Implementing MDM for Insurance Companies in 10 Simple Steps

Insurance companies ingest data from a wide array of sources, including policy administration systems, claims platforms, customer relationship management systems, and even social media, often through automated third-party interfaces.

This disparate data is collected and stored across multiple legacy systems and databases that operate independently, resulting in silos, duplication, and inconsistent records that complicate reporting and analytics.

These limitations hinder accurate insights, delay decision-making, and increase operational risk, particularly when data changes frequently or is inconsistent across multiple versions of the truth.

Consequently, insurers require a single repository and a unified view of validated master data to streamline operations and support business analysts in deriving reliable insights.

This is where Master Data Management (MDM) comes in. MDM is a viable solution because it consolidates, cleanses, and governs data from disparate systems, enabling consistent data quality and 360-degree visibility for analytics and reporting.

In this article, we discuss how an MDM solution enhances different insurance processes, its challenges, and a 10-step implementation strategy to help you get started.

Master Data Management (MDM) is the process of developing and managing a centralized data repository that is crucial to business processes and making informed decisions.

MDM is crucial to the insurance industry because it must manage large volumes of data to underwrite policies, assess risks, and settle claims.

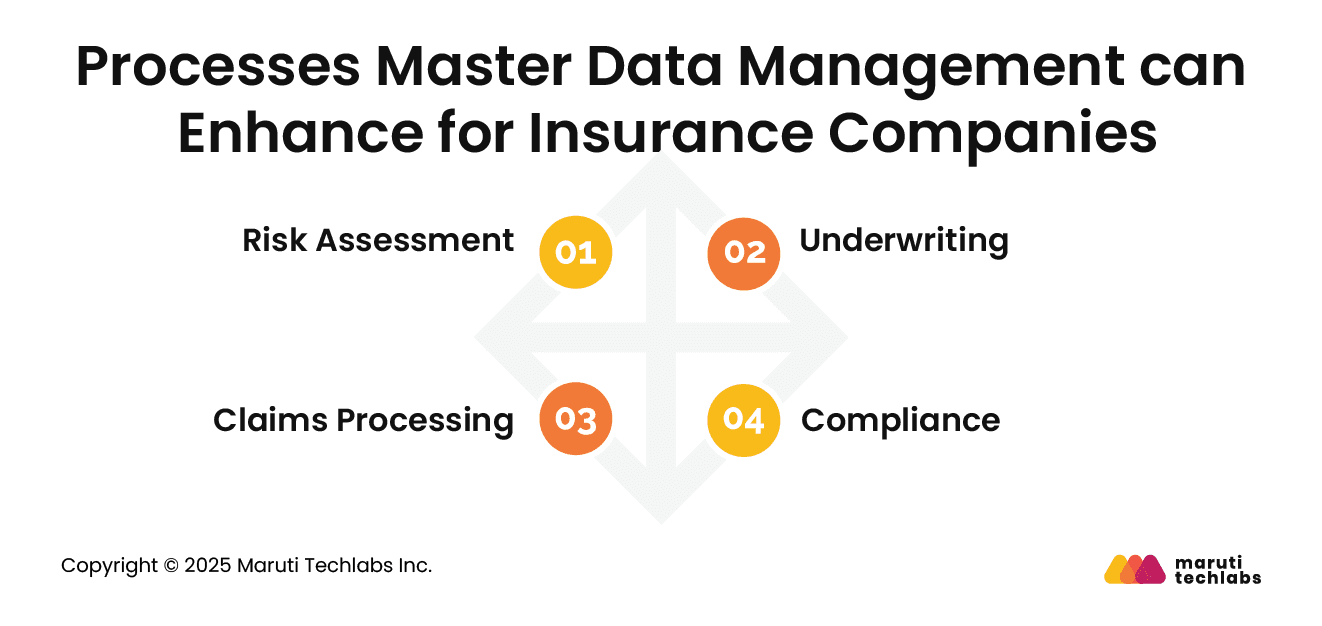

Here are some critical areas where MDM makes irreplaceable contributions.

