Seize New Insurance Opportunities With Predictive Analytics Insights

The insurance industry is leading the way in adopting technological innovations, especially in data analytics. Predictive analytics transforms insurers' operations by enabling them to make smarter, data-driven decisions that boost efficiency, minimize fraud, and enhance customer satisfaction.

Data Bridge Market Research shows the global predictive analytics market is estimated at USD 358.5 billion in 2024. It is expected to reach USD 728.63 billion by 2029, growing at a CAGR of 15.24% from 2024 to 2029. This indicates the increasing importance of predictive analytics in insurance for industries at large. By analyzing historical data patterns, predictive models enable companies to foresee future trends and risks, making them an essential tool for success.

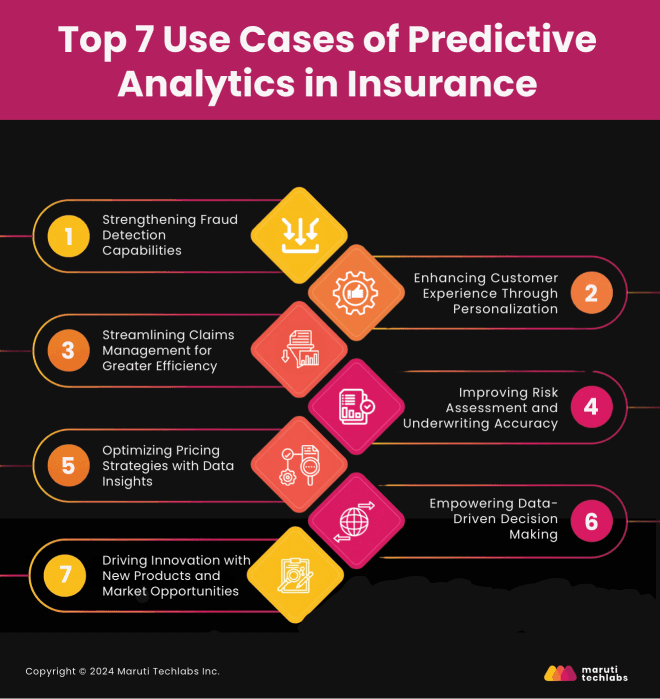

This blog will explore how predictive analytics strengthens fraud detection, enhances customer experience, streamlines claims processing, and refines risk assessment and pricing strategies. We’ll also examine how this technology uses data-driven decision-making and drives progress in the insurance industry.

Predictive analytics is the practice of studying historical data that finally predicts future outcomes. It utilizes machine learning algorithms and statistical techniques to identify patterns with some voluminous data sets, thereby obtaining actionable insights. For insurance companies, it translates into enhanced risk assessment, optimized pricing, streamlined claims processing, and more.

Various predictive analytics models exist, such as classification models, clustering techniques, and time series forecasting. These models assist in predicting future outcomes by analyzing data and deriving insights in different ways.

The process of predictive analytics involves several key steps:

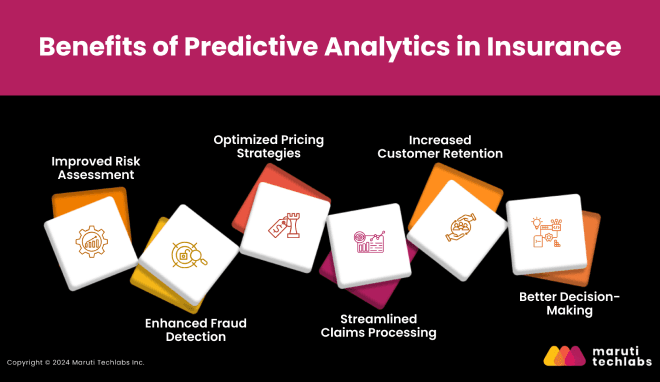

Predictive analytics transforms the insurance industry by helping companies anticipate trends, improve efficiency, and deliver better customer experiences.

Here's a look at how it benefits insurers:

As we explore the top use cases of predictive analytics in insurance, one of its most significant use cases emerges in its ability to combat fraud effectively.

Predictive analytics in insurance has become a powerful tool in combating fraud. It allows companies to identify suspicious activity early and take proactive steps to prevent hard and soft fraud.

Predictive analytics employs complex machine learning algorithms to find anomalies in underwriting and claims. These models can also provide real-time alerts for inconsistencies based on behavioral patterns, transaction histories, and external data.

For example, if there are disparities between the reported injuries by the customer and their medical history through the claims data, these predictive models can create alerts for the insurer to investigate such instances before fraudulent claims gain momentum.

