Build an Insurance App Like the Lemonade App | Maruti Techlabs

The Global Insurance Outlook survey, conducted a few years ago by EY, revealed that insurance companies were less trusted than banks, car manufacturers, and supermarkets. Insurance brokers were perceived similarly to real estate agents. Complex forms and rising premiums contributed further to the challenges in their industry.

Rebuilding trust is key to long-term success in any business and new approaches are making insurance more transparent to achieve this. These include high demand, innovative business models, better data access, and improved risk assessment and pricing. According to EY’s report 2024, three key issues are currently driving the strategic agenda in the insurance industry:

Companies that take bold and innovative actions can leverage these trends to create value for customers, society, and their profits.

Explore these trends in depth and discover how insurers can navigate the future.

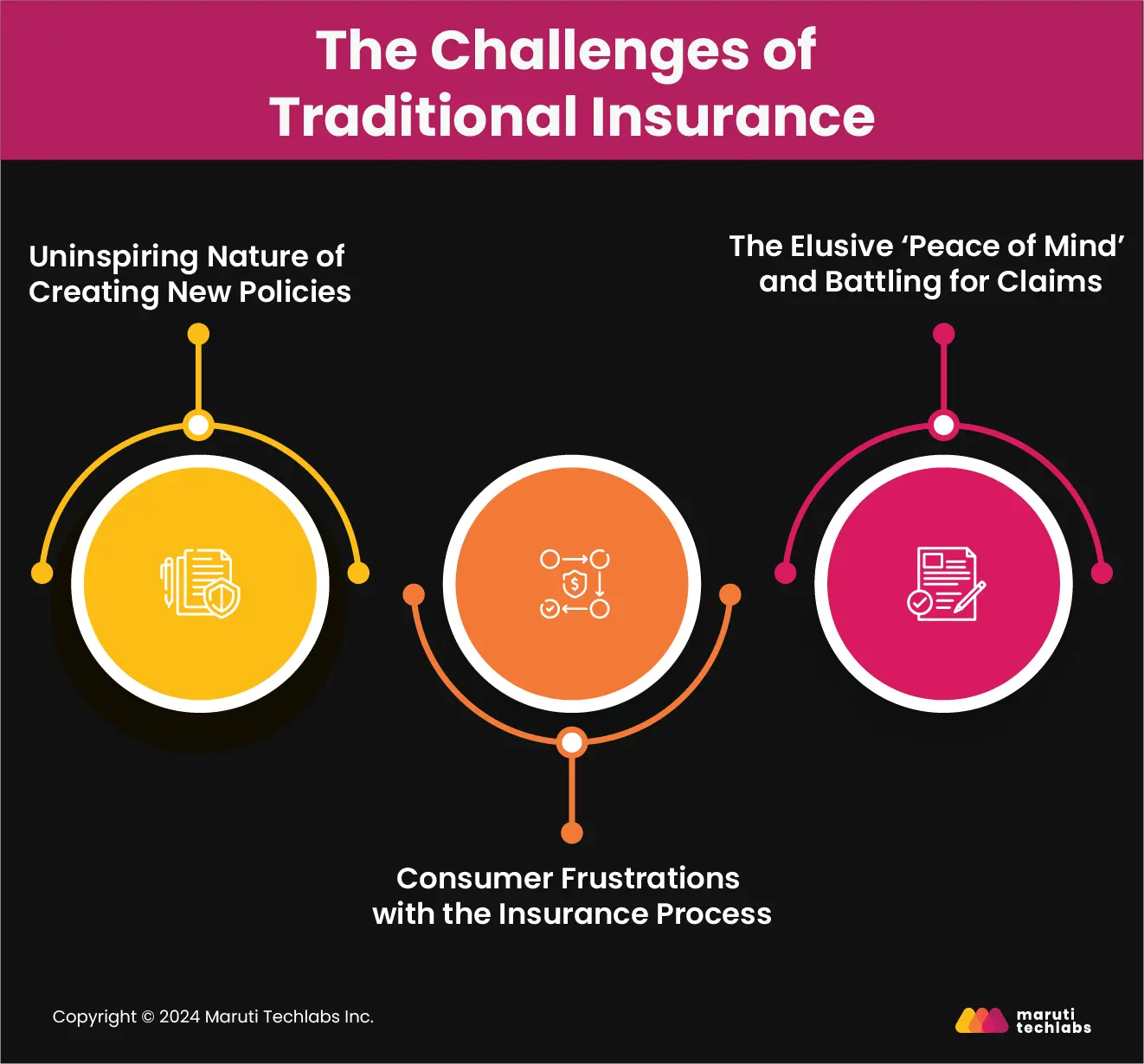

Traditional Insurance companies face various challenges that lead to consumer dissatisfaction and mistrust, ultimately discouraging many from purchasing insurance. Some of them include:

Customers find taking new insurance policies dull and hardly inspiring. Unlike other purchases like a car or a new gadget, insurance policies do not provide immediate, tangible benefits, making the process mundane and unexciting.

Lengthy form-filling is time-consuming and tedious. Customers must provide extensive personal and financial information to navigate various policy options. In addition, escalating premiums add to financial strain and frustration.

The promised ‘peace of mind’ is rarely achieved because of the widespread belief that insurers profit by denying or delaying claims. The fear of dealing with the insurance company when you need help defeats the purpose of insurance.

These problems make people unhappy and keep many from buying insurance.

Lemonade, a leading American insurance company founded in September 2016 by Daniel Schreiber and Shai Wininger, focuses on renters and homeowners insurance.

Lemonade offers a fresh approach to insurance which makes it simpler and more user-friendly. Here’s how they do it:

Lemonade is different from other insurance companies because it charges a fixed fee and doesn’t profit by denying claims. This helps Lemonade focus on fast and easy claims for its customers.

With the Lemonade app, you can buy insurance quickly—sometimes in just 90 seconds. Claims are handled through video, avoiding long forms. Automated systems and claims bot review and approve claims within seconds.

