Top 6 Digital Transformation Trends in the Insurance Industry

In 2025, the insurance industry is undergoing a rapid evolution as digital transformation becomes mission-critical. With 74% of insurers identifying technology adoption as a top priority, companies are embracing automation, the cloud, and AI to stay competitive.

Customer expectations have shifted toward seamless digital journeys, operational efficiency is under pressure, and regulatory demands are intensifying.

This blog explores the top digital transformation trends in the Insurance Industry. It offers clarity on what each trend brings to the table, why it matters in 2025, and how forward-looking insurers are putting them into practice to drive growth, resilience, and customer satisfaction.

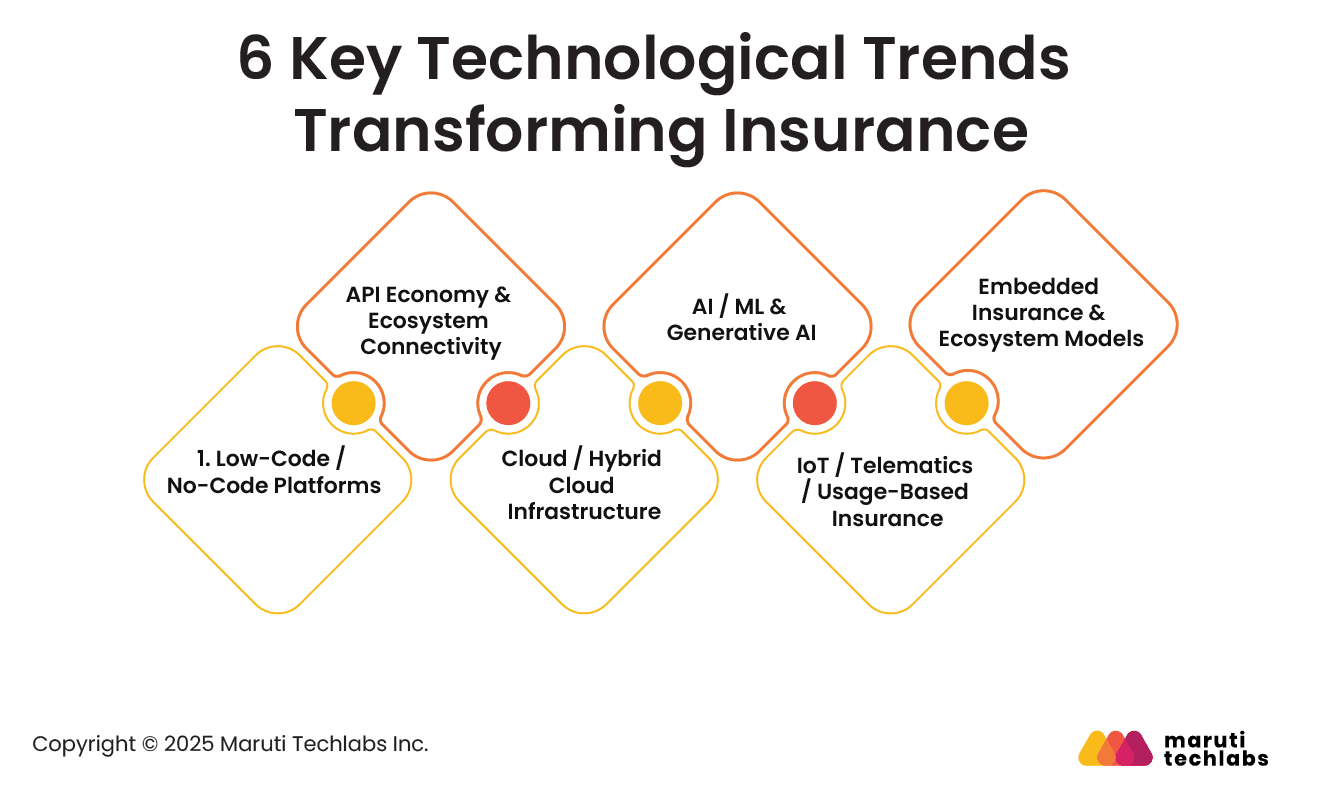

The insurance industry is being redefined by rapid digital adoption. These technologies are driving agility, efficiency, and customer-centric innovation—reshaping everything from underwriting and claims to distribution and personalized policy experiences.

