How Cloud Adoption in Insurance Can Drive Efficiency, Innovation, and Growth

Cloud is a significant change for insurance in 2026 because it enables faster delivery, real-time access, and improved customer service. It also helps teams scale smoothly as business needs grow.

Insurance firms face rising digital use, fast growth in data, and constant pressure to act quickly. They must adhere to strict rules when competing against new players. Cloud helps them respond quickly and with control.

Cloud adoption helps manage sudden spikes in claims, brings all data into one place, and releases new products faster. It also reduces cost pressure and supports customers who want quick service, simple tools, and clear digital journeys across channels.

Cloud improves speed, cost, and customer service. It supports growth and strong data use. It also needs careful planning, strong controls, and clear change steps. Teams must balance benefits with risks to get long-term value.

Cloud-based solutions enable insurers to store and process applications on remote services via the Internet.

It is like renting a car. You could buy a high-performance Maserati, but it’s expensive, requires heavy maintenance, and lacks practicality. Also, purchasing a Maserati is not a feasible option for many.

Renting offers flexibility and cost-effectiveness.

Similarly, migrating to the cloud makes sense, considering the long-term cost benefits, scalability, and flexibility. Insurers can scale their resources up or down based on the demand.

For example, companies can scale up their resources during peak demand periods, such as monsoons or natural disasters, and scale down when the demand drops. Thus, cloud-based platforms offer unbeatable cost savings and enhanced efficiency.

Cloud-based solutions also enable insurers to securely store vast amounts of data related to policies, claims, and customers on the cloud. This central repository facilitates automating and streamlining policy issuance, renewals, and cancellations, improving speed and accuracy.

Delloite says ‘speed’ is the new currency in insurance, and rightly so.

Today’s digitally driven customers expect everything at the touch of a finger. Their groceries get delivered within minutes, and their travel bookings are done in a click, so why not their insurance?

With cloud technologies, insurance companies are pushing the envelope of innovation.

Cloud computing has fuelled a paradigm shift in the ‘build-buy-acquire’ mentality. Today, big or small companies are moving to a more dynamic and cost-effective model of a ‘rent-try-evolve.’ With access to unlimited resources, insurance companies can afford to experiment, innovate, fail, and grow.

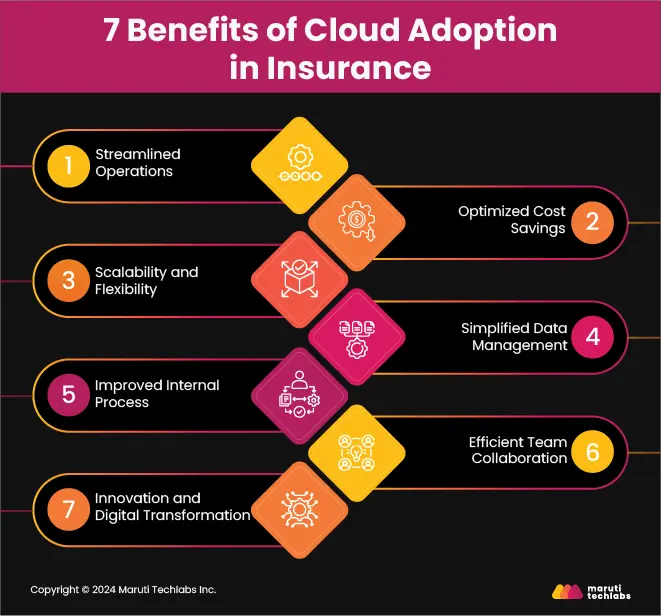

Check out the benefits of cloud adoption in insurance -

In a recent survey, 52% of participants picked operational efficiency as one of the most crucial factors driving cloud adoption.

Lemonade uses cloud tech to streamline onboarding and claims. MetLife, too, migrated to the cloud to automate its processes, approvals, and payouts. Progressive Insurance implemented cloud technology to automate many aspects of claims management, resulting in quicker processing times and more efficient operations.

Several insurance companies are implementing cloud tech solutions for real-time data analysis, better risk assessments, predictive modeling, and easy claims management.

Cloud migration can curb IT spending by about 30% - McKinsey.

Cloud-based solutions enable insurers to move from legacy systems and infrastructure to advanced cloud technologies. This enables them to automate and optimize workflows, significantly reducing operational costs.

73% of insurance executives see scalability as a significant benefit of cloud adoption.

Scalability and flexibility fuel insurance businesses amid rising risks, market shifts, and changing consumer demands. Cloud computing enables companies to adjust resources on demand, avoiding over- or under-provisioning.

