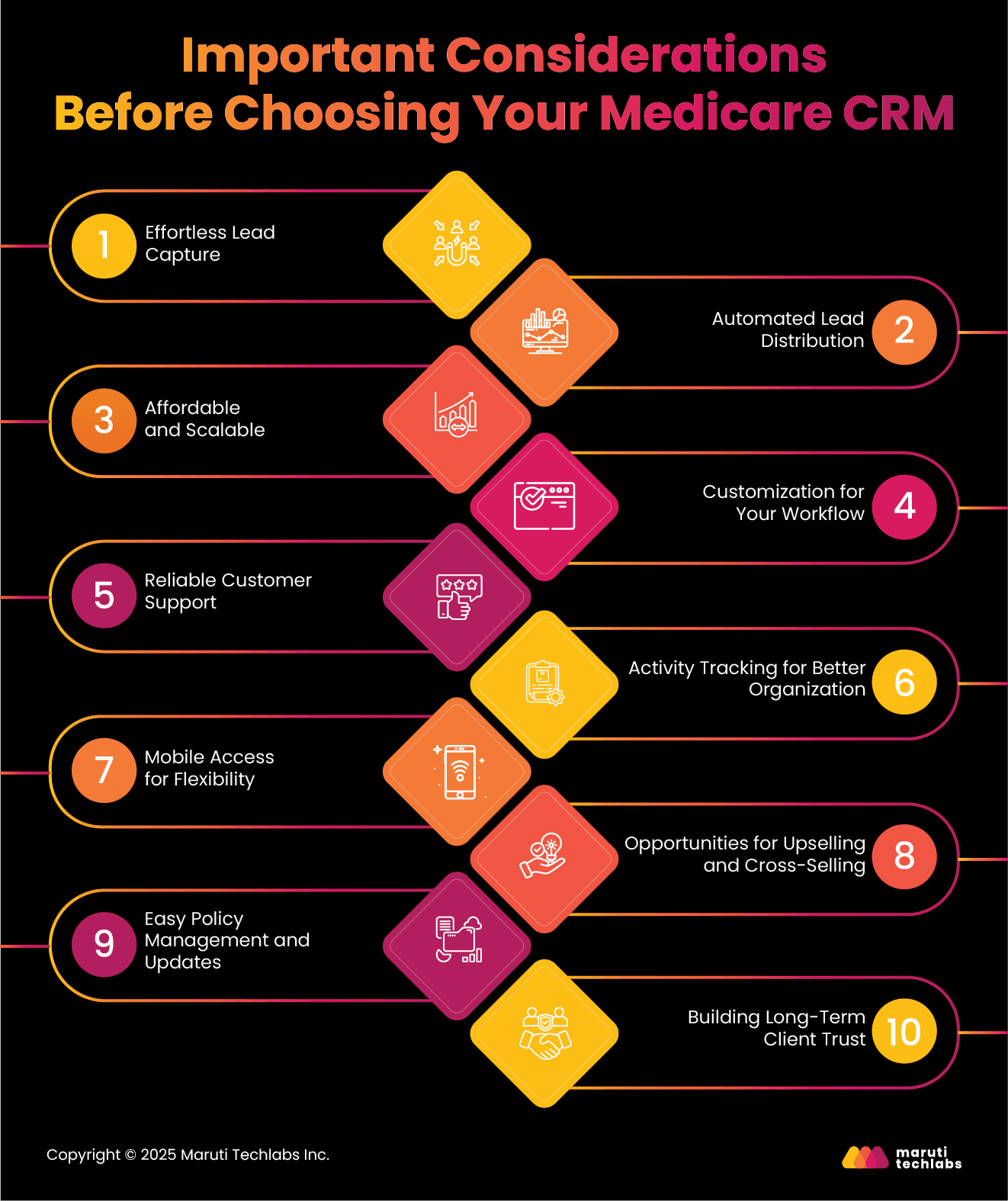

Choosing the right CRM isn’t just about having a system to manage client data—it’s about finding a tool that makes an agent’s job easier, improves efficiency, and supports business growth. A good Medicare CRM should help agents capture leads, stay organized, and provide better service. Here are key factors to consider before making your choice:

A CRM should make it simple to collect and track potential clients, whether they come from calls, emails, or online inquiries. Agents should be able to access and update leads anytime, even when they’re on the go.