Lemonade uses clear pricing and supports social causes by donating leftover premiums to charities picked by users. This transparency and social commitment appeal to younger people who want fair and straightforward insurance.

Lemonade's launch on Product Hunt and its 'Giveback' program highlight its commitment to honesty and community support, making it unique in the insurance world.

Insurance apps are designed to simplify life by providing quick access to essential services. Here’s a look at the key features that make these apps user-friendly and effective:

This feature makes signing up quick and easy. People can create an account by entering basic details or linking their Google or Facebook accounts. Once signed up, they can manage their profiles, updating personal information, contact details, and preferences to keep everything current.

With this feature, browsing and buying insurance policies becomes simple. A well-organized list of options helps users find what they need quickly. After purchasing a policy, they can easily access all the details and documents to understand their coverage and terms.

Filing claims is straightforward with this feature. Users can submit claims by filling in details and uploading necessary documents. It also supports video testimonials and automated processing to speed up the claims process, making it more transparent and ensuring timely support.

Secure and diverse payment options make this feature essential. It supports various payment methods, including credit/debit cards, bank transfers, and digital wallets. Users can also set up automatic premium payments to avoid missing any payments, ensuring continuous coverage.

In-app chat support offers instant help with questions or issues, providing quick and effective solutions. This feature includes a detailed FAQs section and help center, so users can easily find answers to common questions without contacting support.

This feature ensures timely notifications and alerts about insurance policies. It sends reminders for policy renewals and updates on claim statuses, keeping users informed and reducing uncertainty.

Adding a charitable giving feature during sign-up can enhance the app’s appeal. Users can choose a charity to support, and the app allows them to track their contributions, giving them a sense of fulfillment and connection to their chosen cause.

These features ensure insurance apps provide essential services that keep users satisfied and engaged. By being easy to use, secure, and efficient, with the added benefit of charitable giving, these features enhance the overall customer experience, making interactions with the insurance company easier, quicker, and more enjoyable.