One of the biggest benefits of cloud adoption is simplified data management.

Data is the backbone of insurance. Legacy systems ran on fragmented data, which hindered information accessibility and impacted performance and efficiency.

Cloud data storage solutions like AWS or Azure offer centralized and secured data storage and management. This not only makes the data easily accessible but also paves the way for data analytics, predictive modeling, and data-driven risk management.

Medigap Life, a prominent US-based online insurance aggregator, optimized its internal workflow by migrating to the cloud. This resulted in an 88% reduction in their process execution time.

Cloud migration and modernization facilitate process automation, thus enabling reduced redundancies and faster responses. From policy underwriting, claim handling, and lead generation to ongoing support, cloud-based platforms elevate several internal processes.

Read more: How is AI in Underwriting Poised to Transform the Insurance Industry?

Cloud-based collaboration helps businesses shorten time to market, quickens product upgrade cycles, and gives a competitive edge. – Forbes

Cloud-based insurance solutions offer centralized platforms for accessing and sharing data securely. Teams enjoy enhanced capabilities in communication, product and service delivery, information sharing, tapping knowledge resources, and group problem-solving. Such collaborations improve business processes, including purchasing, manufacturing, marketing, sales, and technical support.

According to McKinsey, with advanced analytics, companies have achieved a 40% reduction in average handle time, a 5-20% increase in self-service rates, and up to $5 million in employee cost savings.

Cloud computing has brought a seismic transformation in the insurance sector. From data analytics and AI to IoT and telematics, cloud tech is reshaping the insurance industry in unprecedented ways.

Today, insurance companies are breaking new ground with real-time asset monitoring and usage-based insurance coverages that take customization to the next level. With AI-enabled image recognition, insurers further push the edge with end-to-end automated claim processing and instant settlements.

