GenAI for Insurance Underwriting: Implementation in 4 Simple Steps

The insurance industry is undergoing a profound transformation as market volatility, evolving customer expectations, and regulatory pressures expose the limitations of traditional operating models.

Manual, rules-driven processes, particularly in underwriting, are no longer sufficient to manage growing data volumes, complex risk profiles, and the need for faster decisions. Insurers that continue to rely on legacy workflows face inefficiencies, higher loss ratios, and reduced competitiveness.

Artificial Intelligence, and increasingly Generative AI, is enabling insurers to reimagine core functions and position themselves for sustainable growth. By automating data ingestion, augmenting risk assessment with advanced analytics, and delivering real-time insights, AI empowers insurers to underwrite more accurately and at scale.

AI empowers insurers to underwrite more accurately, consistently, and at scale. GenAI further enhances underwriting by synthesizing structured and unstructured data, improving decision transparency, and reducing turnaround times.

This blog explores how AI and GenAI are reshaping underwriting, examines different insurance use cases, and shares a brief implementation process of GenAI in underwriting.

Insurers today function in a dynamic environment where traditional models aren’t equipped to predict risk. Customer expectations, climate uncertainty, economic ups and downs, and digital fraud are driving carriers to adopt more intelligent, adaptive tools.

GenAI proves to be a critical capability for insurance companies through its offerings, including personalization, complex risk pattern analysis, large-scale data evaluation, and rapid decision-making.

With the global InsurTech market on the rise, AI-powered models are making underwriting faster and more reliable. Its ability to automate reasoning and simplify the processing of complex unstructured data helps underwriters uncover insights that were previously impossible to detect manually.