For teams, an effective CRM should automatically assign leads based on set rules, ensuring quick follow-ups and better engagement. This prevents lost opportunities and helps agents focus on closing deals.

Your CRM should fit your budget while offering the flexibility to grow with your business. Look for a solution that meets your current needs but can also handle future expansion without requiring a complete overhaul.

No two agents work the same way. A CRM that allows customization—such as adjustable fields, automation rules, and personalized reports—will help align the system with your specific needs.

Issues can arise at any time. Having a CRM with fast and effective support ensures that technical difficulties don’t slow down your work.

A good CRM keeps a record of all interactions, tasks, and follow-ups. This ensures that nothing gets overlooked, helping agents stay on top of client communication and renewals.

Agents aren’t always at their desks. A CRM with a mobile app or a responsive web version allows agents to manage clients, update records, and schedule appointments from anywhere.

The right CRM doesn’t just help with new clients—it also helps retain and grow existing business. It should provide insights into policy upgrades and additional services that might be relevant to each client.

Medicare policies change often, and keeping clients informed is crucial. A CRM should allow agents to update policies, track renewals, and notify clients about changes effortlessly.

Consistent communication and prompt service build trust. A CRM that supports automated reminders, follow-ups, and secure data management helps agents strengthen client relationships and increase retention.

By keeping these factors in mind, Medicare insurance agents can choose a CRM that makes their work smoother, improves client satisfaction, and helps grow their business.