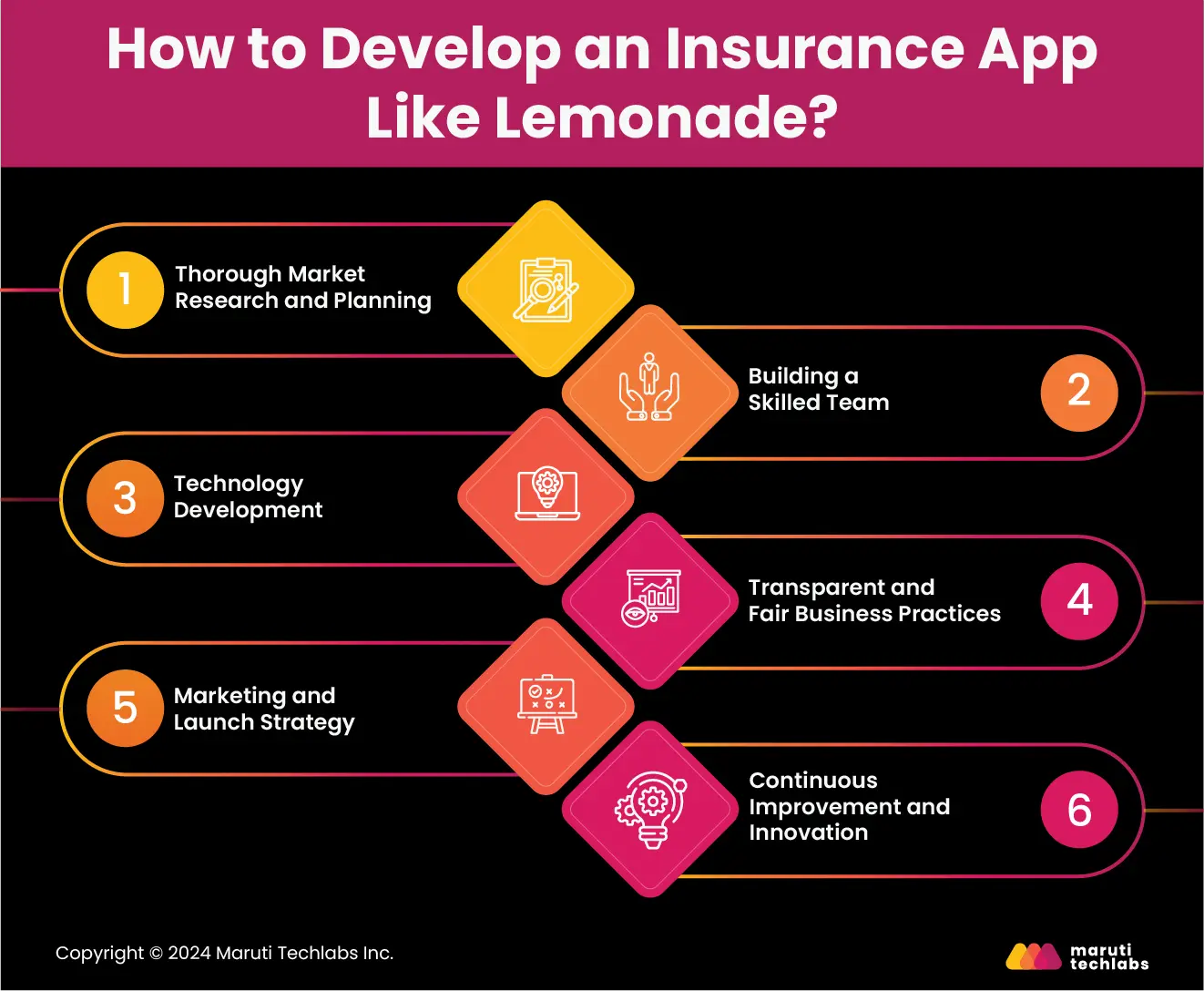

To develop an insurance app like Lemonade, you must carefully plan and follow several important steps to meet users' and market needs.

To stay updated on market trends, research who will use your app and what they want from it. This helps you find ways to improve and figure out how to make your app stand out. Understanding what your competitors do and where they fall short can give you ideas on how to do better.

