Event-Driven Fraud Detection in Insurance: Everything You Need to Know

Insurance fraud is a growing concern for insurers worldwide. It happens when individuals or associated parties knowingly provide false or misleading information to receive higher payouts. This may involve inflated claims, staged accidents, fake medical reports, or altered repair bills. Such practices are standard across motor, health, and life insurance, and they gradually weaken trust while increasing operational and financial pressure on insurers.

Traditional insurance fraud detection relies heavily on post-event reviews, static rules, and historical analysis, which limits its ability to detect fraud in real time. As fraud methods continue to evolve, traditional systems struggle to keep up.

Insurance data now comes from many sources, such as claims systems, customer interactions, hospitals, garages, and third-party platforms. Older, disconnected tools cannot handle this data in real time, which allows fraud to slip through.

Event-driven, real-time fraud detection offers a better approach. By using AI with event-driven systems, insurers can review data as soon as something happens, like a claim being filed or a policy being updated. This helps spot unusual activity early and take action before losses grow.

This blog discusses the key challenges in detecting insurance fraud, explains event-driven fraud-detection technologies, outlines a real-time scoring pipeline, shows how it applies to claims and underwriting, and highlights fraud-detection use cases across industries.

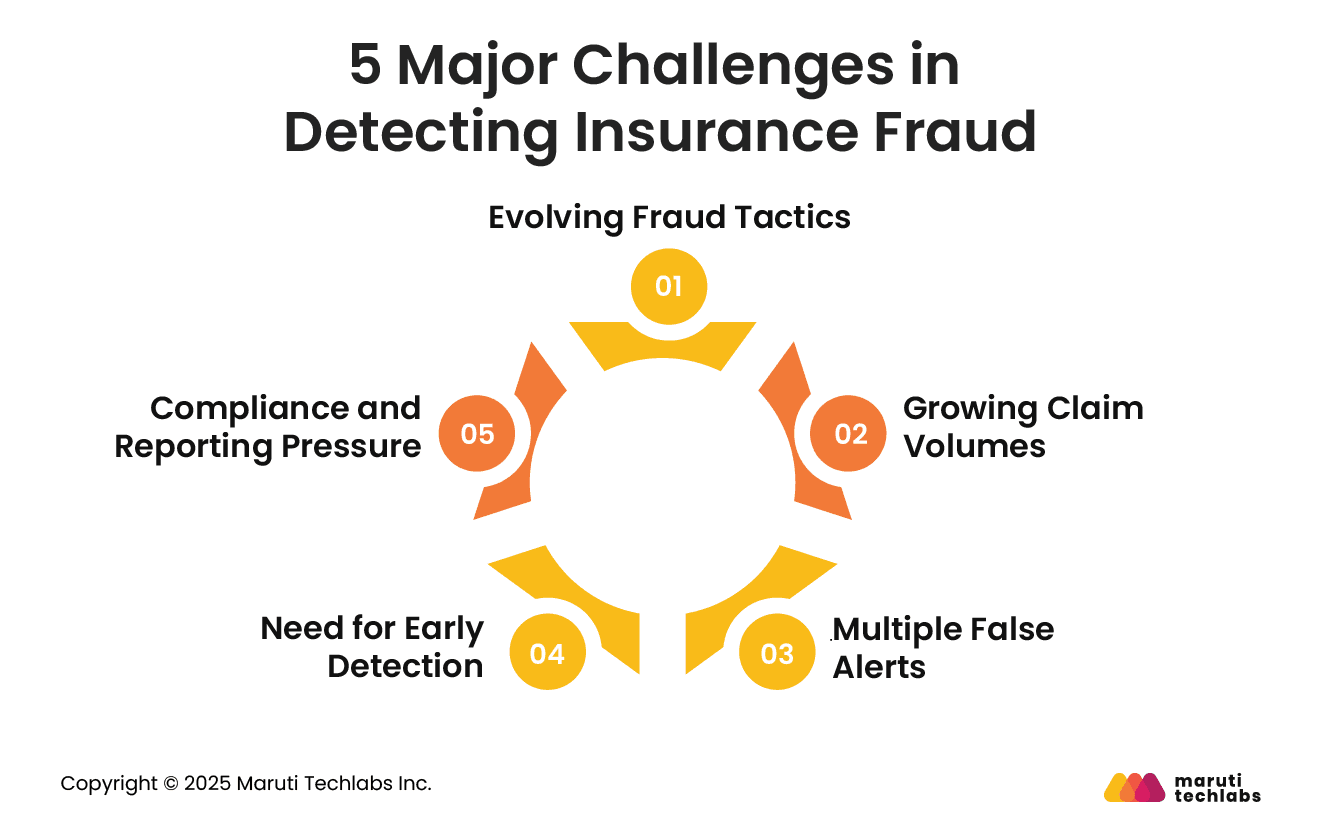

Detecting insurance fraud is a constant challenge for insurers. Fraud patterns keep changing, claim volumes continue to grow, and customers expect faster claim settlements. At the same time, insurers must operate within strict regulatory boundaries. These factors make it difficult for traditional fraud detection methods to deliver consistent and reliable results.