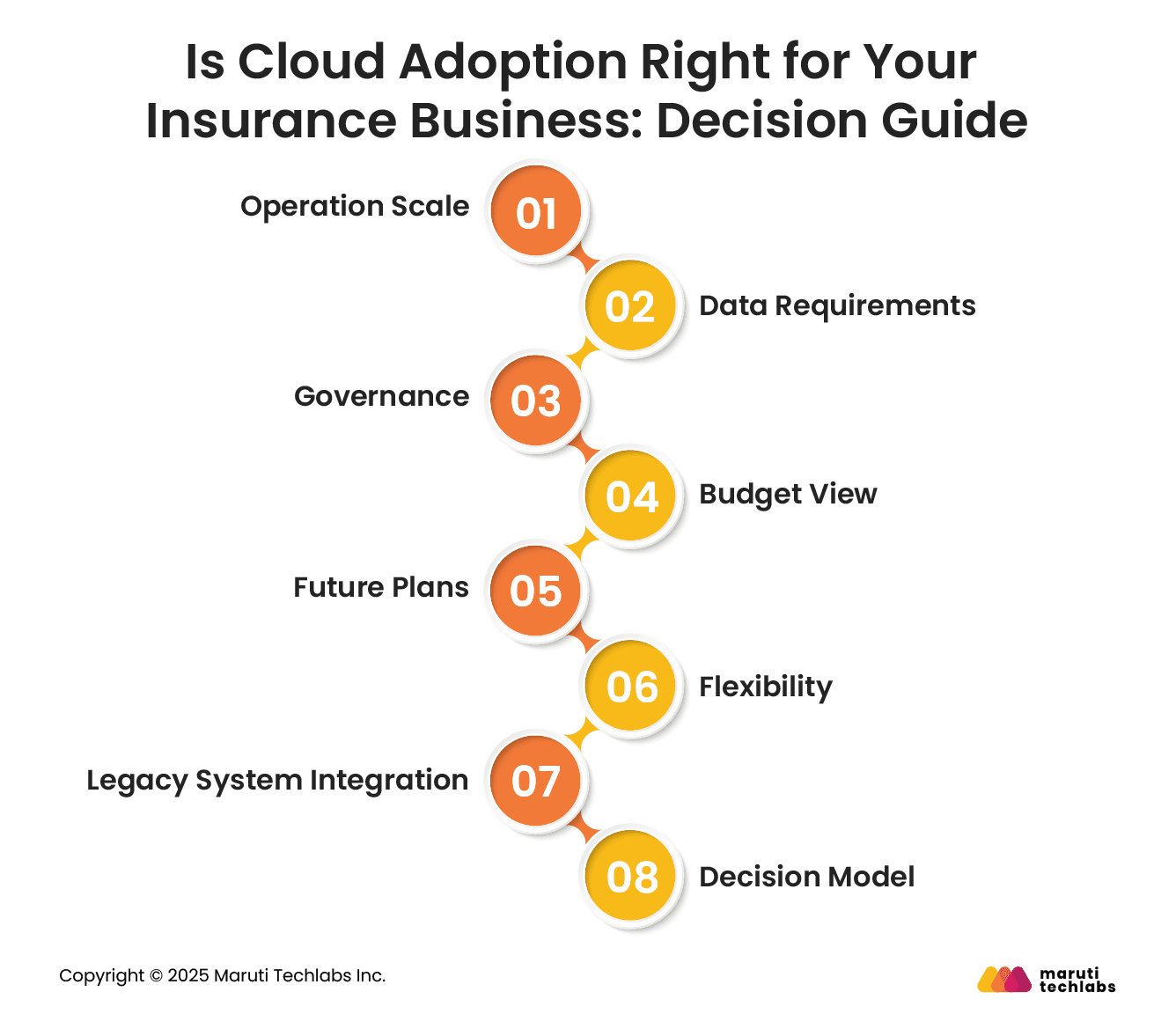

This checklist helps insurance firms understand if the cloud supports their goals. It brings clarity to planning and reduces guesswork.

Large operations may gain more value from cloud speed and reach, while smaller firms may adopt cloud in steps. Review service volume, claim load, and team size to see if the cloud improves daily work and long-term goals.

Firms with large datasets gain significant value from cloud storage and analytics. Cloud supports quick access and deep insight. Review current storage, data quality, and reporting needs to decide if the cloud will improve decisions and customer service.

Insurance firms face strict rules. Cloud can support audits, reporting, and controls. Review current rule needs, oversight gaps, and required checks. Compare available tools and confirm how cloud systems support transparent governance and steady compliance.

Cloud offers flexible cost models. Some firms save money, while others spend more without a clear plan. Review current cost, long-term goals, and expected growth to decide if the cloud offers balanced value for your business.

If your business plans to expand, the cloud supports new products, new regions, and higher demand. Review upcoming plans and check how the cloud can reduce delays and support faster delivery. Confirm if the cloud helps you grow with less pressure.

Cloud offers freedom to change tools and scale. Firms with fast-changing needs may benefit more. Review expected change, new product ideas, and required updates to decide if the flexibility of cloud supports your direction.

Old systems slow progress and increase cost. Cloud helps reduce this burden. Review the age of current systems, support issues, and upgrade needs. Decide if a planned shift to the cloud can remove limits without heavy risk.

A simple scoring model helps compare readiness across areas like scale, data load, rule pressure, cost, growth, and legacy risk. Score each area from low to high and review the overall result to guide a clear cloud decision.