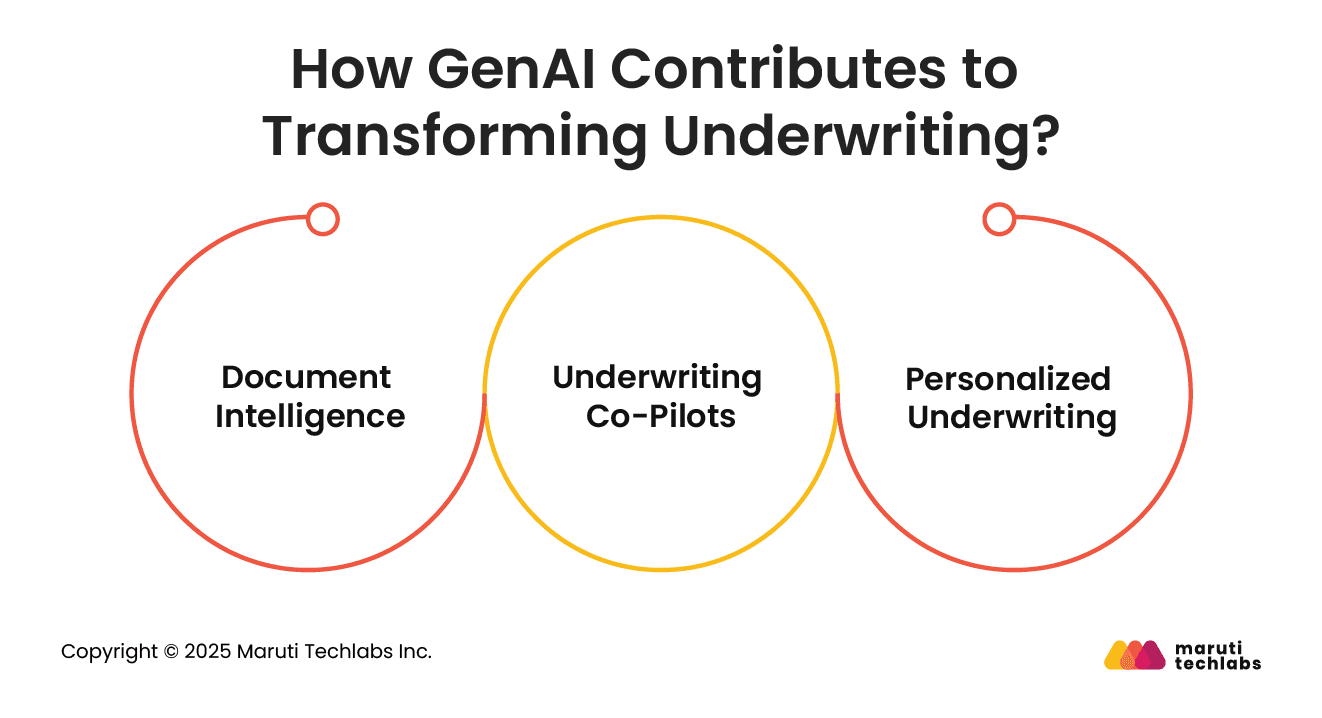

Underwriting is conventionally performed using structured data, defined rules, and human intervention. GenAI enhances this process with a model that can reason across numerous risk signals simultaneously. It not only accelerates the existing process but also redefines it by introducing predictive capabilities.

Here are the three most prominent areas where it contributes.

In underwriting, one has to analyze documents such as medical reports, claim histories, KYC documents, financial statements, and more. GenAI performs the same tasks much faster.

Compared to manual document review by human underwriters, GenAI can extract the required details within seconds. This enhances operational efficiency, allowing insurers to focus more on strategic tasks rather than manual data handling.

In addition, GenAI increases consistency across the underwriting process, improves compliance, and decreases human error.

Over the next decade, underwriters are expected to work with GenAI-powered assistants increasingly. These AI copilots will be adept at scrutinizing applicant profiles, identifying risks, maintaining compliance, sharing analytical notes with missing data, and making evidence-based suggestions.

This shift in an underwriter’s role would mean serving as a decision supervisor rather than a manual reviewer. So, GenAI would be used to aid human judgment and not replace it. This transition would significantly increase productivity, eliminate repetitive tasks, and ensure consistency across the organization.

GenAI is making it possible for insurers to switch to highly personalized models. Using GenAI to analyze and adapt to customer behavior, insurers can offer usage-based insurance, dynamic pricing, micro-policies, and individualized plans.

Such personalization wasn’t possible with conventional underwriting, but now it's making its way into the market. Insurance products are becoming more personalized using continuously updated customer data.