Insurance fraud is no longer limited to obvious or easy-to-spot cases. Fraudsters often understand insurance processes well and use this knowledge to their advantage. They may exaggerate losses, submit false documents, or create incidents that look genuine on paper.

In some cases, multiple parties may be involved, making the claim appear legitimate. Because these cases closely resemble real claims, they are difficult to catch using basic checks or fixed rules.

Insurance companies process a high number of claims every day. With the rise of digital channels, submitting a claim has become easier and faster, which further increases volumes. Reviewing every claim manually is not practical and places heavy pressure on investigation teams. As a result, some suspicious claims may receive less attention or be missed altogether, increasing the risk of fraud slipping through.

Many existing fraud detection systems flag claims that turn out to be genuine. These false alerts slow down the claims process and increase the workload for investigation teams. Customers may face delays even when their claims are valid, leading to frustration and loss of trust. Over time, frequent false alerts also make it harder for teams to focus on cases that truly require investigation.

Fraud is much more complex to manage when it is detected late. If a claim is paid before suspicious activity is identified, recovering the money becomes difficult. Identifying potential fraud early in the claims process helps prevent losses and allows genuine claims to move forward without unnecessary delays. Early detection also reduces the effort required for rework and follow-up checks.

Insurers must follow strict guidelines for fraud detection, monitoring, and reporting. This includes keeping accurate records and reporting suspicious cases to regulators when required. Managing these responsibilities alongside daily fraud detection activities can be demanding. Any failure to meet compliance requirements can result in penalties and harm to the insurer’s reputation.

