How AWS Security Hub Supports Compliance in the Insurance Industry

Insurance helps people and businesses stay protected from unexpected events. Policyholders get support when things go wrong by paying a small amount regularly. Since insurance companies deal with a lot of personal and financial data, keeping that information safe, secure, and transparent is crucial.

Today, many insurers are moving to the cloud to work faster and more efficiently. AWS is a popular choice because it offers flexibility and strong security. But with that shift, it’s also important to make sure all data stays protected and follows industry rules.

AWS is built with security at its core and is trusted by banks, governments, legal tech, and healthcare companies around the world.

In this blog, we will cover understanding regulatory compliance in the insurance industry, AWS Security Hub, how AWS Security Hub supports insurance regulatory compliance and best practices for insurers using AWS Security Hub.

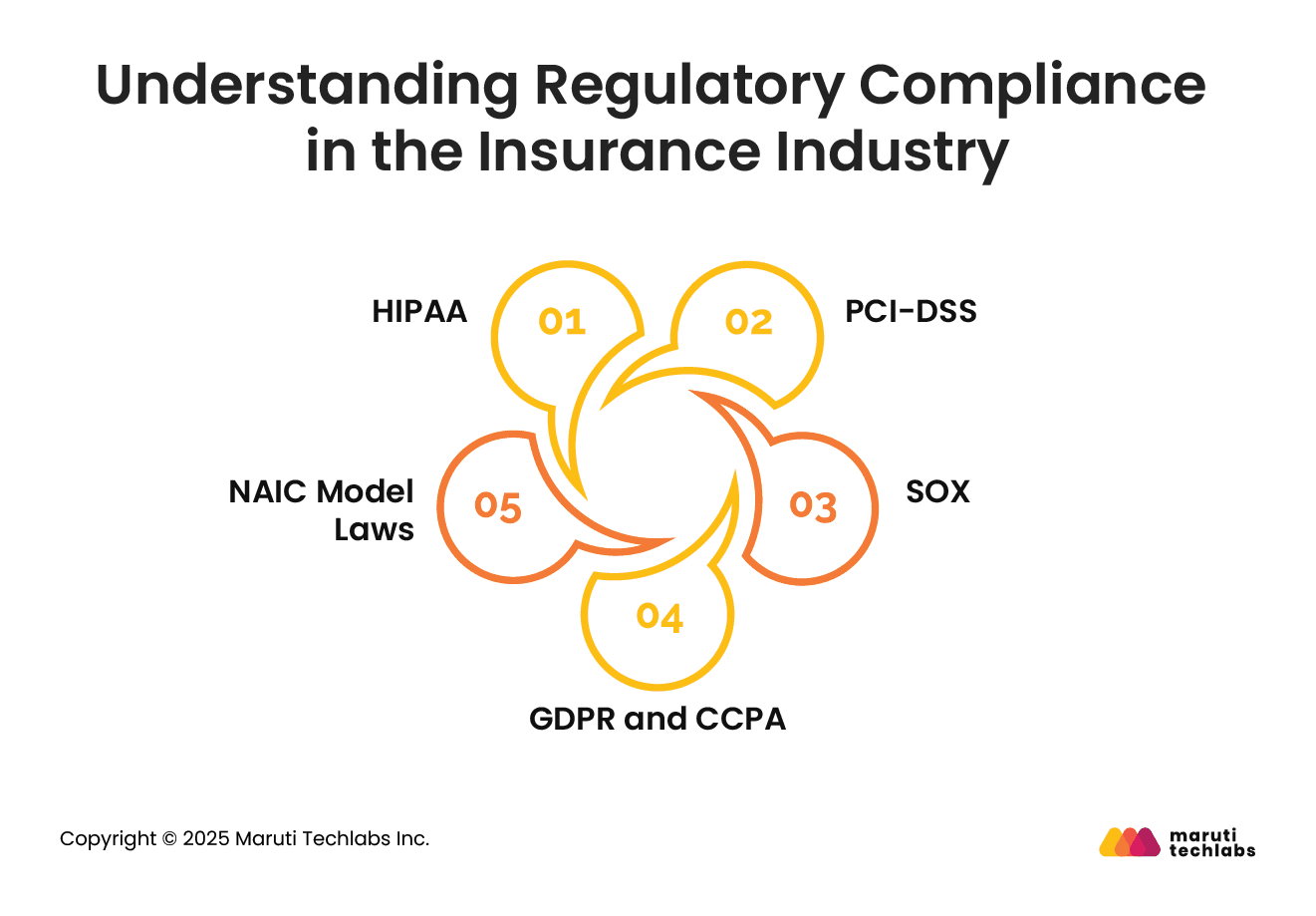

Regulatory compliance in insurance involves following laws and rules set by the government and regulators. These rules help keep things fair, protect customer data, and make sure companies stay honest in their dealings. For insurance companies, it’s not just about selling policies—it’s also about earning trust, keeping records safe, and being clear with their customers.