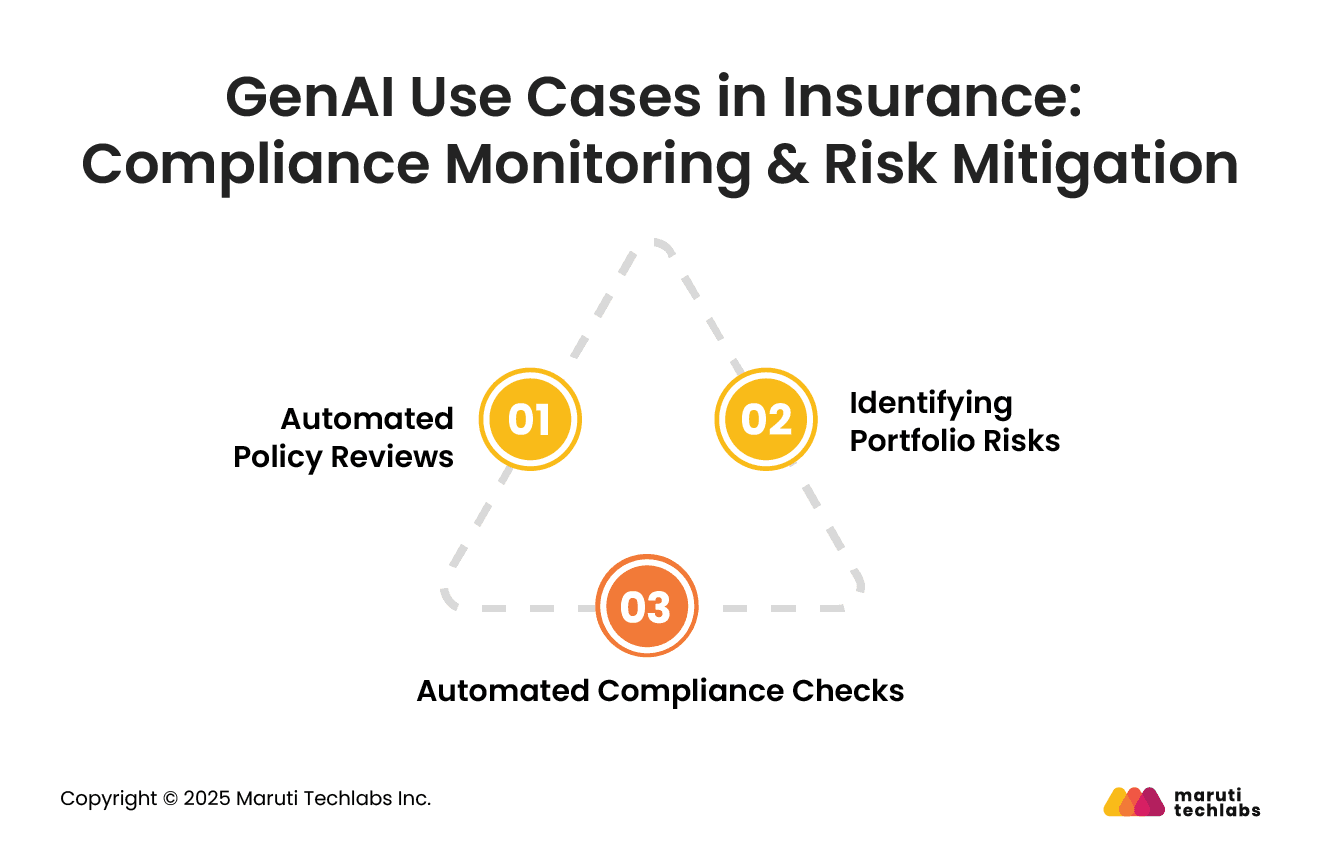

Post issuing a policy, insurers don’t catch a break from risk monitoring. It’s a continual process where insurers must ensure the exposure is proportionate to their risk appetite. In addition, issued policies must comply with changing regulations. Here are a few use cases where GenAI can help.

This involves examining policies that no longer match the insurer’s risk appetite or have lost importance over time. GenAI is proficient in analyzing policies post-issue to spot exposures that weren’t considered during underwriting or have emerged due to regulatory upgrades.

This timely review using AI helps identify clauses that enhance risks, miscalculated coverage limits, or industry-specific risks that weren’t considered. These reviews help insurers revisit risk assessments and eliminate unnoticed exposures.

It’s crucial to balance risks within a portfolio to monitor the distribution of exposures and avoid overconcentration. AI tools are adept at scrutinizing whole portfolios to identify risk concentration, geographic, or industry-based exposures.

These systems leverage real-time data to identify trends that could affect insurers in the long run. For instance, AI can detect if too many policies are offered to areas exposed to natural disasters. AI helps insurers build a more secure portfolio by taking corrective steps, such as altering coverage terms or opting for additional reinsurance.

AI can automatically review policies to maintain compliance with regulatory frameworks and internal underwriting standards. With changes in regulations and industry standards, AI can monitor policy language, exclusions, and exposures to adhere to legal requirements.

By spotting non-compliant clauses early, insurers can take active steps such as revising policy documents or urging customers to update their coverage. This helps avoid hefty penalties and ensures adherence to risk management best practices.