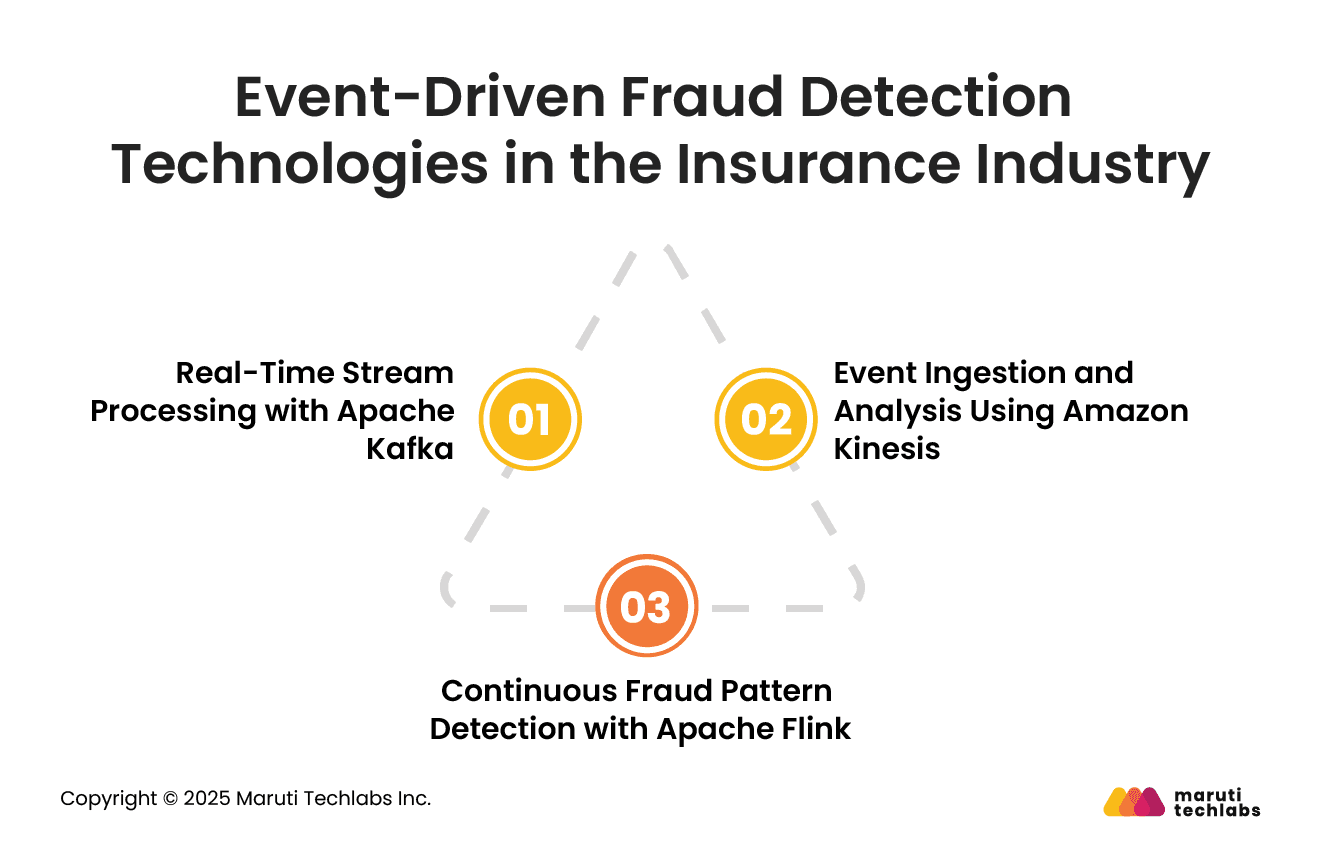

Insurance companies work in a challenging environment. Rules are strict, customers expect quick service, and business conditions keep changing. Many insurers still use older systems that are slow and not built for real-time decisions. To detect fraud faster and respond more effectively, insurers are moving toward event-driven technologies that process data as it is created, not hours or days later.

Apache Kafka helps insurers stream events like claim submissions, policy updates, payment activities, and third-party checks as they happen. Instead of waiting for batch reports, teams see a continuous flow of insurance data in real time, making it much easier to spot suspicious activity early.

Kafka also works well alongside existing systems, which is vital for insurers that cannot replace legacy applications overnight. By streaming events continuously, insurers gain better visibility into claim activity and can identify unusual behavior early in the process.

Amazon Kinesis focuses on collecting and analyzing data from multiple sources in real time. It allows insurers to bring together events from web portals, mobile apps, partner systems, and internal platforms into a single stream. As data flows through Amazon Kinesis, AI models analyze claim attributes, behavioral signals, and historical anomalies in real time to detect early signs of fraudulent activity.

This supports faster claim reviews and reduces reliance on manual checks. Kinesis is especially useful for handling sudden spikes in data volume, such as during natural disasters or high-claim periods, without slowing down fraud detection.

Apache Flink is designed for continuous data processing and real-time analysis. It helps insurers notice patterns that are easy to miss when looking at one claim at a time. Minor issues across many claims can point to planned fraud. Since the data is checked as it comes in, teams can act quickly rather than react later.

Overall, these event-driven tools help insurers catch fraud earlier, limit losses, and handle genuine claims more smoothly.