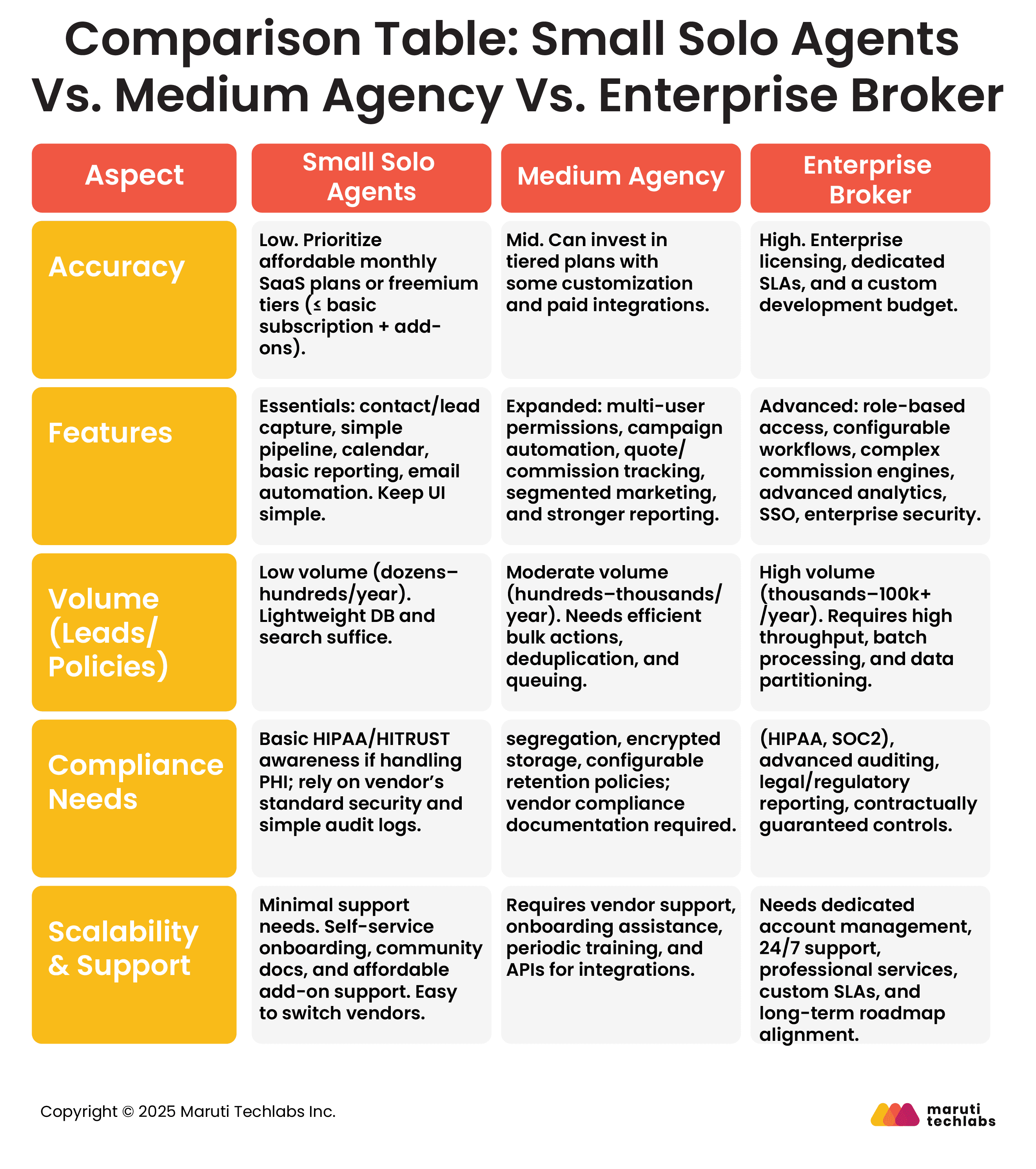

Here’s a comparison table that shows how different CRMs work for various types of agencies.

Choosing the right CRM can greatly affect how Medicare insurance agents manage clients, track policies, and stay compliant. Below are five of the best CRM solutions tailored for Medicare insurance professionals.

CrmOne is specifically designed for Medicare insurance agents and offers tools that streamline policy management, client interactions, and compliance tracking. It simplifies claims processing, makes it easier to handle policy workflows, and ensures that all transactions follow Medicare regulations.

Agents can quickly store and access important documents, record their conversations with healthcare providers, and run marketing campaigns to connect with the right clients. The CRM also provides reports and insights to help agents understand their performance and improve their sales approach.

CrmOne provides flexible pricing plans, which include a free basic version and paid plans starting at $119 per month (billed annually), making it a cost-effective choice for agencies of all sizes.

Salesforce Health Cloud brings advanced data management and automation to Medicare agents. It integrates multiple healthcare services, allowing agents to efficiently manage client records, appointments, and policies in one place. The platform automates document handling, organizes patient interactions, and provides deep insights through its Data Cloud for Health.

With pricing starting at $325 per user/month, Salesforce is on the higher end, but it offers robust AI-driven features that help agents personalize client interactions and optimize operations.

MedicarePro CRM is explicitly built for Medicare insurance professionals, focusing on security, simplicity, and efficiency. It follows HIPAA guidelines, so agents can confidently handle sensitive client data. The simple dashboard makes it easy to see important details at a glance, and the built-in analytics help agents make better business decisions. A key highlight is its excellent customer support, which helps agents resolve issues quickly.

The pricing is straightforward, with plans starting at $45 per agent per month, making it a highly affordable option without hidden fees.

Zoho CRM is a flexible option for Medicare agents who require a system that adapts to their needs. It works smoothly with different business applications, making daily tasks easier and organizing data. Agents can adjust fields, automation settings, and modules to fit their workflow. The CRM also automates follow-ups and report generation, saving time and reducing manual work.

Zoho CRM’s affordability is a strong selling point, with plans starting at $14 per user/month (billed annually), making it suitable for both small agencies and larger enterprises.

Inovaare Health Plan CRM is designed for healthcare providers and insurance agents handling Medicare policies. It specializes in managing compliance, ensuring all regulatory requirements are met.