Another important step is to build a strong team with skills in technology, insurance, and customer service. Hiring knowledgeable team members is key because they will help create and manage insurance policies. You also need tech experts to develop an easy-to-use app that keeps user information safe.

A user-friendly app makes tasks easier, improves efficiency, and keeps customers engaged. Users should be able to find insurance information quickly, buy policies easily, and handle claims smoothly. Strong technology is essential to handle increasing user demand.

Your business model should be clear and fair. Users should understand the claims process and trust that their needs will be met quickly and fairly. Adding features like automatic claims processing and real-time updates can show reliability. Donating part of your profits to causes users care about can also appeal to those who value social responsibility.

Once your app is ready to enter the market, you'll need a good plan to launch and promote it. To effectively promote the app and generate early user interest, utilize social media platforms, online communities like Product Hunt, and other digital channels.

Make sure your brand stands out by highlighting what makes your app unique. Share stories from happy users and give demos to build excitement before launching. Consider using emails and working with influencers to reach more people and connect with a larger audience.

Launching your app is just the start. You need to keep getting user feedback and check the data to find ways to improve. Introduce updates to the app to add new features and fix issues based on user feedback and industry trends. By staying flexible and paying attention to user needs, you can ensure that your app stays useful, competitive, and valuable to people.

Lemonade, like insurance app development, involves several key steps. If you have an idea for a product but aren't sure how to make it happen, consider teaming up with a company specializing in developing apps. They can guide you through the entire process, from planning and design to development and launch.