Insurers require data related to claims, demographics, or credit scores to assess risks accurately. By having all data in one place, insurers can learn trends and patterns by analyzing it and conducting a thorough underwriting process.

After assessing risk, insurers must decide whether to underwrite a particular policy. This can be done after evaluating factors such as the policyholder’s history, policy type, and associated risks.

Insurers can offer better pricing and risk assessment by making informed decisions using MDM.

When a claim is filed, insurers are expected to process it accurately to serve the policyholder and reduce their costs.

MDM is the perfect solution for accessing all claims-related information and documentation. This enhances the speed of claims processing and reduces the likelihood of fraud.

Data management and reporting are subject to strict regulations in the insurance industry. By supporting data governance policies and standards, MDM ensures that insurers meet these requirements. MDM can classify and mask sensitive information while offering extensive data lineage.

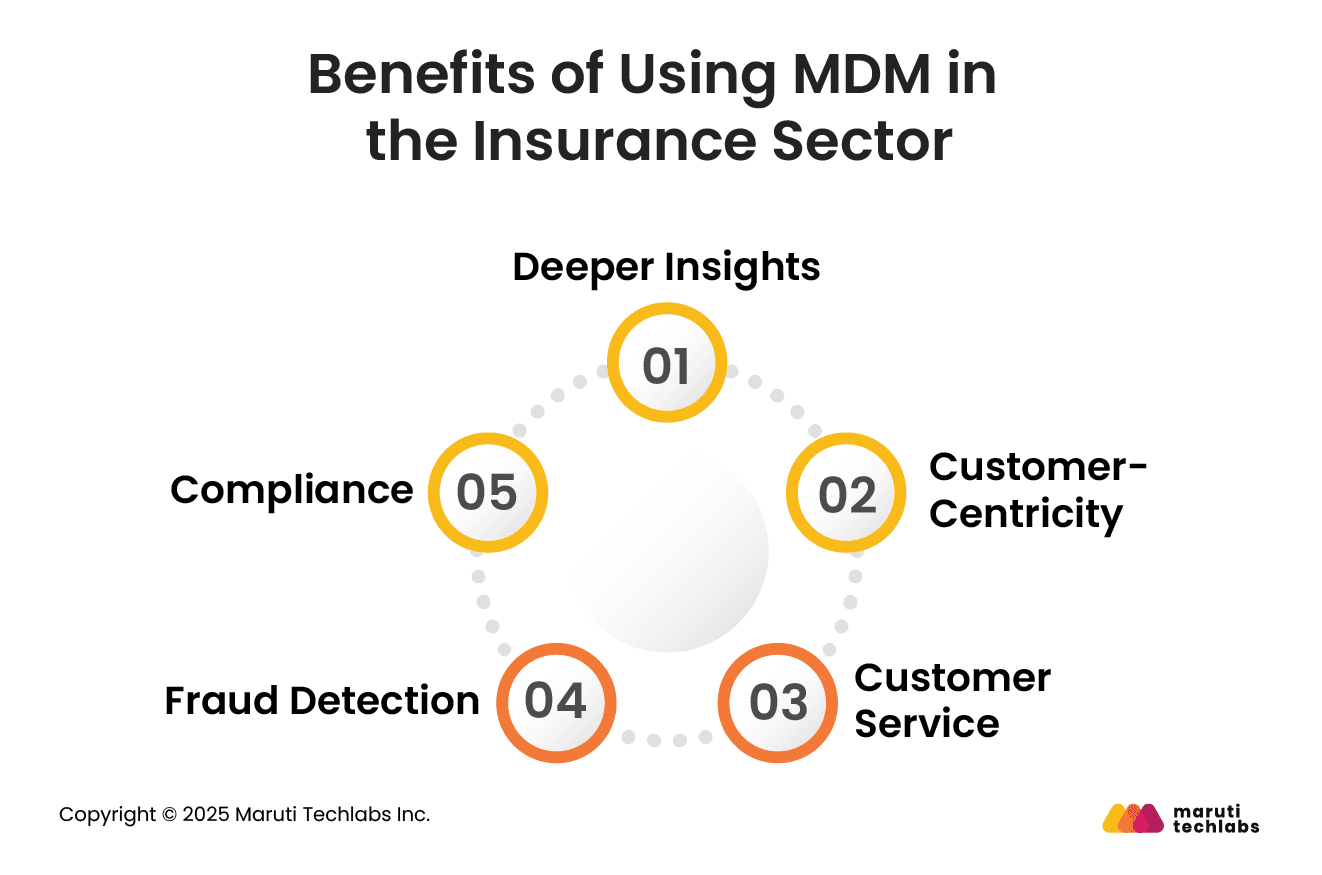

With consistent and governed data at its core, MDM strengthens decision-making, efficiency, and customer experience. Here are the top 5 benefits organizations can observe after implementing MDM.

Quality data from MDM enhances the predictive analytics capabilities. Subsequently, this increases upselling opportunities and improves profitability forecasts, thereby improving decision-making.

Aggregating and analyzing potential and existing customers from different data sources and behavioural patterns can help insurers make targeted marketing efforts.

As insurers move toward digital and self-service models, accurate customer data becomes critical. MDM provides a unified customer view that supports personalized offerings, consistent interactions, and data-driven cross-sell and upsell strategies.

A data-based approach can benefit various aspects of the insurance process. For instance, an advanced MDM solution can speed up claims processing. Accurate and reliable data can enhance customer experiences by automating processes such as customer payouts.

Furthermore, a comprehensive view of all insurance processes can simplify claims submissions, thereby improving the overall customer experience.

Consistency and accuracy of customer data gathered from multiple sources can help learn inconsistencies during claims processing.

These inconsistencies, when analyzed further with advanced MDM solutions, can help detect fraudulent customer activity and save millions of dollars.

Managing private data, such as customers' financial or health information, requires privacy measures and appropriate access controls. This is a requirement from both the customer and the legal perspective.

MDM offers a 360-degree bird’s-eye view into critical business data. Subsequently, accessing relevant data reports, observing gaps, and taking adequate action can help organizations maintain end-to-end compliance.