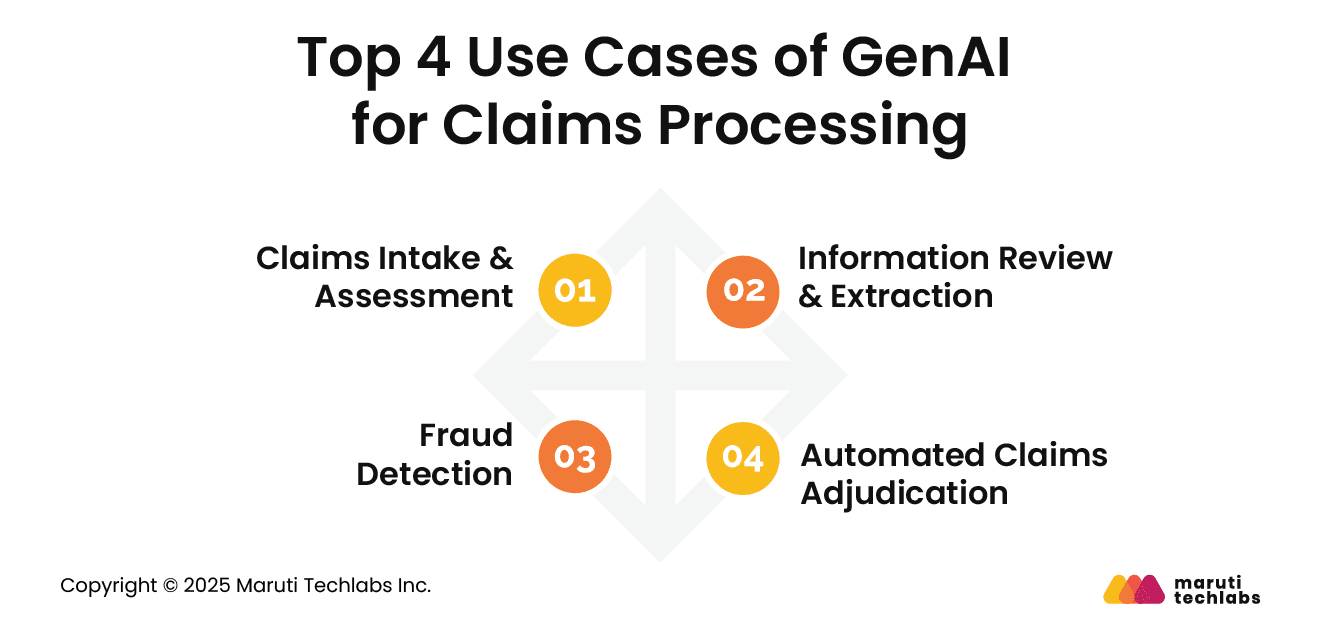

Accuracy and speed are prime requirements for claims processing. Introducing AI reduces the resources required while ensuring a reliable claims lifecycle. Here are GenAI’s most valuable contributions to claims processing.

AI-based systems can gather and organize claims by complexity or urgency across channels such as phone, email, or online portals. Examining the specifics of the claims, AI can triage complex cases for further investigation while offering a quick resolution for simple ones. This quickens initial processing and the handling of high-value or complex claims.

GenAI can explicitly extract key information, such as accident reports, medical bills, or repair estimates, from claim documents. This reduces manual work, eliminates mistakes, and reduces processing times. It can also flag issues if documents are missing or incomplete.

AI’s most prominent feature is its ability to identify patterns. It can spot activities like similarities in the language of claims from doctors or frequent claims from the same organization or individual.

By analyzing historical data and fraud cases, AI can become adept at spotting fraudulent activities. These benefits enhance the integrity of the claims process while reducing fraudulent claim payouts.

AI can adjudicate claims by analyzing claims data against policy specifics, older claim outcomes, and other data sources. It can facilitate quick resolutions by accepting or denying simple claims according to predefined rules. For complex claims, AI can perform a detailed analysis and create summaries for human adjudicators to review.