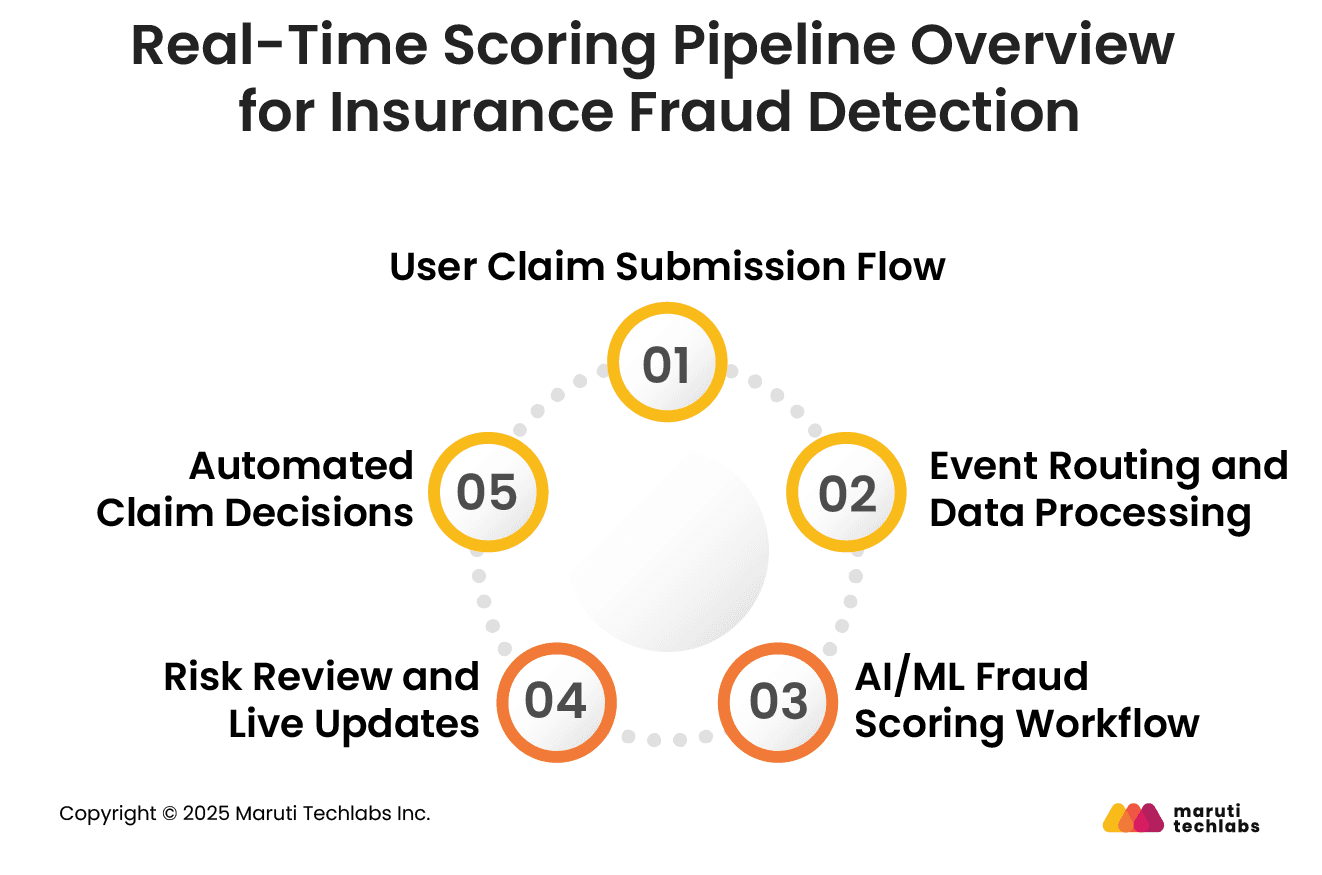

A real-time scoring pipeline helps insurers assess fraud risk as soon as a claim is submitted. Instead of reviewing claims after they move through the system, this approach allows insurers to evaluate risk at every step and respond quickly. Below is a simple overview of how this pipeline works in an insurance fraud detection setup.

The process starts when a customer files a claim through a website, mobile app, or with an agent. Key details such as policy information, claim amount, location, and documents are captured immediately and sent to the system for further checks.

Claims, once submitted, are treated as an event and routed through connected systems. Data from multiple sources, such as past claims, policy history, and third-party records, is brought together. The system cleans and organizes this data so it can be reviewed quickly and consistently as the claim moves forward.