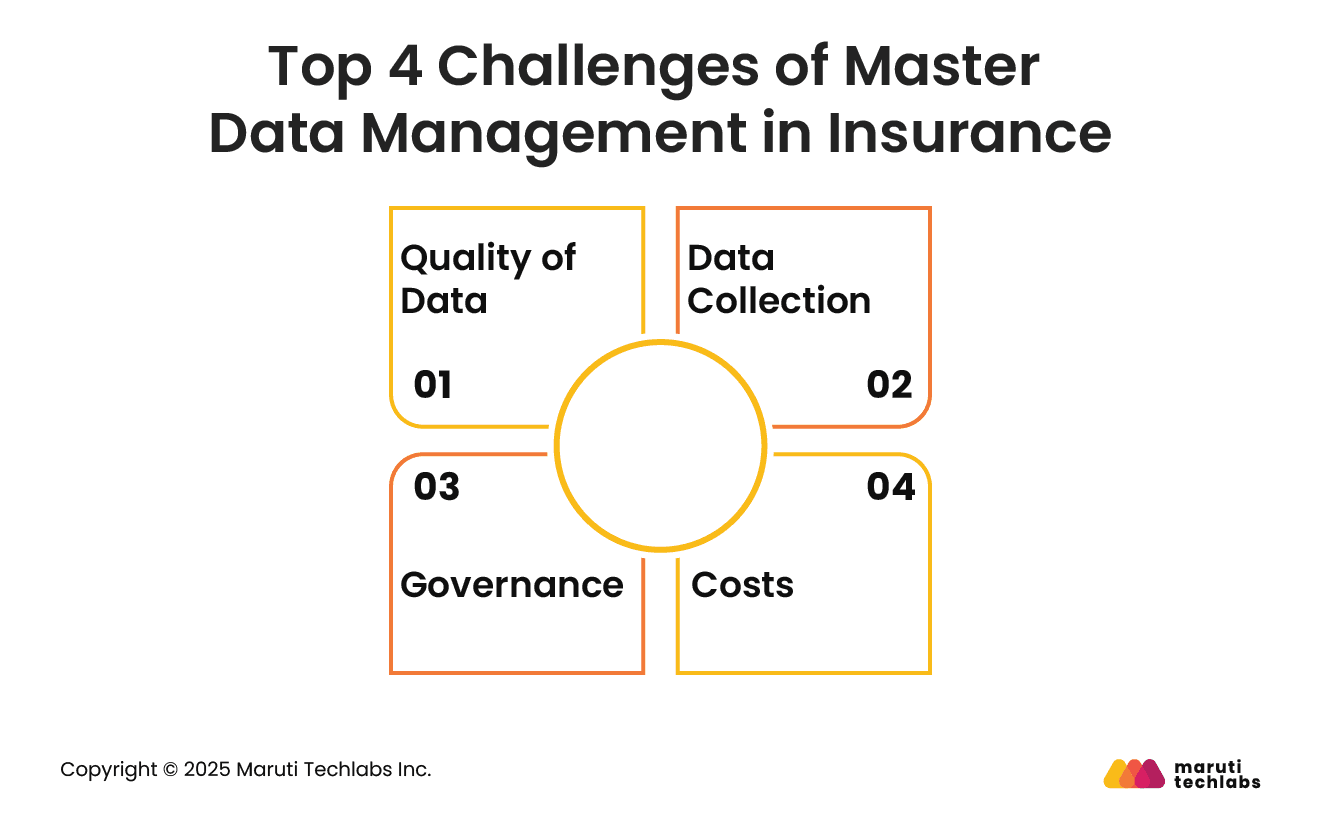

Implementing MDM for insurance comes with its own challenges. Here are the most evident challenges one can face while executing.

Insurance companies receive data from various sources and formats. This makes data cumbersome to manage. Traditional MDM solutions can struggle to analyze and organize semi-structured and unstructured data.

Organizations need advanced MDM solutions that can consolidate data in almost any format, offering refined data ready for use.

Insurance data is often scattered across different databases or systems. This makes it difficult to gather into an MDM repository. It can demand significant data mapping and integration efforts.

Governance is imperative to ensure effective and efficient data management. This requires organizations to define clear policies along with adequate support and training for employees.

To ensure data isn’t mishandled or compromised and remains in accordance with governance standards, organizations opt to use a data governance platform alongside an MDM system.

Implementing an MDM system can be costly, given investments in hardware, software, and training. In addition, observing any value or benefits from your investment or collecting and cleansing data can take months or even years.

Therefore, executing an MDM should be done with thoughtful consideration to avoid hurting an organization’s budget and planning.