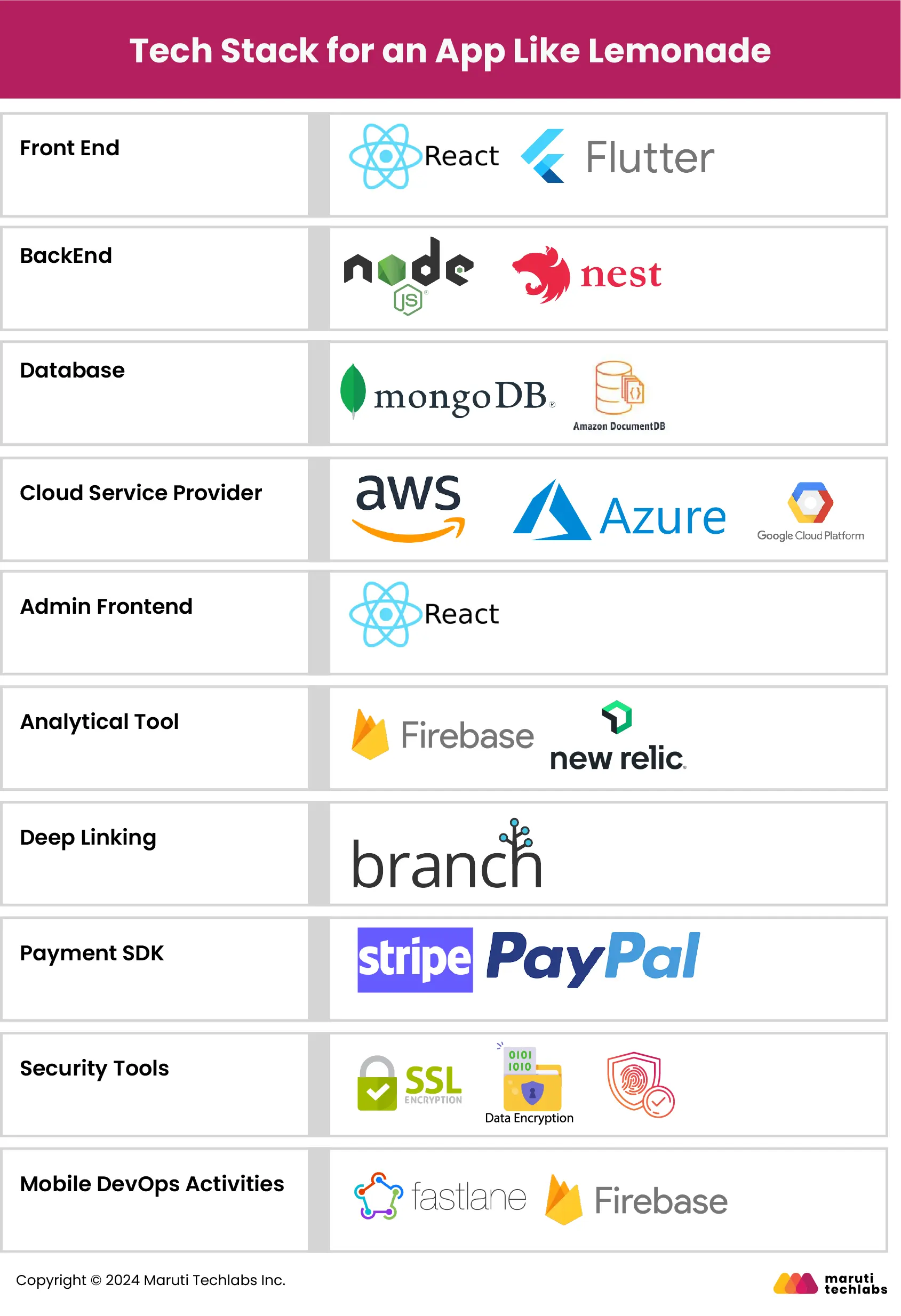

Choosing the right tech stack for insurance apps is essential. It impacts the app's functionality, stability, scalability, and security of users' information. The following are the required technologies:

This tech stack ensures the app is functional, secure, and scalable, meeting the standards for a competitive insurance app like Lemonade.