Low-code and no-code tools empower insurers to build and deploy applications faster without heavy coding expertise. They enable business teams to automate workflows, prototype quickly, and adapt to changing market needs.

This agility accelerates product launches, reduces IT dependency, and enhances overall digital transformation across core insurance operations.

APIs allow seamless data exchange between insurers, partners, and third-party platforms. They support embedded insurance, payment integrations, and ecosystem-based products.

By participating in the API economy, insurers can innovate faster, co-create with fintechs and insurtechs, and deliver connected customer experiences that extend beyond traditional insurance boundaries.

Cloud and hybrid cloud models offer scalable, secure, and cost-efficient environments for insurers. They simplify data management, enhance collaboration, and enable real-time analytics.

Hybrid setups balance compliance needs with flexibility, allowing insurers to modernize legacy systems while safeguarding sensitive data and ensuring business continuity across distributed environments.

Artificial intelligence and machine learning are revolutionizing risk assessment, fraud detection, and claims automation. Generative AI adds new dimensions through policy summarization, chatbot interactions, and personalized recommendations.

These technologies improve accuracy, efficiency, and customer engagement, enabling smarter underwriting decisions and proactive, insight-driven insurance experiences.

IoT devices and telematics enable real-time risk monitoring, powering usage-based insurance (UBI) models. Insurers can personalize premiums based on driving behavior, health metrics, or home sensors.

This data-driven approach enhances risk accuracy, promotes safer behavior, and fosters a more transparent, mutually beneficial relationship between insurers and policyholders.

Embedded insurance integrates coverage directly into customer journeys, such as travel bookings, e-commerce purchases, or fintech apps. Paired with ecosystem partnerships, it helps insurers reach new audiences and deliver instant, contextual protection.

Evolving customer expectations are reshaping how insurers engage and deliver value. Modern customer experience now depends on personalization, convenience, and connected digital journeys that prioritize accessibility, speed, and proactive service delivery.

Insurers are leveraging AI and analytics to create hyper-personalized products tailored to individual needs, risk profiles, and life stages.

From customized policy recommendations to adaptive pricing, personalization builds stronger customer trust, loyalty, and satisfaction, transforming insurance from a transactional product into a relationship-driven, value-enhancing experience.

Customers increasingly prefer managing policies, claims, and renewals independently. Self-service portals and mobile apps empower them with 24/7 access, instant document uploads, and claim status tracking.

This not only enhances convenience but also reduces operational costs, allowing insurers to focus on improving experience and efficiency simultaneously.

Digital-first engagement ensures seamless communication across web, mobile, chat, and call centers. Omnichannel strategies unify these touchpoints, giving customers a consistent, personalized experience across platforms.

Insurers adopting this approach improve responsiveness, reduce churn, and deliver cohesive interactions that align with modern consumers’ on-demand expectations.

Advanced analytics and real-time data tracking allow insurers to anticipate customer needs and act before issues arise. Predictive insights enable proactive communication, such as renewal reminders or risk alerts, that strengthen relationships.

This shift from reactive to anticipatory service builds trust, retention, and long-term customer satisfaction.

The emergence of creative business models that provide clients with more freedom and value is one of the biggest changes in the insurance sector.

Let’s take a look at these models:

In car insurance, Usage-Based Insurance (UBI) is gaining popularity, offering customers more customized and cost-effective policies. Instead of a one-size-fits-all approach, UBI adjusts premiums based on how often and well you drive. Telematics devices—such as GPS trackers or mobile apps—are installed in vehicles to monitor driving behavior, including factors like speed, mileage, braking patterns, and even time of day.

For example, if you’re a safe driver who only uses your car on weekends, you’ll pay less than someone with a long daily commute. This model provides a fairer pricing structure and encourages safer driving habits, making it a win-win for insurers and policyholders.