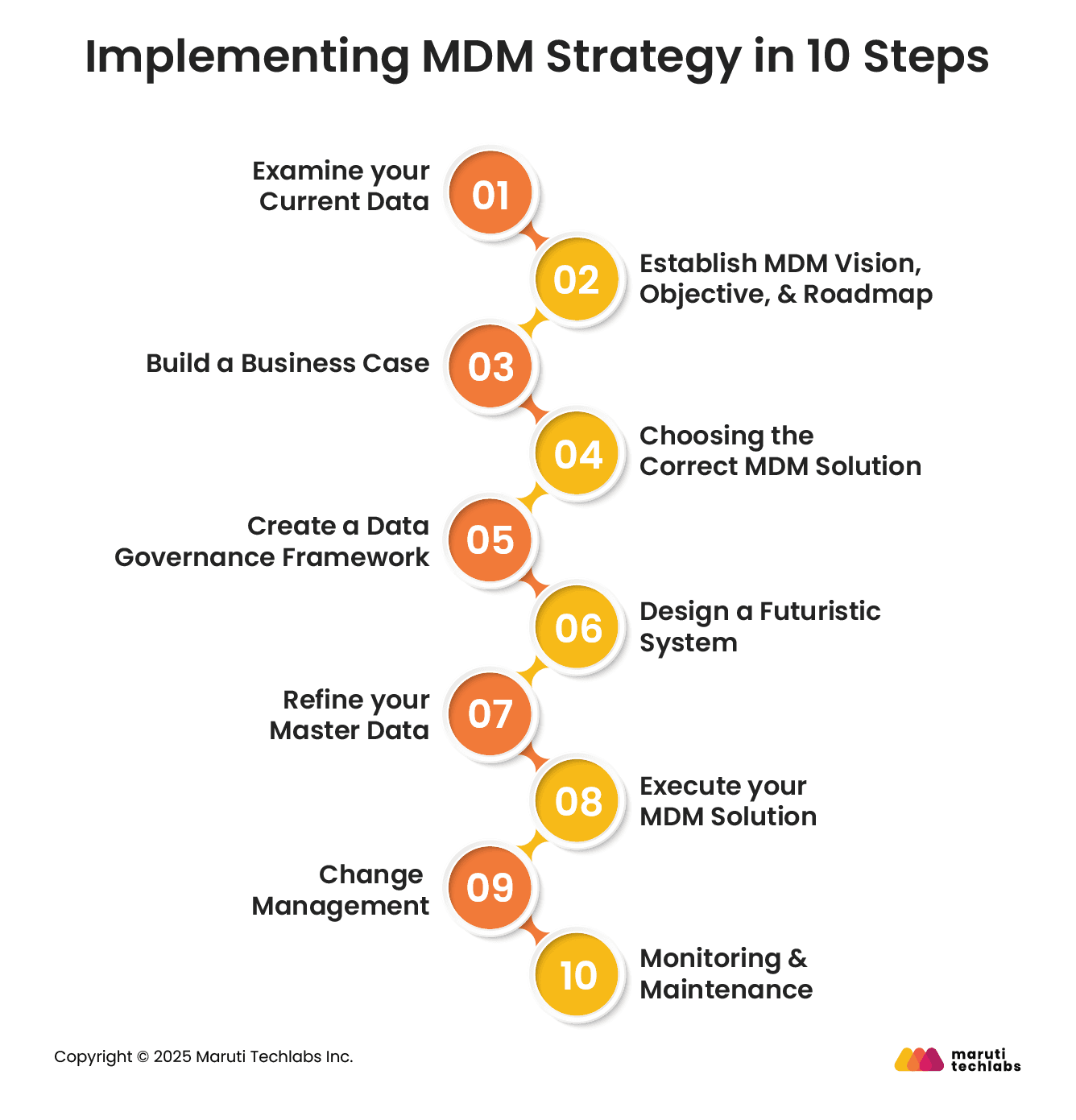

Thoughtful planning and implementation are crucial to executing MDM correctly. Therefore, we’ve broken down this process into 10 steps.

These steps encapsulate everything from vision to maintenance, starting with:

Garner a complete understanding of your data landscape. You can start by performing end-to-end data audits to learn data sources, formats, and quality concerns. This analysis would identify areas for improvement, helping you devise a sound MDM strategy.

MDM execution starts with visualizing the future data management framework that you want. This is the end goal that helps align all your efforts and decisions as you implement.

The tricky part is breaking this vision down into smaller, tangible goals. Your strategy must account for data integration, quality, governance, and change management.

A business case is critical for gathering the right resources and support needed for an MDM project. So leverage the SMART framework (Specific, Measurable, Achievable, Relevant, & Time-bound) to list down the benefits expected from MDM.