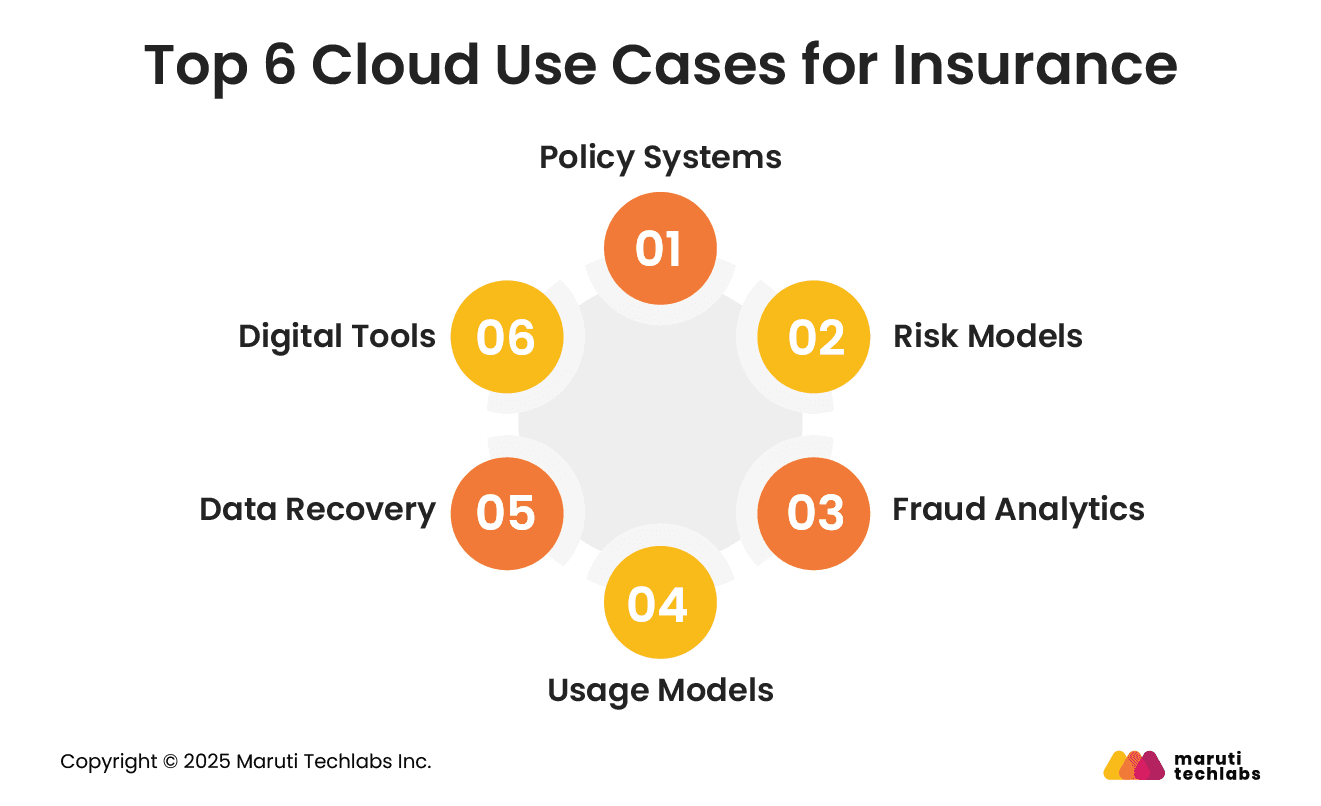

Cloud helps insurance firms run stable systems, use data better, and deliver new ideas quickly. These use cases show where the cloud offers real value.

Cloud supports strong policy and claim systems that handle daily tasks with ease. It manages updates, workflows, and large volumes of data. It also helps service teams respond more quickly and improves customer trust throughout the claim journey.

Cloud allows insurers to run large data models for risk and underwriting. It helps teams test ideas faster, use fresh data, and improve accuracy. This leads to better pricing and stronger decisions for every customer and product.

Cloud tools help detect fraud early with predictive checks and clear patterns. They support real-time alerts, risk scoring, and quick action by review teams. This improves safety, saves costs, and maintains trust across the entire claim process.

Cloud supports products based on real-world use. With connected devices and simple data flow, insurers can track driving, health, or usage patterns. This enables fair pricing, new products, and more personal customer experiences across markets.

Cloud offers secure backup and quick recovery for essential data. It protects against loss, supports business continuity, and reduces downtime. Firms can restore services fast during events and maintain customer confidence during tough moments.

Cloud makes it easier to build helpful customer tools. These include service portals, mobile apps, chat systems, and dashboards for agents. They improve engagement, reduce wait time, and support smooth experiences across all channels.

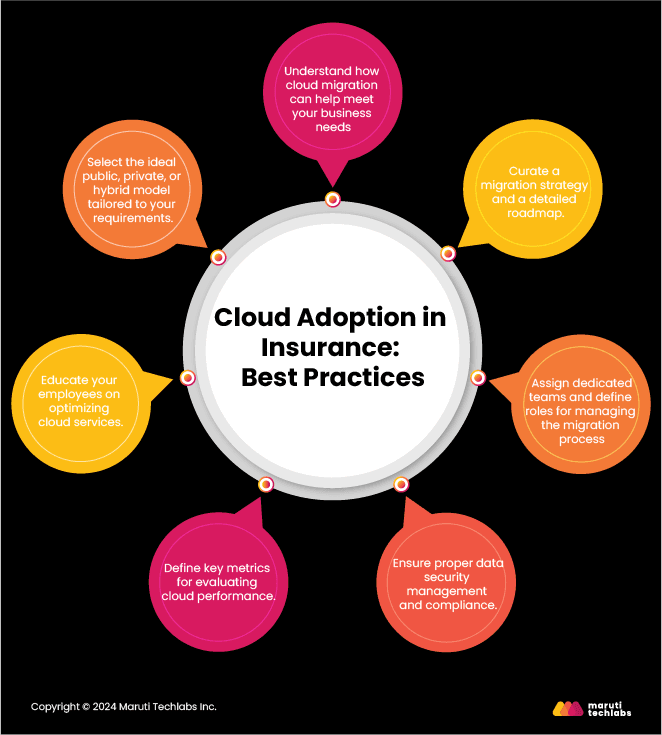

About 83% of insurance leaders believe that cloud adoption is crucial for staying competitive and driving innovation within the industry. However, successful cloud migration is complex and requires a well-defined action plan to manage risks and opportunities.

