How to Reduce Costs on Your Insurance Data Platform: 10 Proven Ways

Insurance data platforms significantly impact day-to-day costs and the speed at which teams can make decisions. When data is organized and easy to access, claims move faster, manual work goes down, and teams get a clearer view of what is happening across the business. The problem is that many platforms in use today were not built for how insurance operates now.

Most traditional data warehouses were created years ago for scheduled reports and delayed analysis. They made sense when claims were paper-based and processed in steps. Today, claims generate data in real time, from mobile photos and telematics to fraud alerts and instant customer messages. Older systems struggle to handle the speed, scale, and variety of data, directly increasing processing time and costs.

These technical limitations also force insurers to rely heavily on outdated technologies. However, McKinsey states that data automation can reduce operational costs by up to 30%, with even greater savings when combined with intelligent document understanding.

The challenge is not a lack of data, but the inability to use it efficiently. Insurance companies hold vast amounts of valuable information, yet much of it remains underutilized due to fragmented systems and outdated data architectures. Unlocking this value requires a modern, well-structured insurance data platform.

This blog explores the role of insurance data platforms, the key drivers of data-related costs, proven strategies for cost optimization, and real-world examples of how insurers are reducing data platform costs while improving performance.

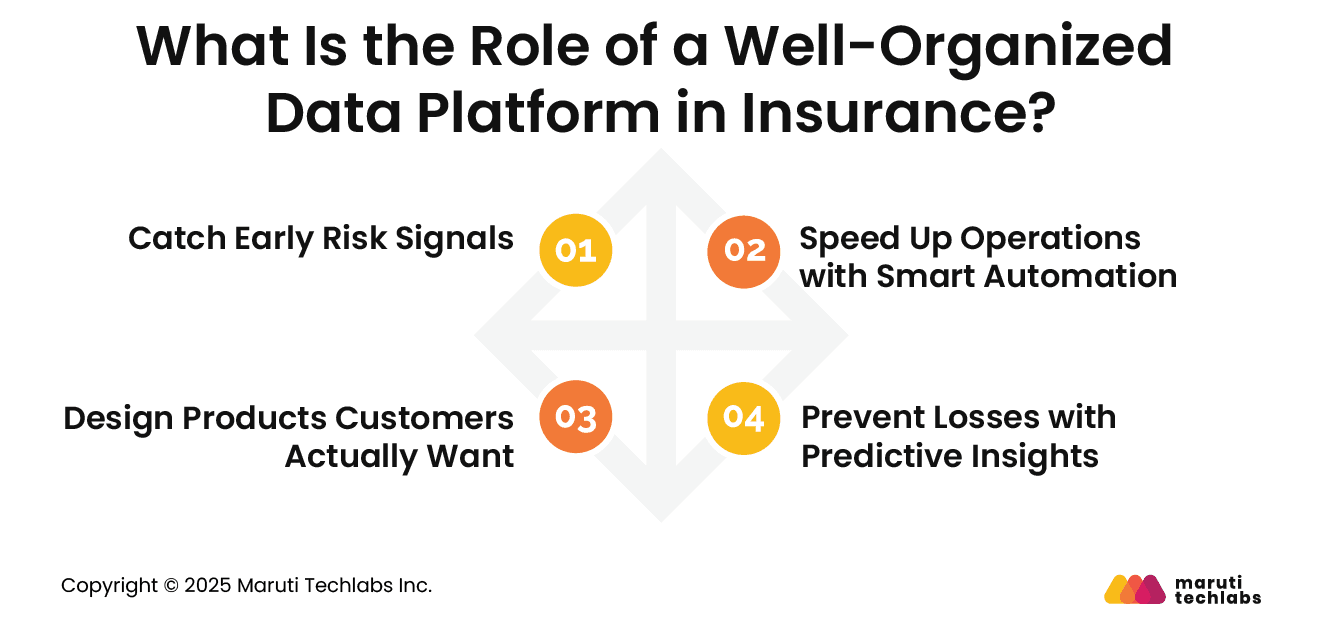

A well-organized insurance data platform helps insurers keep things simple and efficient. Instead of data being scattered across systems, everything comes together in one place. This makes it easier to cut costs, work faster, and make better decisions that support both teams and customers.

When data is readily accessible, insurers can spot warning signs early. They can see when risks are increasing or when small changes, like pricing updates, can improve renewals. Acting early helps avoid bigger issues later and keeps the business on track.

Connected data makes automation possible. Systems can quickly review damage photos, read claim documents, and pull information from different sources. Claims that once took weeks can now be handled in hours. This reduces manual work, lowers expenses, and improves the customer experience.

A clean data platform helps insurers understand how customers behave and what they need. Using this information, insurers can offer policies that better match real usage and preferences. Personalized products lead to happier customers, better renewals, and more opportunities to provide the proper coverage.