Insurers are increasingly tapping into big data sources, including social media, to gather contextual information on claims. By analyzing social media activity, predictive models can identify cases where a claimant’s online behavior contradicts their reported injuries or damages.

Predictive analytics in insurance performs well in differentiating complex fraud (completely fabricated claims) and soft fraud (exaggeration of legitimate claims). Machine learning models trained on historical data of fraudulent cases may identify common patterns between the two types of fraud.

These models analyze variables such as claim amounts, customer characteristics, and claim frequency and can help detect suspicious cases early on to avoid payouts for fraudulent claims.

Behavioral biometrics, such as typing speed, mouse movement, or even voice patterns, offer a sophisticated method for detecting fraud. Predictive models use these biometrics to identify deviations from a customer’s behavior.

For example, if a user’s typing speed drastically changes during an online claims submission, it could indicate that a third party is fraudulently attempting to file the claim. Integrating these biometrics with predictive analytics strengthens fraud prevention efforts by adding another layer of authentication and security.

In one instance, an insurance company detected a suspicious claim involving a car accident that seemed legitimate. However, the predictive model revealed inconsistencies between the claimant’s behavior and their online activity.

Social media analysis indicated that the claimant had posted about traveling abroad on the date of the supposed accident, raising a red flag. Upon further investigation, the insurance company discovered that the accident had been staged, and the claim was denied, preventing a significant payout.

This example highlights how predictive analytics can help insurers detect fraud early and minimize financial losses.

Beyond fraud detection, predictive analytics' potential extends to enhancing customer experience, making it a versatile tool in an insurer's arsenal.

Predictive analytics may provide insurers with vital insights into how they interact with clients by discovering more about customer behaviors and preferences.

One of the best usage scenarios where predictive analytics enhances the customer experience is when an insurer can communicate according to each customer's individual preferences.

Whether recommending a policy that best suits a customer, determining renewal dates for a policy, or accepting promotional offers, predictive models enable insurers to understand customers' needs and reach out more effectively.

A significant challenge in the insurance industry today is retention. Predictive analytics in insurance can identify the customers most likely to leave through its ability to give an insider's view on customer behavioral patterns, such as disengagement, delayed payments, or claims inquiries.

Insurers can take early measures such as offering personal discounts or improved customer service to retain those with high risks of leaving. Predictive models can also help identify customers whose premiums will increase substantially; hence, they can design tailored products to keep customers from switching to competitors. This strategy holds much promise to dramatically lower churn rates.

The digital age allows customers to experience the service through its touchpoints – website, mobile app, email, or phone. Predictive analytics helps insurers provide a seamless, consistent, personalized experience across all these touchpoints by analyzing customers' interactions with these different touchpoints.

Whether the customer initiates an inquiry through the website and then continues with further information over the phone or via email, the predictive models ensure consistency of information and updated information for a seamless experience, hence boosting satisfaction and overall perception of the brand by the insurer.

Given rising customer expectations, insurers must be able to streamline their claims handling, automate routine tasks, and focus on cases that require more human interaction.

All these objectives can be achieved through the comprehensive adoption of advanced technologies. Embracing these technologies allows insurers to streamline claims handling, automate routine tasks, and focus on cases that require human intervention.

One significant advantage of predictive analytics in claims management is its ability to automate the handling of routine, low-risk claims. This frees up valuable resources for more complicated cases that require human intervention. Machine learning models assess claims in real time, categorizing them based on urgency and complexity.

For example, a simple car repair claim might be automatically processed, while a multi-car accident with potential fraud indicators gets flagged for a closer review by the claims team. This intelligent allocation of resources ensures that claims are handled efficiently while maintaining high accuracy and oversight.

Predictive analytics also does a great job of finding outlier claims that, when compared with historical data, do not fit the normal pattern of behavior. Identification at an earlier stage would prevent such expensive problems from growing out of control. For example, if a claim shows unusual patterns in cost, frequency, or customer behavior, predictive models trigger an alert, prompting the insurer to investigate. Catching these issues early helps reduce losses and gives insurers better control over claims expenses, preventing unexpected costs in the future.

The adjudication process is often time-consuming, but predictive analytics in insurance makes it faster and more accurate. Such models can predict the probable outcome of existing claims by analyzing historical claims data so that insurers can adjudicate claims that fall in specific ranges without hassle.

Even predictive algorithms can prescribe a reasonable payout range for the particular type of claim, thereby reducing the manual review. This can improve operational efficiency, minimize errors, and reduce the time customers spend before their cases are resolved, which enhances customer experience.

Predictive analytics is the power source behind machine vision, which completely transforms insurers' handling of physical damage claims. The technological innovation lets the system analyze visual data in photos or videos, thanks to those submitted by claimants. Immediately following the car accident, claimants can simply upload pictures of the damage to their vehicle for assessment regarding possible repair costs by the machine vision system.