Many industry giants have faced challenges and failures due to poorly executed cloud migrations, underscoring the need for careful planning.

Here are seven cloud migration best practices to facilitate a smooth transition:

Identify the business goals and objectives that can be achieved through cloud migration, such as cost savings, improved scalability, enhanced collaboration, and increased agility.

Develop a comprehensive plan outlining the scope, timeline, and resources required for the migration, including assessment, planning, design, implementation, testing, and deployment.

Establish clear roles and responsibilities for team members, including project managers, technical leads, engineers, and stakeholders, to ensure effective communication and coordination throughout the migration process.

Implement measures to ensure the secure data transfer to the cloud, including encryption, access controls, and monitoring to meet regulatory requirements and industry standards.

Establish key performance indicators (KPIs) to measure the success of the migration, such as uptime, latency, scalability, and cost savings to ensure optimal cloud performance.

Provide training and education on cloud services and best practices to ensure employees can effectively use cloud resources and optimize their usage.

Evaluate the pros and cons of public, private, or hybrid cloud models to determine which best meets your organization's needs.

Cloud offers substantial value but requires care. Insurance firms must understand risks and plan controls to avoid delays or failure.

Insurance firms handle sensitive customer data and must follow strict rules. Cloud needs strong governance, clear oversight, and constant checks. Integrating old systems can be slow and may need careful planning to avoid errors or delays.

Some cloud tools limit control or create long-term dependence. Moving between providers can be costly and slow. Teams must study exit paths, long-term cost, and change effort before choosing a provider.

Cloud can increase safety when used well, but firms must apply best practices. Strong access controls, steady checks, and clear monitoring protect data. Without these steps, the system may face unavoidable risks.

Cloud depends on reliable internet and provider stability. Service issues can slow work or block access. Teams must plan backup methods, monitor provider performance, and ensure networks stay strong for all users.

Our client, a leading online insurance aggregator, aimed to enhance their CRM and workflow systems to address scalability, speed, performance, and functionality issues, ultimately seeking to improve customer service and operational efficiency.

To cope with these issues, they sought an experienced team who could guarantee a seamless migration without disrupting their ongoing business operations.

We proposed a distributed, configurable, and scalable solution and implemented it by meticulously sorting and prioritizing the most crucial migration workflows.

Here’s how we implemented a seamless migration to the cloud -

The migration resulted in phenomenal improvement in system performance.

These results aided in elevating their customer service, enhancing customer retention and loyalty.

Read our detailed case study to learn more about how Maruti Techlabs accomplished this migration seamlessly.

Cloud insurance is revolutionizing the insurance landscape, dismantling infrastructural barriers in insurance. Cloud-based platforms make advanced insurance technology and data storage facilities accessible and affordable for insurers of all sizes, paving the way for innovative solutions and enhanced efficiency in the industry.

Companies can now streamline their operations, automate repetitive tasks, eliminate much of the tedious paperwork, save costs on infrastructural investments, and easily gain scalability.

With centralized data, scalable resources, and advanced analytics, cloud insurance also sets the foundation for integrating artificial intelligence and machine learning. Thus, cloud insurance is no longer a choice but the only way to win customer loyalty and survive cutthroat competition. However, migrating to the cloud involves technical, operational, and security challenges. Connecting with a cloud security service provider helps implement robust security measures and ensure data protection.

With over a decade of expertise in cloud application development services, Maruti Techlabs has experience successfully executing highly customized cloud-based solutions in the insurance industry. Our expert cloud consultants can help you analyze the intricacies of your current system, assess the feasibility of cloud adoption, and create a detailed roadmap for a seamless transition to the cloud.

Contact us today to leverage the power of cloud insurance.

Cloud computing is revolutionizing the insurance claims process by providing secure, scalable data storage and management, electronic intake, real-time tracking, and automation of routine tasks through AI and machine learning. One key benefit is the implementation of machine learning for claim processing, which enables AI-powered algorithms to analyze claims data, identify patterns, and predict outcomes. It also enables collaboration through secure online portals and predictive analytics to identify patterns and prevent potential losses.

Implementing cloud-based solutions requires proper planning and strategy. Here are a few steps that you can follow to ensure successful implementation -

CDP in insurance stands for ‘Customer Data Platform’. A CDP collects and unifies customer data from multiple sources, creating a single, comprehensive view of data.

Insurance companies are using generative AI for analyzing vast datasets that aid in -