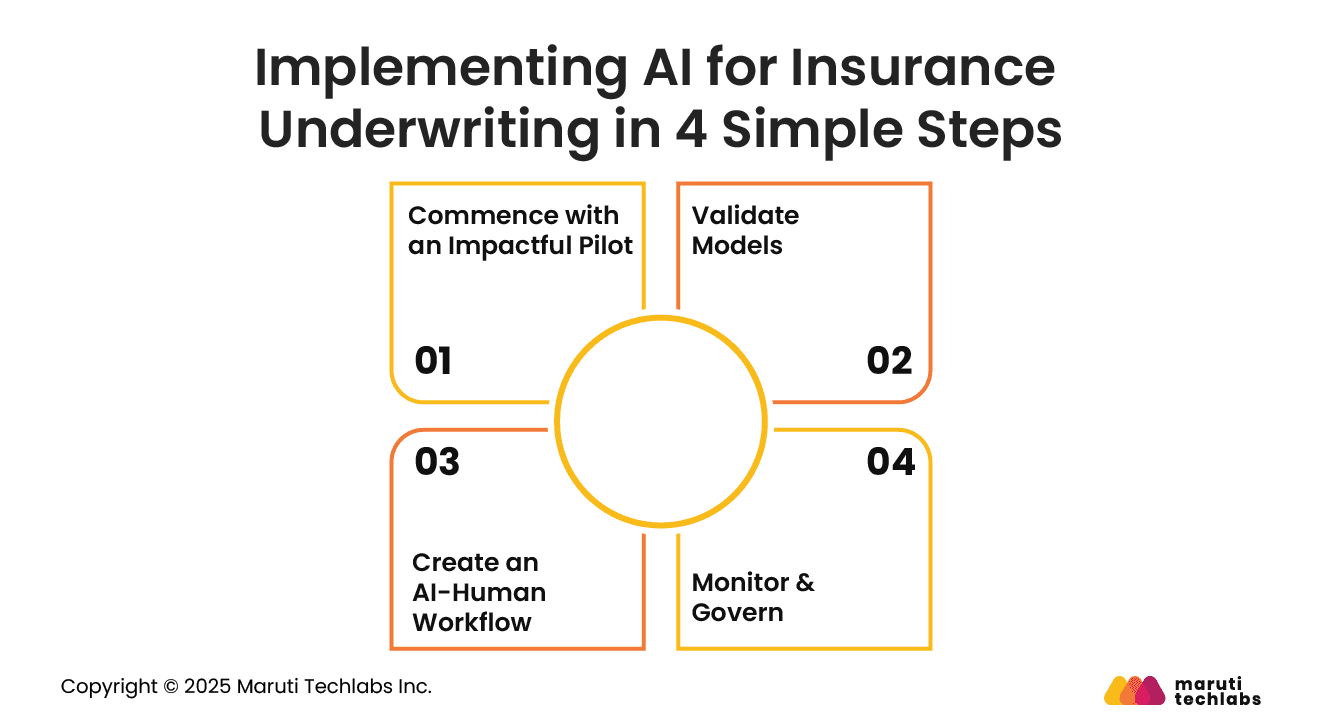

Here is the end-to-end brief process for implementing AI in insurance underwriting, designed to balance speed, accuracy, and regulatory compliance. Here is the end-to-end brief process for implementing AI in insurance underwriting.

Start your process with one use case, such as information extraction or risk scoring. Keep things simple by selecting a limited product line or a smaller region to control complexity.

Involve your underwriters along with your data scientists to train models, validate predictions, and align your efforts with current underwriting guidelines. Your models should be validated for explainability, fairness, accuracy, and operational performance.

AI shouldn’t be created to replace humans but to speed up decision-making. Underwriters should examine the AI-related outputs, correct them where necessary, and feed learnings back into the model. This human-AI collaboration can improve decision-making while enhancing trust.

Governance ensures that your model performs reliably over time. Monitoring eliminates model drift, spots data shifts, and fosters alignment with the latest regulations.

Generative AI is fundamentally redefining insurance underwriting by replacing manual, rule-based evaluations with data-driven, real-time risk intelligence. By analyzing structured and unstructured data, including claims history, medical records, historical data, and external signals, GenAI improves risk accuracy, reduces turnaround time, and enhances underwriting consistency.

Beyond underwriting, GenAI delivers value across insurance operations, from automated claims triage and fraud detection to personalized policy recommendations, customer support, and regulatory compliance. Insurers gain faster decision-making, lower operational costs, and improved customer experiences across the policy lifecycle.

To unlock these benefits at scale, insurers need secure, domain-ready GenAI solutions. Explore Maruti Techlabs’ Generative AI Services to modernize underwriting and drive enterprise-wide transformation.

Connect with us today to discover how GenAI can be introduced in your insurance processes.

Companies can leverage AI to analyze large volumes of structured and unstructured data to identify risk patterns, predict potential failures, and assess exposure accurately.

AI models evaluate historical trends, external data, and real-time signals to support informed, data-driven risk decisions and proactive mitigation strategies.

AI supports real-time risk assessment by continuously ingesting data from multiple sources such as transactions, sensors, market feeds, and external events.

It detects anomalies, updates risk scores in real time, and triggers alerts, enabling organizations to respond quickly to emerging risks and changing conditions.

AI tools enhance project risk management by predicting schedule delays, cost overruns, and resource constraints using historical and real-time project data.

They provide scenario analysis, early warnings, and recommended actions, helping project managers reduce uncertainty, improve planning accuracy, and ensure timely project delivery.