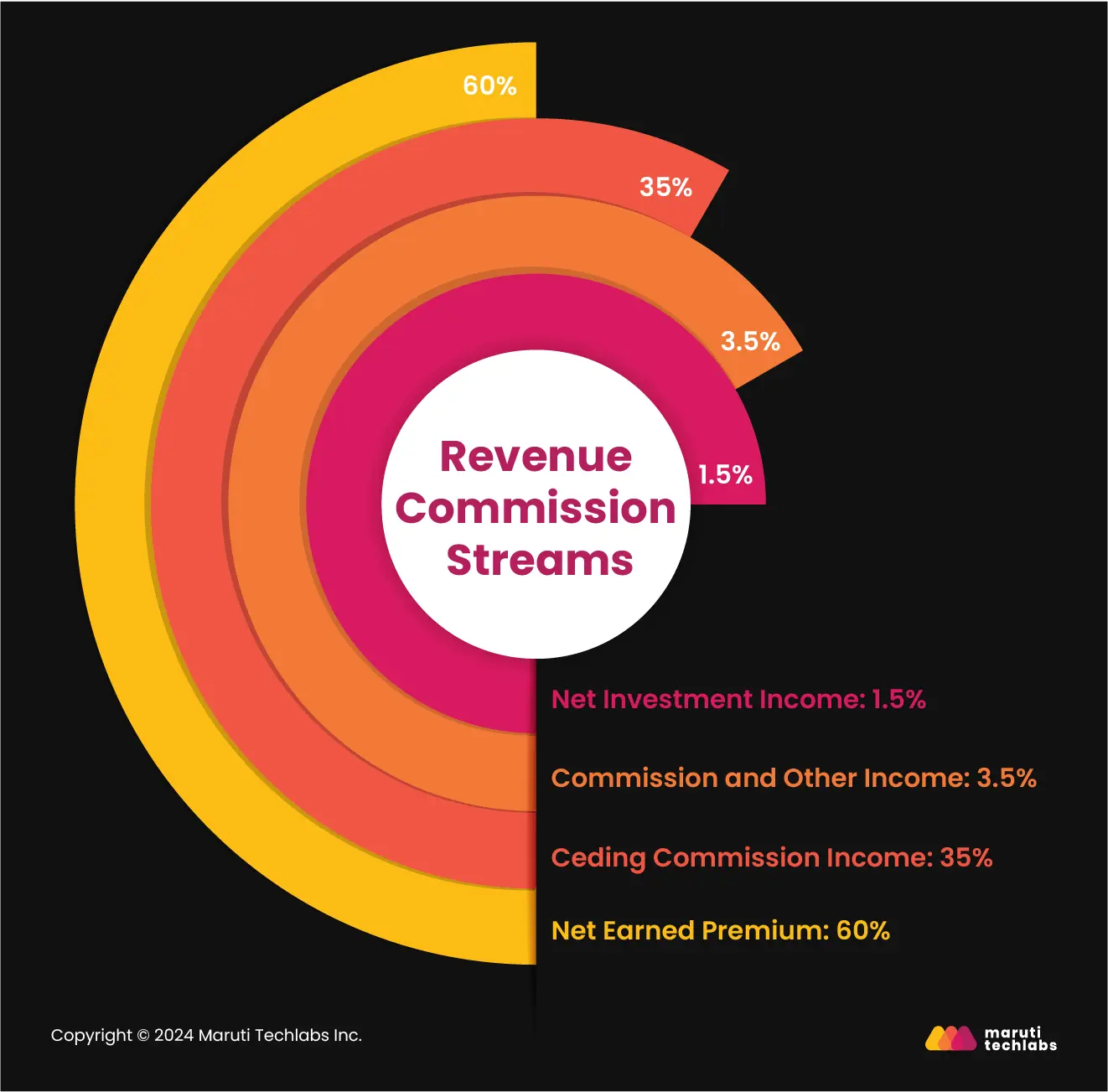

Lemonade has a solid and reliable way of making money, thanks to its high customer loyalty and subscription model. In 2021, Lemonade Insurance made $128 million, a 36% increase from the previous year. The company mainly makes money in four ways:

By focusing on these revenue streams, Lemonade ensures a steady and growing income, allowing it to provide a reliable service to its customers while continuing to innovate in the insurance industry.

Lemonade has transformed the insurance industry using machine learning and artificial intelligence to improve customer satisfaction and streamline operations. The company has made insurance more enjoyable, affordable, and socially responsible, solving many traditional problems and becoming a preferred insurance company worldwide. Lemonade has great growth potential, with $128 million in revenue in a huge $5 trillion industry.

Adopting machine learning and artificial intelligence technologies makes things more efficient by automating tasks like managing claims and customer support. Customers prefer fast and easy sign-up and claims filing using AI chatbots.

Maruti Techlabs is here to help companies looking for innovative insurance app development. We handle everything from the initial idea to the final launch and maintenance. With our design, development, and artificial intelligence expertise, we ensure your app delivers a seamless and enjoyable user experience. We are a complete partner, supporting every stage of your app's growth.

Our discovery workshop, agile process, and trusted product development partnership enable us to guide you through every stage of your digital transformation journey.

From UI/UX design to development, product maturity, maintenance, and AI capabilities, we offer a comprehensive range of services to ensure your success.

If Lemonade’s success inspires you and you want similar insurance app development, explore our product development service. We help turn your vision into reality. Additionally, be sure to browse other "build an app like Tik Tok" blogs in our series.

For companies seeking mobile app development in Chicago, Maruti Techlabs offers the local expertise and global experience to build standout digital products.

Lemonade is a fully licensed and regulated insurance company, which means it creates, prices, and sells policies and handles and pays claims. It takes a flat fee from customers' premiums and uses the rest to run the business, handle claims, and pay for reinsurance. It donates its leftover money to charity. Unlike traditional insurance companies, Lemonade isn’t motivated to deny claims because any leftover funds don’t go to it.

The estimated cost to create a mobile app can range from $25,000 to $150,000 and may exceed $300,000 for custom complex apps. We say estimated because the cost of custom mobile app development depends on various factors, such as the app’s complexity, features and functions, development method, and more.

An insurance app allows quick and easy communication between an insurance company and its customers. It automates boring manual tasks and eliminates paperwork. Users also want better, easier-to-use insurance apps because of the rise of insurtech and similar trends in other industries, and the mobile app simplifies their entire process.

To choose the right app development company, look for one with extensive experience, certified teams, and a strong track record of timely delivery. Ensure they follow Agile and Lean practices, offer robust communication, and prioritize data protection. Consider their ability to provide custom solutions tailored to your needs.