Telematics is revolutionizing how insurers tailor pricing for individual drivers. By tracking driving behavior in real-time using GPS and onboard sensors, insurers can create premiums that reflect each driver’s specific habits, ensuring more accurate and fair pricing.

However, the advantages of telematics go beyond just customized rates. It also plays a vital role in fraud detection. In the event of an accident, the data collected provides detailed insights into the incident, allowing insurers to identify false claims and reduce fraudulent payouts quickly. This dual benefit makes telematics a transformative tool for both insurers and policyholders.

Let’s explore how risk management advancements shape the insurance industry’s future.

Risk management isn’t just about avoiding problems anymore—it’s about using technology to predict and prevent them. Today, insurance companies are embracing innovative tools and techniques to make risk management more accurate, efficient, and proactive.

Leveraging predictive analytics, businesses are better equipped to recognize natural calamities and develop reasonably priced coverage. For example, predictive models can greatly assist in determining the probability of a claim. Therefore, insurers will modify premiums in case of a change. This approach minimizes financial risks and ensures customers receive fair and personalized pricing.

The Internet of Things (IoT) has transformed how insurers collect data for risk management. Insurers can gain immediate insights into potential risks by integrating IoT devices, like smart home sensors and connected cars.

For example, when a water leak is identified in your home, you receive a phone notification that lets you fix the problem before huge financial losses are made and claims are filed. This information is fed into streaming analytics, allowing insurers to act quickly to reduce risk and improve customer satisfaction.

Insurers use AI to evaluate risk faster and more efficiently. Using a large amount of data, AI-supplemented algorithms, for instance, find threats that are not always seen in manual evaluations. This brings efficiency to decision-making and accuracy to the whole process. For example, AI evaluates driving habits from telematics data, enabling insurers to assess risk more accurately and tailor policies to match each driver’s unique profile.

While insurers are using advanced technologies to improve risk management, they still face challenges associated with digital transformation. Let’s examine these obstacles and how to overcome them.

Like any other tool in the world, digital transformation has the following advantages: it is insightful but has some drawbacks and is impactful.

Insurers must overcome these to optimize opportunities and maintain market leadership.

The insurance market is more crowded than ever, with new players and Insurtech startups constantly emerging. Companies need to be agile and adapt quickly to changing customer expectations to remain competitive. This means embracing technologies like AI to make operations more efficient and deliver innovative solutions faster.

For instance, AI-powered chatbots can significantly improve customer service by providing quick, accurate responses, which keeps customers informed and satisfied.

Data security has now become more important for organizational customers. Any insurer is required to maintain strict data privacy laws and seek developed security mechanisms. Components like multi-factor authentication, working in conjunction with encryption mechanisms, are effective tools in ensuring privacy and protecting sensitive data, in addition to ensuring the clients' comfort.

Adopting new technologies requires skilled employees, but the industry faces a growing talent gap. Additionally, some staff members who are used to traditional ways of working might be hesitant to adapt to these changes, which can slow down progress. To address this, insurers should focus on training programs that help employees develop the right skills. By creating a supportive environment that encourages learning and innovation, teams will feel more confident and open to embracing new technologies.

As the insurance industry’s digital revolution speeds up, organizations that effectively tackle these challenges will be in a strong position to thrive.

Transforming digitally requires more than adopting new tools; it demands strategic alignment and execution. This roadmap helps insurers structure their transformation journey from assessment to measurable impact and continuous innovation.

Start by evaluating your organization’s digital capabilities across data, technology, processes, and people. Identify existing strengths, skill gaps, and infrastructure limitations. A structured maturity assessment provides clarity on where your business stands today and defines a realistic roadmap to reach the next level of digital excellence.

Focus on initiatives that directly impact profitability, efficiency, or customer experience. Whether it’s automating claims, enabling self-service, or deploying AI for underwriting, prioritize use cases with measurable ROI. This ensures transformation efforts stay purpose-driven and deliver tangible results rather than scattered, isolated technology experiments.