Once a claim enters the system, AI models check it immediately for anything unusual. The claim is compared with past claims and known fraud patterns to see if something feels off. The system evaluates fraud signals such as abnormal claim timing, mismatched policy details, repeated service provider usage, and inconsistencies across submitted documents.

When the risk level is assigned, the claim moves forward based on its priority. Claims marked as higher risk are sent for closer review, while others continue as usual. The latest status is visible to teams through live dashboards, which show ongoing claims, risk levels, and areas that may need attention.

The system helps decide the next step without manual effort. Claims with low risk can move ahead quickly, reducing wait times for customers. Higher-risk claims are paused and shared with investigators for further checks. This approach saves time, avoids unnecessary reviews, and helps teams focus on cases that truly matter.

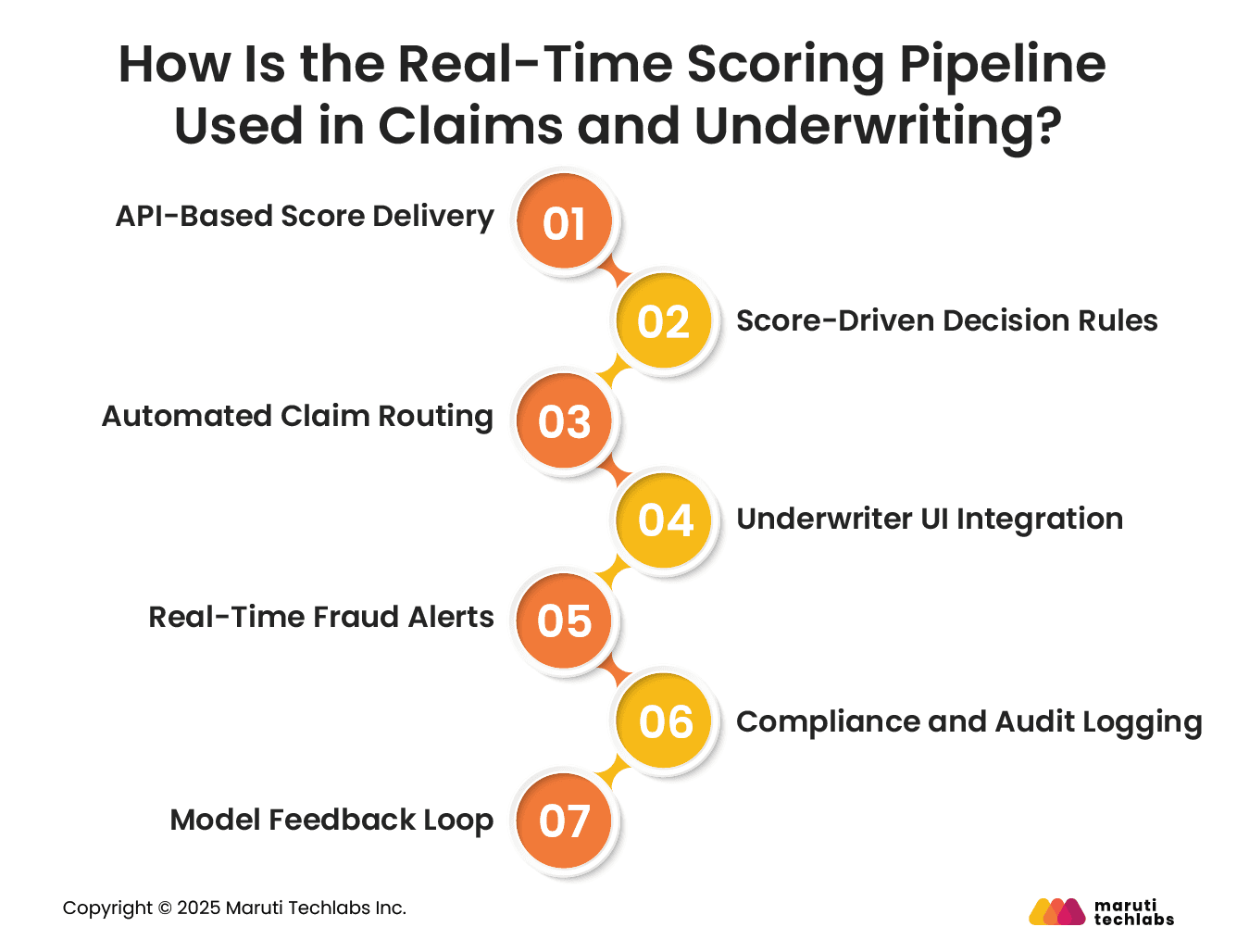

The real-time scoring pipeline helps claims teams and underwriters work faster and make better decisions. It fits directly into daily workflows and highlights which cases need attention.