There are several important regulations insurers must follow:

HIPAA protects sensitive health data. If an insurance company handles any medical records, they must keep that information private and secure. HIPAA also gives patients rights over how their data is used.

If insurers accept card payments, they must follow PCI-DSS rules. These are standards that make sure card data is handled safely and protected from hackers.

The Sarbanes-Oxley (SOX) Act ensures that financial reports are honest and accurate. Insurance companies must prove their financial data is secure and hasn’t been tampered with.

GDPR and CCPA give individuals control over their personal data. Insurance companies must clearly explain how they collect, use, and store this data. They are also required to delete the data if requested.

In the U.S., the NAIC (National Association of Insurance Commissioners) provides a set of model laws, like the Insurance Data Security Model Law. These help states create rules to keep customer data safe in the insurance industry.

Together, these regulations help the insurance industry stay secure, responsible, and customer-focused.

AWS Security Hub is a tool that gives you a clear picture of how secure your AWS setup is. It brings together security information from across all your AWS accounts, services, and even some outside tools you may use. This makes it easier to spot problems and understand what needs attention.

For insurance companies that deal with a lot of personal and sensitive data, staying secure and meeting compliance rules is a big responsibility. AWS Security Hub helps by checking your cloud environment against well-known security standards and best practices. It supports rules set by AWS and also follows popular industry standards like CIS, PCI DSS, and NIST. These checks help you know whether your systems meet the basic safety requirements.

Security Hub doesn’t just run checks—it also pulls in alerts from other security tools like Amazon GuardDuty, Inspector, and Macie. This gives you one central place to see everything related to your security. You can even send these alerts to other tools if needed.

Another helpful part of Security Hub is its automation features. You can set rules so that when something goes wrong, actions are taken right away without manual effort. For example, you can flag serious issues automatically or set up quick responses using Amazon EventBridge.

In short, AWS Security Hub helps insurance companies stay on top of their security, meet rules more easily, and respond faster when something goes wrong.