This automatic assessment cuts down on manual inspections and speeds up the process. Machine vision helps analyze damage from natural disasters such as floods or storms, generating quick and accurate claims evaluation without needing in-field visits for property insurance.

Returning to insurers' core operations, predictive analytics are invaluable in refining risk assessment and underwriting processes.

Accurate risk assessment helps insurers offer competitive premiums and ensures financial stability by reducing exposure to high-risk individuals. Predictive analytics transforms these processes by providing a more granular and data-driven approach, enabling insurers to offer customized policies while minimizing uncertainties.

Today's traditional risk assessment models can only consider a minimal number of variables. However, when done with predictive analytics, the insurer can assess dozens or hundreds of factors to understand the level of customer risk. Metrics here vary from simple demographic data about a customer and his credit scores to external ones, including location, weather, and even driving habits.

By analyzing this huge set of data points, this type of prediction-based risk profiling becomes more precise for each policyholder. This better scoring can then facilitate a better insurer's re-evaluation of the risk, which reduces the chance of mispricing a policy and, consequently, brings the premium closer to the true level of risk.

Predictive analytics in insurance go beyond assessing current risk. It uses historical data to create personalized insurance plans that cater to individual customer needs. By analyzing previous claims data, policyholder behaviors, and market trends, insurers can design policies tailored to specific risk factors. This level of personalization enhances customer satisfaction and ensures that the insurer appropriately balances risk with revenue potential.

As insurance companies grow, so does the volume of quotes they need to process. Predictive analytics streamlines the quoting process by automating risk assessments and ensuring consistency across more significant volumes of requests.

Machine learning models analyze various inputs to generate accurate quotes in real time, allowing insurers to respond promptly to customer inquiries. This efficiency doesn’t come at the cost of accuracy—predictive models continuously refine themselves based on new data, enabling insurers to maintain high precision in risk assessments while handling more extensive quotes.

Besides evaluating the individual risk associated with a customer, predictive analytics helps an insurer forecast key performance indicators that determine long-term business planning. Insurers can make accurate forecasts on future performance metrics after identifying the trend regarding claims frequency, loss ratio, and policyholders' behavior patterns. This information will allow insurers to manage risks and optimize underwriting strategy proactively. They will then adjust pricing models to ensure profitability.

With insights derived from predictive analytics, insurers can also optimize their pricing strategies, ensuring they remain competitive in a rapidly evolving market.

Predictive analytics enables insurers to develop more sophisticated, data-driven pricing models that benefit the business and ensure fair and dynamic pricing for customers.

In most traditional insurance models, premiums are divided into categories based on age, location, or occupation. With predictive analytics, more specific risk assessments based on many data points, including driving behavior, health history, and lifestyle choices, are possible. This allows insurance companies to create individualized pricing models, ensuring customers pay according to their risk level.

A good driver might pay a less expensive premium than an individual whose driving record shows many speeding tickets. This system benefits the insurance company and the customer, reducing the risk and bringing a fairer premium quote.

One of predictive analytics' most exciting innovations is the creation of dynamic, usage-based pricing models. This innovation enables people to pay premiums in pay-as-you-go insurance, where customers pay for what is real-time usage or behavior.

For instance, telematics data from a customer's vehicle might help calculate premiums based on driving habits, miles driven, or time spent on the road. Health insurers might offer plans based on wearable devices, with premiums that change based on actual physical activity or other lifestyle factors. This dynamic model provides much more flexibility to customers because they can assume responsibility for their premiums by changing their behavior.

With predictive analytics, insurance companies can adjust premiums based on factors beyond their control. These include economic trends, regulatory changes, and shifts in customer behavior. Consumer behavior data, such as purchasing habits and digital activity, can be measured to assess customer loyalty and guide adjustments in pricing models.

With a clear understanding of its impact on pricing, we can appreciate how predictive analytics leverages data-driven decision-making across all facets of the insurance business.

Predictive analytics in insurance equips insurers with the insights necessary to make informed decisions that enhance efficiency, customer satisfaction, and financial performance.

One of the significant benefits of predictive analytics in insurance is its ability to analyze historical data to forecast future industry trends. Insurers can leverage vast datasets—from past claims and customer behavior to macroeconomic factors and regulatory shifts—to identify patterns and predict emerging risks or opportunities.

Predictive models might highlight a growing interest in short-term or usage-based insurance policies among younger customers. Insurers can adjust their offerings, marketing strategies, and risk management approaches accordingly, positioning themselves as market leaders. This proactive approach helps companies stay agile and responsive to shifts in consumer preferences, economic conditions, or environmental risks.