To avoid overwhelming stakeholders, keep the benefits focused on basics such as increased revenue, operational efficiency, and a better customer experience. The investment you expect to execute MDM on should also be quantified, along with the ROI it would offer.

The MDM solution you select should align with your goals and business objectives. If you're a large enterprise, consider user-friendliness, flexibility, scalability, and ease of integration.

Select a solution that can manage complex data relationships and massive data volumes. It should also offer robust data governance and security while integrating seamlessly with your enterprise systems.

Ensure you choose an experienced vendor that provides your team with adequate support, training, and guidance in your MDM journey.

Absence of a data governance framework can introduce anarchy. So, it’s crucial to have one in place to experience any success.

One must ensure that their data is managed in a timely and secure manner. To achieve this feat, an organization must have policies and standards for how it stores, accesses, and uses data.

Always plan and design a system with the future in mind. With upgrades to your business, you would need an architecture that is flexible, scalable, and adaptable.

At this stage, you would list all interactions with your MDM solution, identify data flows, and plan future integrations.

One must make sure their master data is accurate and consistent. Start by leveraging data profiling techniques to spot errors, abnormalities, and duplicate data.

Then refine this data using data-cleansing rules. And introduce consistency by standardizing data formats and values.

Once you have cleansed and refined your data, you can deploy your MDM solution. You must take the necessary steps and seek assistance from your MDM vendor or partner to understand the system, develop workflows, and set up your security perimeter.

Perform an initial launch with a small group to test and identify any underlying issues before your final deployment.

A successful implementation doesn’t end at deployment. To bring your efforts to fruition, you would have to offer training while managing this change across your company.

All users need to be made aware of new processes and policies. Additionally, any concerns or resistance to change must be discussed openly and honestly.

An MDM solution is a continuous process, not a one-time project. It demands timely monitoring of data quality and addressing any emerging issues.

So, you must perform data audits to uphold data governance policies and standards. Furthermore, it’s imperative to upgrade your MDM solution to evolving business requirements.

Master Data Management (MDM) serves as a holistic solution to insurers’ growing data challenges by unifying fragmented data across policy, claims, customer, and partner systems into a single, trusted source.

By standardizing, governing, and synchronizing data, MDM enables insurers to improve data accuracy, enhance regulatory compliance, and empower business analysts with reliable, analytics-ready insights.

It offers advantages like improved operational efficiency, faster decision-making, and consistent reporting across functions. However, insurers may face challenges with the quality of data, data collection, and costs during implementation.

These risks can be mitigated by following a structured, step-by-step MDM implementation approach by clearly defining your MDM vision, governance models, change management, and consistent monitoring.

This disciplined methodology ensures scalability, long-term adoption, and measurable business value, allowing insurers to modernize their data foundation and support future digital initiatives confidently.

Transform your insurance data into trusted, actionable insights with Maruti Techlabs’ Data Analytics Services. Build a unified, analytics-ready foundation that drives smarter decisions and measurable business outcomes.

Get in touch with us today and see how unified data platforms like MDM can work wonders for your insurance organization.

A Unified Policyholder Data Platform centralizes policyholder information from multiple systems into a single, governed repository.

It provides a consistent, 360-degree view of customers across policies, claims, billing, and interactions, enabling accurate analytics, personalization, and operational efficiency.

Insurance carriers need a unified platform to eliminate data silos, improve customer experience, and support data-driven decisions.

It enables faster underwriting, proactive servicing, cross-sell opportunities, regulatory compliance, and consistent insights across business, actuarial, and analytics teams.

Insurers face challenges such as fragmented legacy systems, inconsistent data definitions, poor data quality, duplicate records, complex integrations, and regulatory constraints.

Managing data governance, ownership, and real-time synchronization across multiple internal and external sources further complicates platform implementation.

Core components include data ingestion and integration layers, master data management, data quality and governance frameworks, a centralized data store, identity resolution, analytics and reporting tools, security controls, and APIs to enable seamless access across enterprise systems.