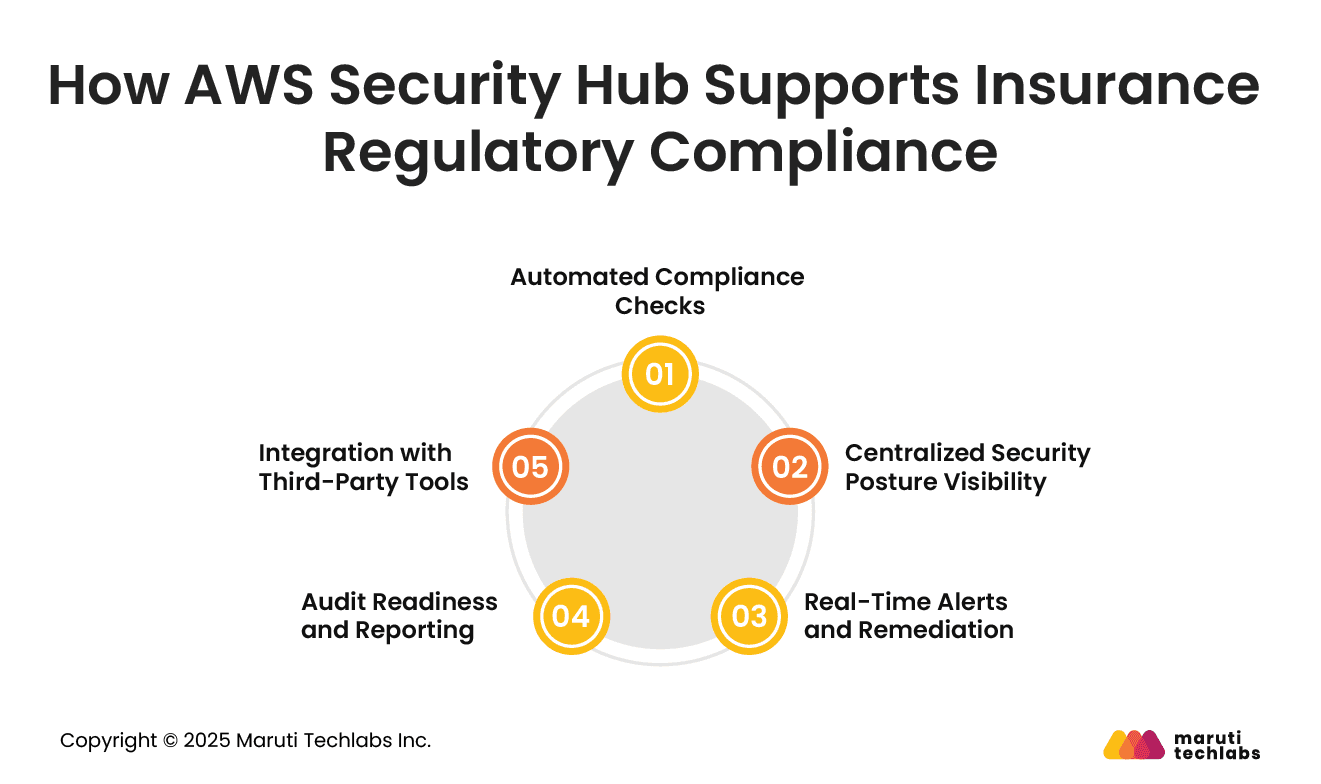

Insurance companies must follow strict rules to protect customer data and meet industry standards. AWS Security Hub helps by making security easier to manage and understand, saving time and reducing the chance of mistakes.

Security Hub automatically verifies whether your systems follow rules like PCI, NIST, and HIPAA. If something is wrong, it shows you the problem so your team can fix it early.

Security Hub brings all your security details into one place. This works even if you use more than one AWS account. It gives you a clear picture of your overall security without switching between tools.

When a security problem occurs, Security Hub sends alerts immediately. It gathers security issues from tools like GuardDuty and Macie. You can also set rules to fix common problems as soon as they occur.

Security Hub keeps a record of checks and findings, which makes it easier to prepare for audits. You can also download official audit reports using AWS Artifact.

Security Hub connects with many outside tools. This lets you use what you already have while keeping your security setup strong and updated.