Predictive analytics assists in anticipating market shifts and improves day-to-day operational and financial decision-making. By analyzing data on claims volume, customer demographics, and financial performance, insurers can allocate resources more efficiently.

On the economic side, predictive insights enable insurers to outline more accurate budgets, manage investments more effectively, and find points where expenses may be reduced without decreasing quality. This level of data-driven decision-making leads to more sustainable business growth and stronger financial outcomes.

The modern insurance industry faces Predictive analytics that enables insurers to create holistic, 360-degree customer profiles by fusing data from various sources, such as transaction histories, claims data, social media interactions, and even third-party data providers. These profiles give insurers a deeper understanding of customers' needs, preferences, and behaviors, allowing them to deliver more personalized services.

Additionally, comprehensive customer profiles facilitate more impactful marketing campaigns, ensuring that the right message reaches the appropriate audience at the right time.

The influence of predictive analytics extends beyond operational improvements; it also drives innovation by uncovering new product opportunities and market segments.

Predictive analytics is also a key driver of innovation in the insurance industry. By identifying new opportunities, insurers can introduce new products and expand into untapped markets.

Predictive analytics enables insurers to identify lucrative, high-growth market segments by analyzing demographic and behavioral data. This approach allows insurers to understand the unique needs of different customer groups, such as first-time homebuyers, small business owners, or retirees.

With this detailed knowledge, insurers can tailor their offerings to meet these groups' specific demands, whether customized health insurance plans for seniors or commercial policies for small businesses.

Moreover, predictive models can assess macroeconomic factors like population growth, urbanization, and economic development, helping insurers pinpoint regions or industries ripe for expansion. This data-driven approach reduces the risks of entering new markets, allowing insurers to decide where to focus their growth efforts.

As consumers become more tech-savvy and data-driven in their decision-making, usage-based insurance (UBI) models are gaining popularity. These innovative products, powered by predictive analytics, offer dynamic pricing that adjusts based on real-time data.

Millennials and Gen Z customers represent a growing portion of the insurance market, and their expectations differ significantly from those of previous generations. These younger consumers prioritize convenience, transparency, and personalization when choosing insurance providers. Predictive analytics helps insurers understand these preferences by analyzing data on how younger generations interact with digital platforms, consume products, and make purchasing decisions.

Younger customers might prefer managing their policies through a mobile app or being offered instant, personalized quotes based on minimal input. Predictive models can segment these consumers by analyzing their online behavior, allowing insurers to adapt their products, marketing strategies, and customer service to better meet the demands of this tech-savvy demographic.

Offering customizable, digital-first insurance options or even embedding insurance into other financial services can be a key differentiator for insurers targeting younger consumers.

Predictive analytics reshapes the insurance industry by enabling more accurate risk assessments, enhancing fraud detection, optimizing pricing models, and improving customer experiences. More importantly, as insurers venture into embracing predictive models, they unlock new growth opportunities, cut operation costs, and offer more personalized services to customers.

The right technology partner will equip your insurance business enough to stay at the forefront in this data-driven landscape. Maruti Techlabs is here to help you get the most out of predictive analytics and other cutting-edge technologies designed to give an innovative turn to your insurance operations.

Not sure where to begin? Try our AI Readiness Assessment Tool to evaluate your organization's preparedness for predictive analytics and AI adoption.

Get in touch with Maruti Techlabs and harness the power of data to drive smarter decisions and accelerate your business growth. Whether you need fraud detection, pricing optimization, or improved customer experiences, we provide solutions to meet your needs. Explore our data analytics services today!

Predictive analytics in insurance typically utilizes various data types, including historical claims data, customer demographic information, transaction records, external data sources (such as economic indicators and weather patterns), and behavioral data derived from social media and digital interactions.

Predictive analytics enhances customer retention by identifying at-risk customers through behavioral patterns and engagement metrics. Insurers can then proactively address these risks by offering personalized incentives, improved services, or tailored policy options to encourage loyalty and reduce churn.

Insurers may encounter several challenges when implementing predictive analytics, such as data privacy concerns, integration of disparate data sources, ensuring data quality and accuracy, and the need for skilled personnel to interpret and act on predictive insights effectively.

Predictive analytics can assist insurers in monitoring regulatory compliance by identifying patterns that may indicate potential compliance issues. By analyzing historical data and real-time transactions, insurers can proactively address discrepancies and reduce the risk of regulatory penalties.

Machine learning is a key predictive analytics component, enabling insurers to analyze large data sets, identify complex patterns, and generate insights. Machine learning algorithms improve as they learn from new data, allowing for more accurate predictions and refined models for risk assessment and pricing strategies.