By looking at past claims and patterns, insurers can predict where problems may occur. This allows them to warn customers early and suggest simple steps to avoid damage or loss. Fewer claims mean lower costs and stronger trust between insurers and customers.

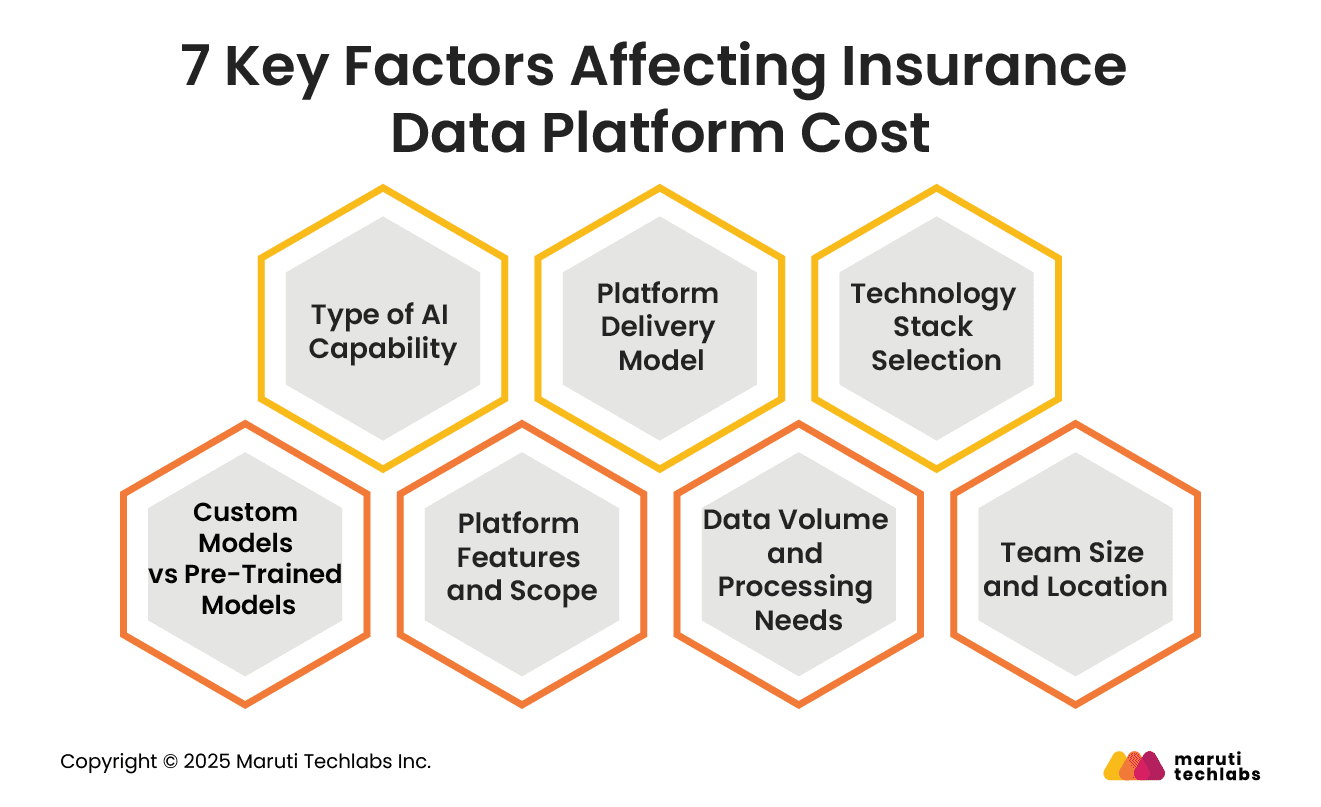

Multiple design and delivery choices influence the cost of an insurance data platform. Each factor affects not only initial development expenses but also long-term operational and scaling costs.

The kind of AI used plays a big role in platform cost. Basic automation for claims or simple risk checks costs less to build. Advanced capabilities such as fraud detection, document reading, and behavior analysis cost more because they require complex models and more computing power.

The choice of platform affects overall cost. Web-based platforms are more affordable to develop and maintain. Mobile platforms add extra cost due to separate development, testing, and ongoing updates. Supporting both web and mobile further increases expenses.

The tools and frameworks used impact both development and long-term costs. Open-source tools help keep costs lower, while enterprise cloud platforms add licensing and usage fees. More advanced technology stacks also require skilled teams, which raises costs.

Custom AI models built for insurance use cases require higher upfront investment but deliver better accuracy. Pre-trained models are quicker and cheaper to implement, but they offer limited flexibility and may not fully meet insurance-specific needs.

The number and depth of features affect platform cost. Core capabilities like claims processing and policy management cost less. Advanced features such as predictive insights, decision support, and intelligent customer engagement increase development and data costs.