Develop a flexible, cloud-based architecture that supports rapid experimentation and scaling. Strengthen your data foundation through governance, integration, and interoperability across systems. Agile architecture empowers insurers to innovate faster, connect legacy systems seamlessly, and adapt to evolving regulatory, market, and customer demands effectively.

Leverage partnerships with insurtechs, fintechs, and technology vendors to accelerate innovation. A strong ecosystem strategy expands capabilities beyond internal resources, enabling faster go-to-market, embedded insurance models, and value-added services. Collaboration ensures agility while keeping the insurer at the center of an interconnected digital ecosystem.

Set clear KPIs across efficiency, engagement, and financial performance. Use analytics to monitor progress, identify areas for improvement, and validate ROI. Continuous iteration based on customer feedback and real-time data keeps transformation efforts aligned with business goals, ensuring sustained momentum and long-term digital maturity.

The coming years will redefine the insurance landscape as digital innovation accelerates. Emerging technologies and InsurTech collaborations will reshape operations, customer experience, and trust models across the global insurance ecosystem.

Insurers will increasingly rely on AI-driven agents, edge computing, and hyper-personalized products to enhance responsiveness and precision. Trust platforms powered by blockchain will ensure data transparency and regulatory compliance.

Edge devices such as wearables and smart sensors will feed real-time data into risk models, enabling proactive coverage and instant claims processing. The integration of GenAI, predictive analytics, and voice-based interactions will make insurance more conversational, intelligent, and seamlessly embedded in everyday life.

InsurTechs will continue to push boundaries through agile product design, low-code infrastructure, and data-first innovation. Their speed and customer-centricity will pressure incumbents to modernize legacy systems and adopt flexible, partnership-driven models.

Traditional insurers will increasingly collaborate or even co-develop solutions with InsurTechs to gain access to niche technologies, real-time insights, and new distribution channels. This convergence will blur the line between startups and established players, fostering a more open, innovation-driven insurance ecosystem.

Competitors across the insurance segment agree that digital transformation is no longer optional but essential. Major trends have emerged over the past few years, including the growth of low/no-code tools, the expansion of the API economy, and the shift toward hybrid cloud environments. These advancements are reshaping the insurance industry and improving how firms deliver products and engage customers.

Technologies like predictive analytics, AI, and IoT also enhance insurers’ ability to offer more personalized services, improve risk assessments, and streamline claims processing. These advancements are helping insurers meet evolving customer expectations and drive operational efficiency and innovation.

Organizations must continue to innovate and preserve their agility to succeed on this journey. To support organizations in their quest for innovation and agility, Maruti Techlabs steps in as a key partner. As a mobile app development , cloud solution specialist, and custom software development company, we assist companies in implementing cutting-edge software and positioning themselves for success.

Let’s connect if you plan on enhancing your insurance services with the latest technology. Our team is here to guide you every step of the way. Get in touch today!

Indeed, AI automation is well worth the expense and can benefit the company or organization that implements it. It can perform basic operations, process data better, and supply information to support the decision-making body. For growing insurance companies, this means a quicker turnaround in claims, improved risk analysis, and the ability to compete much harder in the marketplace.

Predictive analysis also includes the possible risk risks and customer behaviors based on historical information. This assists you in determining better pricing strategies given each customer’s special liability exposure; you will find that your premiums are reasonable and adjusted based on your circumstances.

IoT objects like cars and home monitoring devices share their data in real-time with insurance companies, improving risk evaluation. This makes it possible for you to solve something that might have gone wrong, for instance, address home water leakages or instill safe driving practices. This, in turn, leads to increased accuracy of the prices, fewer complaints from the clients, and, in general, more effective communication with the target customers.

To achieve this, training courses that initially address the importance of digital implementations and how these tools can be utilized should be developed. To this end, facilitate the creation of conditions that will allow the staff to experiment with new technologies. You don't have to tackle this journey alone. With Maruti Techlabs as your technology partner, implementing digital transformations becomes much simpler.