As soon as a claim is submitted, the fraud score is automatically sent to the claims or underwriting system via APIs. This means teams get risk information immediately, without waiting for reports or switching tools, enabling faster and smarter decisions.

Each claim receives a score indicating its risk level. Low-risk claims can move forward quickly, while higher-risk claims are sent for review. This keeps decisions consistent and reduces mistakes.

Claims are automatically routed to the appropriate team based on their risk level. Simple claims move fast, while suspicious ones go to investigators. This saves time and lets teams focus on the cases that need the most attention.

Underwriters use real-time fraud scores to identify risks such as policy stacking, identity manipulation, or unusually high coverage requests before policies are approved. Having everything in one place makes it easier to assess risk quickly without extra steps or switching systems.

If the system spots anything unusual, it sends an alert right away. This lets teams act quickly, preventing losses and stopping fraud before it gets worse.

Every score, alert, and decision is recorded automatically. This creates a clear audit record and helps insurers comply with regulations without extra work.

The outcome of each claim, whether approved, denied, or under investigation, is fed back into the system. This helps improve scoring over time, making the fraud detection process more accurate and reliable.

Companies across many industries use event-driven fraud detection to quickly identify issues and reduce losses.

PayPal processes billions of messages every day using Kafka. This helps them detect suspicious transactions in real time, stop fraudulent activity quickly, and protect customers before losses occur.

Capital One treats every event in its system as part of running the business, powered by Confluent. By monitoring events as they happen, they prevent around $150 of fraud per customer each year and safeguard sensitive personal information during transactions.

Kakao Games, a South Korean gaming company, uses data streaming to watch for unusual activity. They track more than 300 patterns in KSQL to quickly spot anomalies and respond before problems affect players or the game environment.

These cross-industry examples demonstrate how the same event-driven, AI-powered fraud-detection principles can be applied to insurance claims, underwriting, and payment workflows.

Data streaming and real-time processing are changing the way insurers detect fraud. By analyzing claims and events as they happen, insurers can spot suspicious activity immediately, rather than reacting after the fact. This proactive approach helps reduce financial losses, improve risk management, and keep operations running smoothly.

Using predictive analytics and machine learning on streaming data enables insurers not only to protect their business but also to provide a better customer experience. Fraud can be detected early, claims can be handled faster, and teams can focus on the cases that need the most attention.

Maruti Techlabs helps insurers build event-driven insurance fraud detection systems using real-time data streaming, AI, and scalable cloud architectures. Explore our AI/ML services to see how we can help modernize your fraud detection strategy. Get in touch to proceed further.

Insurance fraud detection software uses data analysis, pattern recognition, and sometimes AI to monitor claims. It evaluates each claim for unusual activity, compares it with historical data, and assigns a risk score. High-risk claims are flagged for further review, helping insurers act quickly and accurately.

Insurance fraud is detected by analyzing claims, comparing them to historical patterns, and identifying inconsistencies. Red flags can include exaggerated damages, unusual claim frequency, or mismatched information. Modern systems use real-time data, AI, and analytics to quickly and efficiently identify suspicious activity.

Proof for insurance fraud typically includes evidence showing intentional deception, such as falsified documents, fake invoices, staged accidents, or false statements. Supporting data, witness accounts, surveillance footage, and cross-checks with past claims or external databases help validate the fraud claim.

An investigation is triggered when a claim shows unusual patterns, inconsistencies, or high-risk indicators. Red flags include repeated claims, exaggerated losses, conflicting statements, suspicious timing, or alerts from automated fraud detection systems, prompting insurers to review the claim more closely.