Insurance platforms handle large and complex datasets. Costs increase when real-time processing, high data volumes, or advanced analytics are required, as they demand stronger infrastructure and optimization.

Development costs vary by team composition and geography. Offshore teams are more economical, while teams in the US or Europe are more expensive. Larger and more experienced teams increase upfront costs but help reduce long-term inefficiencies.

Each of these factors plays a distinct role in determining the cost of an insurance data platform. Evaluating them carefully helps insurers control spending while building a scalable and efficient platform.

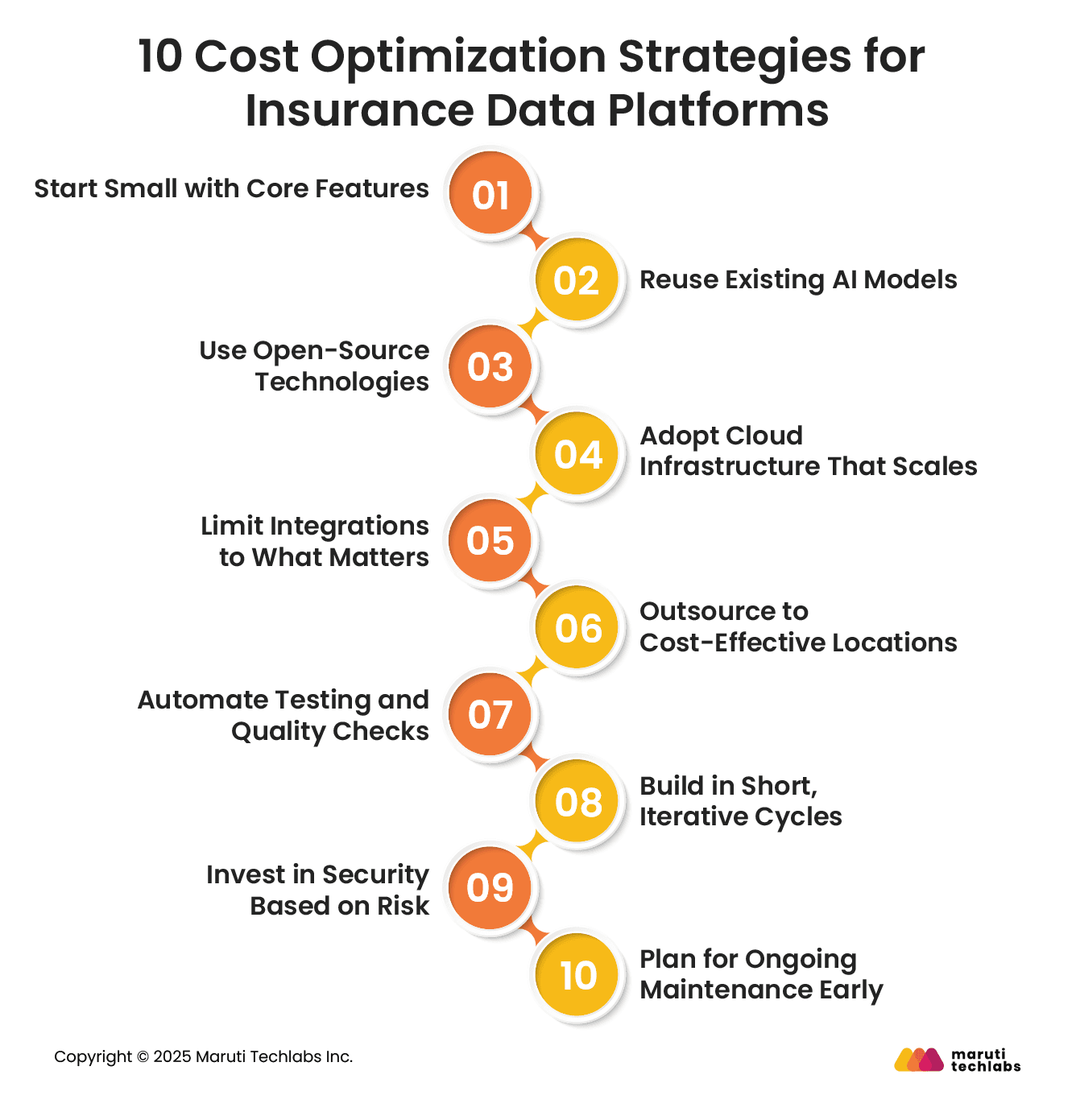

Building and running an insurance data platform can be expensive, especially when AI, real-time data, and compliance requirements are involved. The good news is that costs can be controlled with proper planning and execution. Below are practical strategies to help reduce the cost of insurance data platforms without sacrificing performance or quality.

Instead of building a complete platform at once, it is smarter to begin with a minimum viable platform. Focus only on essential features such as claims intake, basic analytics, or reporting. This reduces upfront spend and helps avoid investing in features that may not be needed immediately.