With built-in analytics, agents can track performance and optimize operations through real-time data insights. The CRM offers personalized dashboard views based on user roles, which makes navigation easier. It also streamlines key processes such as member services, appeals, and grievances.

Pricing is customized based on organizational needs, and interested users must contact the sales team for details.

Each of these CRMs offers unique features tailored to Medicare insurance agents. By investing in the right CRM, agents can work more efficiently, stay compliant, and provide better client service.

As Medicare markets evolve, CRM systems are becoming more intelligent and more connected. Emerging technologies and integrations are redefining engagement, personalization, and compliance for agents, providers, and beneficiaries alike.

AI-enabled CRMs analyze customer profiles, claim history, and preferences to suggest relevant add-ons or policy upgrades. This boosts revenue while personalizing interactions, ensuring agents offer the right plan at the right time based on predictive insights.

With agents constantly on the move, mobile CRMs and push notifications ensure instant updates on leads, renewals, or compliance alerts. This trend enhances responsiveness, reduces delays, and maintains consistent client communications across devices.

Intelligent chatbots handle first-level queries, schedule appointments, and capture lead data in real time. They reduce manual workload, improve engagement, and enable agents to focus on efficiently closing high-value Medicare prospects.

Seamless CRM integration with digital enrolment systems simplifies onboarding and eliminates duplicate data entry. Agents can instantly verify eligibility, track applications, and reduce turnaround times, improving customer satisfaction and compliance.

Linking telehealth platforms with CRMs creates unified patient profiles, enabling agents to personalize coverage recommendations based on actual health interactions. This enhances proactive outreach and supports value-based care coordination across services.

Future-ready CRMs may tap into wearable health data (like heart rate or activity levels) to identify preventive care opportunities or coverage adjustments—supporting wellness initiatives and more personalized Medicare plan management.

Frequent Medicare policy updates demand CRMs that automatically sync regulatory changes and plan details. Smart configuration tools and compliance alerts help agencies stay accurate, audit-ready, and responsive to every new CMS guideline.

For Medicare insurance agents, managing client data, tracking policies, and staying compliant can be overwhelming without the right tools. A well-designed CRM simplifies these tasks by centralizing information, automating routine work, and improving client interactions. With a system that handles everything in one place, agents can focus on building relationships rather than managing paperwork.

Our work with Medigap Life, a leading online insurance aggregator, is a great example of how the right CRM setup can transform operations. Medigap Life faced challenges with an outdated CRM that couldn’t handle their growing customer base. The system was slow, rigid, and struggled to process large amounts of data efficiently.

To solve this, Maruti Techlabs restructured their CRM workflows, optimized data processing, and improved system flexibility. The results were significant—SMS campaign execution time was reduced by 87.5%, CRM page load times improved by 50%, and workflows could now run simultaneously. This not only boosted efficiency but also helped Medigap Life make better business decisions with accurate, real-time data.

Transform your business with smarter technology solutions. Contact us to learn more about our Business Technology Consulting Services and Digital Transformation solutions to see how we can help optimize your operations.

A Medicare-specific CRM often starts around US $45 per user/month for an individual agent plan, and around US $55 per user/month for an agency tier. Actual pricing can vary depending on features, number of users, and customization.

Yes, a general CRM (e.g., Zoho CRM, HubSpot CRM) can be used. Still, it may lack industry-specific capabilities such as Medicare plan tracking, commission workflows or built-in compliance automation. While functional, it may require additional configuration and may not deliver optimal efficiency.

A Medicare-focused CRM can help by providing secure storage (encryption, audit logs), tracking client interactions (e.g., scope of appointment documentation), ensuring policy updates are applied, and generating compliance-ready reports. It reduces risk of regulatory violations by enforcing standard procedures.

For small Medicare agencies key features include: lead and client management with built-in renewal tracking, simple workflow automation for follow-ups, mobile access for on-the-go agents, secure data handling, and reporting dashboards to monitor performance without heavy overhead.