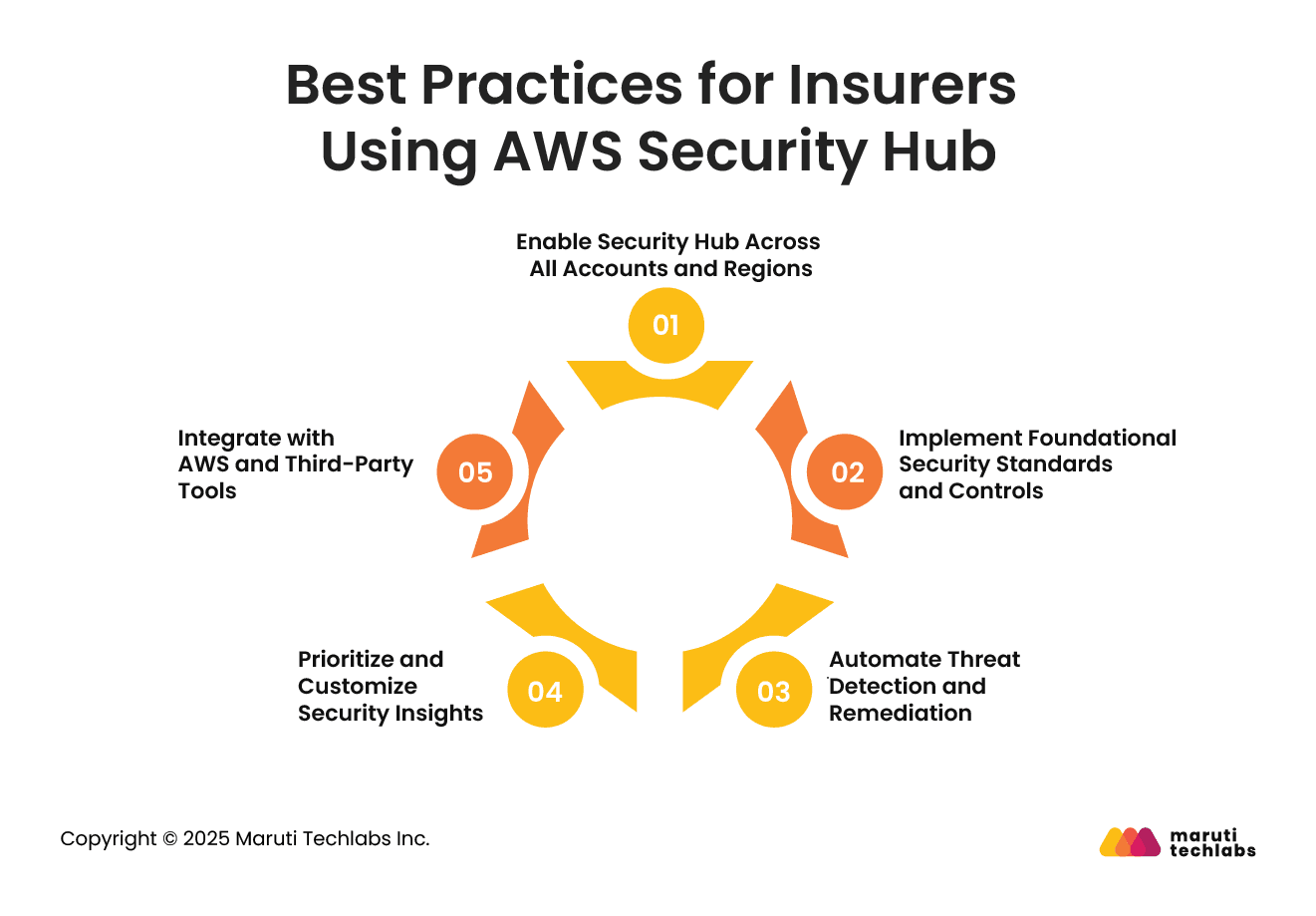

Insurance companies deal with sensitive customer data and must meet strict industry regulations. AWS Security Hub makes it easier to manage security across your cloud environment by collecting findings in one place, highlighting potential issues, and helping you take quick action. To get the most out of it, here are some simple best practices insurers should follow:

Start by turning on Security Hub in every AWS account and region you use—even the ones you rarely touch. Threats can appear anywhere, and it’s important to have visibility across your entire setup. This ensures you don’t miss critical issues in regions or accounts you might overlook.

Security Hub comes with built-in checks that follow well-known standards like CIS and PCI. These checks help you stay compliant with insurance regulations. It’s a good idea to leave these checks turned on and make sure AWS Config is enabled, too. This allows the Security Hub to run its compliance checks effectively in all regions.

Security Hub can alert your team about security threats or compliance issues automatically. You can also set it up to fix smaller problems on its own—like misconfigurations or missing settings—so your team doesn’t have to handle everything manually. This saves time and helps reduce the chance of human error.

Not all security issues are equally urgent. Security Hub offers “insights” that group similar findings together so you can focus on what matters most. You can even create your own custom insights tailored to your company’s needs. This way, you spend less time searching through findings and more time acting on what’s important.

Chances are, you already use tools like Slack, Splunk, or PagerDuty. Security Hub connects with these and many more, so all your alerts and findings can flow into your existing workflows. You can also send findings to AWS tools like Lambda or Systems Manager for custom actions or automation.

By following these best practices, insurance companies can improve their cloud security posture while complying with regulatory standards. The goal isn’t just to find security problems but to make fixing them easier, faster, and more reliable.

Ensuring regulatory compliance and maintaining data security are top priorities for insurance companies operating in the cloud. AWS Security Hub provides centralized visibility, real-time threat detection, automated compliance checks, and seamless integration with other AWS and third-party tools—enabling insurers to simplify security operations while staying aligned with industry regulations such as HIPAA, PCI-DSS, SOX, and GDPR.

At Maruti Techlabs, we helped HealthPro Insurance—a leading Medicare insurance broker in the U.S.—strengthen its cloud infrastructure and security posture. The project involved isolating staging and production environments, migrating from public to private cloud, ensuring data backup and security, and optimizing costs through AWS Aurora Serverless. These steps not only improved stability and scalability but also enhanced overall compliance readiness.

Insurance providers looking to simplify their compliance efforts and improve security operations should consider integrating AWS Security Hub as part of their cloud strategy. As a trusted AWS consulting partner, Maruti Techlabs offers end-to-end support through our AWS services, which include cloud migration, security, DevOps, and more. Contact us to see how we can help improve your infrastructure and meet compliance goals.

And if you’re seeking cloud application development services in New York, our team can help you design, build, and secure cloud-native solutions tailored to your business needs while ensuring compliance and scalability.

AWS Security Hub gives you a central view of your security posture in AWS. It helps monitor compliance with best practices and standards like CIS, NIST, and PCI DSS. It collects, analyzes, and prioritizes security findings by integrating with other AWS services and third-party tools. Automation features let you respond to issues efficiently, supporting faster remediation and stronger overall cloud security management.

AWS Security Hub is not a complete SIEM tool. It provides a unified view of AWS security findings and helps monitor compliance with security standards. Unlike traditional SIEMs, it doesn’t process large-scale log data like CloudTrail.

However, it works well alongside SIEMs to provide deeper insights, longer-term storage, and cross-platform correlation, especially when integrated with tools like Amazon OpenSearch or third-party SIEM systems.

AWS ensures security and compliance through a shared responsibility model, strong infrastructure, and built-in cloud security tools. It provides encryption, identity management, access controls, and continuous monitoring. Customers inherit AWS’s global security best practices and can scale securely without managing physical infrastructure.

With hundreds of tools, certified audits, and support from AWS experts, customers can meet compliance goals while maintaining flexibility and cost-efficiency.

Insurance regulatory compliance refers to the internal systems insurers use to follow industry rules and manage risk. It covers areas like anti-money laundering, data protection, and fraud prevention. These regulations aim to safeguard consumers, ensure fair practices, and maintain trust in the insurance market.

Insurers must implement proper controls and procedures to comply with evolving laws and protect sensitive customer data across all operations.