Building AI models from scratch is costly and time-consuming. However, using pre-built or pre-trained models for tasks such as document extraction or basic fraud checks reduces development effort. These models can later be fine-tuned as needed, significantly lowering AI-related costs.

Open-source tools and frameworks are widely used in insurance data platforms. They reduce licensing costs and offer flexibility. Many of these tools are well-supported by large communities, which also lowers development and troubleshooting expenses.

Scalable cloud platforms allow insurers to pay only for what they use. This prevents overspending on unused infrastructure. As data volumes grow, capacity can be added gradually, keeping infrastructure costs under control.

Every system integration adds complexity and cost. Connecting only essential systems, such as claims, policy, or billing platforms, helps reduce development time and long-term maintenance expenses. Avoiding unnecessary integrations keeps the platform simpler and more affordable.

Development costs vary greatly by region. Working with teams in cost-effective locations can reduce labor costs while maintaining quality. This approach can lower development expenses by a large margin when appropriately managed.

Manual testing takes time and resources. Automated testing helps catch issues early and speeds up releases. This reduces rework, shortens development cycles, and lowers overall testing and quality assurance costs.

Using an agile approach helps teams build the platform step by step. Regular feedback ensures that only useful features are developed. This reduces wasted effort, avoids major rework, and helps keep project costs predictable.

Not all data requires the same level of security. Focusing on protecting the most sensitive data first helps control security spending. This approach balances risk management with cost control.

Maintenance is often overlooked during planning. Budgeting for updates, performance tuning, and compliance changes from the start helps avoid expensive fixes later. This keeps the long-term insurance data platform cost stable.

By applying these cost optimization strategies, insurers can build scalable and efficient data platforms while keeping spending under control. Small, informed decisions at each stage can lead to significant savings over time.

Real examples show how the correct data platform decisions can help insurers control costs while improving accuracy and efficiency.

AXA wanted to reduce large claim payouts by identifying customers most likely to be involved in serious traffic accidents. These cases made up only about 1% of customers but resulted in payouts of more than $10,000 per claim.

To solve this, AXA used predictive analytics based on deep neural networks. The model analyzed more than 70 data points, including driver age and location. Earlier approaches could predict such accidents with less than 40% accuracy. With the new data platform and advanced models, prediction accuracy improved to 78%.

This helped AXA take early action, manage risk better, and reduce unexpected payout costs. By focusing on a small but expensive risk segment, AXA improved cost control without increasing operational effort.

Canara HSBC Life Insurance focused on reducing operational costs by modernizing its data platform. The company moved away from manual and disconnected systems and invested in a more integrated digital setup.

Its transformation was built around cloud infrastructure, analytics, and mobility. By automating manual processes and improving data access across teams, Canara HSBC reduced processing delays and improved overall efficiency. Claims handling became faster, and operational workloads dropped.

This approach helped the insurer control platform costs while supporting growth. By improving how data was stored, accessed, and analyzed, Canara HSBC Life Insurance lowered long-term operational expenses and created a more efficient insurance data platform.

Cost optimization has become essential for insurers to remain competitive while maintaining high service quality. By using technology and data-driven strategies, insurers can reduce expenses, streamline operations, and make smarter decisions.

Taking a holistic approach ensures that cost savings do not come at the expense of growth. Modern data platforms, AI, and automation help insurers gain better insights, improve claims processing, and enhance customer experiences. These strategies not only lower costs but also strengthen profitability and support long-term business growth.

By focusing on the right technology and optimizing operational processes, insurance providers can respond quickly to market changes, manage risks more effectively, and maintain a strong competitive edge.

To explore how cloud solutions and modern data platforms can help organizations optimize costs and improve efficiency, visit Maruti Techlabs’ cloud services page or contact us.

Insurance companies can lower costs by using scalable cloud solutions, automating manual processes, and starting with core features. Leveraging pre-built AI models, open-source tools, and outsourcing development to cost-effective regions also helps. Prioritizing essential integrations and planning for long-term maintenance further controls expenses while maintaining efficiency.

Insurance data platforms are costly because they handle large volumes of sensitive data, require real-time processing, and often integrate multiple systems. Advanced AI models, complex analytics, strict compliance requirements, and ongoing maintenance increase operational costs. Skilled teams and secure infrastructure further increase expenses.

The main cost drivers include the type of AI used, platform choice (web, mobile, or both), technology stack, data processing needs, and system features. Team size, location, and expertise also affect costs, as do integrations, security measures, and long-term maintenance requirements.

A hot vs cold storage strategy separates data based on how often it’s used. Hot data, like active claims, is stored on fast, accessible systems for quick use. Cold data, like old policy records, is stored on cheaper, slower storage. This approach reduces costs while keeping essential data available when needed.