How AI is Transforming Compliance for Modern Businesses

In today's dynamic regulatory landscape, staying updated with evolving compliance requirements is paramount. Traditional compliance processes that rely on manual reviews and outdated workflows can be both inefficient and ineffective in identifying compliance issues.

The integration of Artificial Intelligence (AI) into compliance automation offers tangible benefits. AI in compliance has perks like continuous monitoring, real-time risk assessment, and automated reporting.

It significantly enhances efficiency and accuracy. By automating routine tasks and providing predictive insights, AI reduces human error and allows compliance teams to focus on strategic decision-making.

This article shares insights on why AI in compliance is better than traditional compliance processes, how AI achieves this advantage, a compliance checklist, and the top 5 compliance tools for 2025. This read aims to provide a comprehensive understanding of how AI can streamline compliance efforts and mitigate risks.

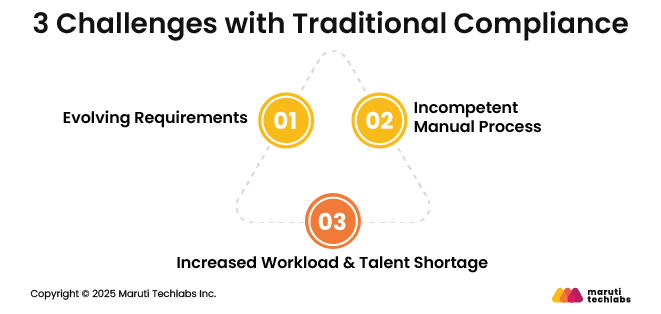

Before diving into modern approaches, it’s essential to understand the gaps in existing methods. Here are the top 3 challenges observed with traditional compliance practices.

The compliance landscape changes rapidly, with new regulations, security standards, and data privacy mandates emerging across industries and regions.

Organizations must continuously adapt to changing regulations, which increases operational complexity and risks falling behind on updates or audits.

Traditional compliance processes rely heavily on spreadsheets, emails, and manual work. These outdated methods are time-consuming, prone to human error, and difficult to scale.

As compliance requirements grow, these inefficiencies slow audits and increase the likelihood of oversight and duplication.

Compliance teams have increased workloads as regulatory scope expands. However, there is a shortage of skilled professionals. The resulting talent shortage strains existing teams, driving higher costs and burnout.

AI has transformed compliance audits by bringing unmatched speed and precision to data analysis. It can quickly process large volumes of information, identify patterns, and flag potential compliance issues in real time. This level of accuracy helps organizations detect risks early and make faster, data-backed decisions.

Beyond speed, AI offers powerful capabilities such as detecting irregularities, monitoring regulatory changes, and providing valuable insights. It also helps auditors by automating repetitive work, allowing them to focus on deeper risk analysis and strategic decision-making.

Machine learning plays a key role in compliance by helping systems learn and adapt from data over time. It continuously improves accuracy, reduces false alerts, and identifies subtle regulatory changes that humans might miss.

By using machine learning, organizations can stay proactive, manage risks effectively, and ensure they remain compliant with evolving regulations.

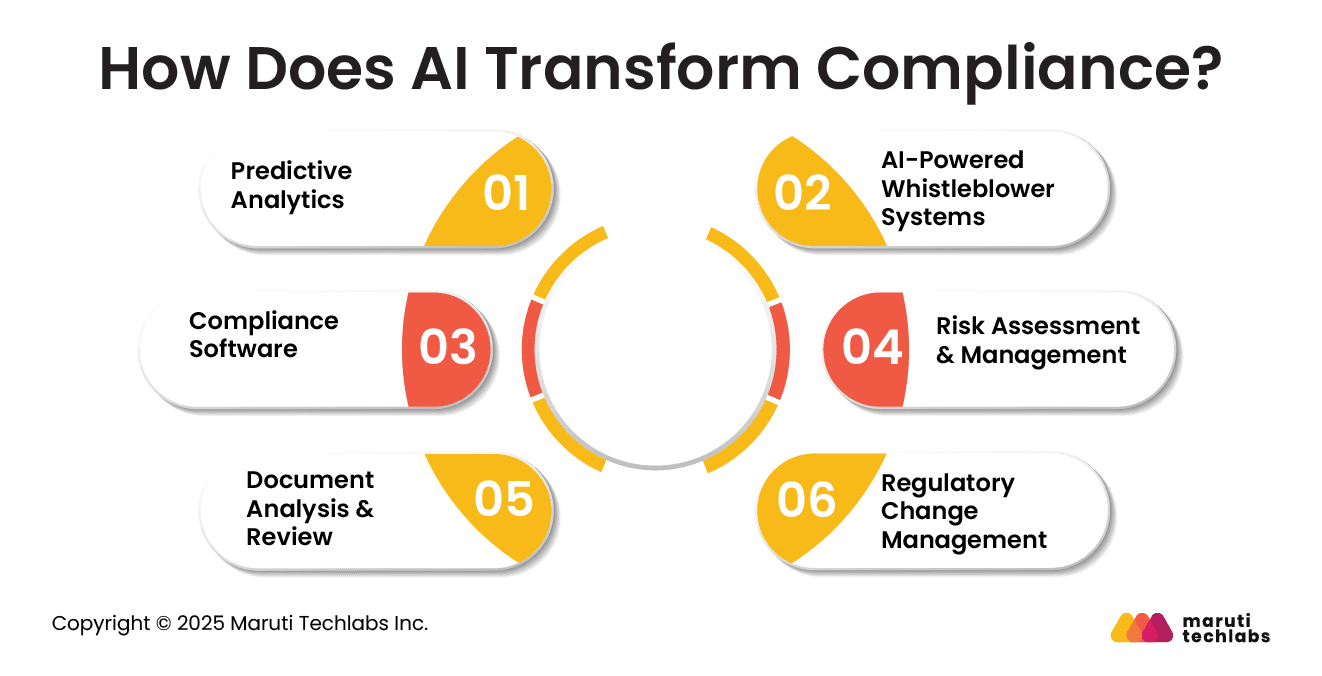

AI introduces agility and precision to revolutionize compliance practices. It enables organizations to uphold regulatory standards by offering perks like predictive analytics and real-time monitoring.

Let’s understand AI’s contribution to different aspects related to compliance.

AI is adept at analyzing historical data and predicting future compliance trends. It proficiently keeps tabs on regulatory updates and risk profiles to address issues beforehand.

For instance, AI can spot irregularities with transactional data, alerting teams to possible fraudulent activity or breaches.

Using AI, companies can design whistleblower systems that can detect misconduct within the organization. These systems generate reports that help investigate compliance issues swiftly. They also cultivate a culture of integrity.

Compliance software can minimize manual efforts by automating everyday compliance activities. They offer enhanced accuracy and efficiency in managing audit trails, regulatory reporting, and document reviews. It fosters timely adherence to regulatory requirements, allowing teams to focus on strategic initiatives.

AI tools proactively identify risks across operational domains. It suggests risk mitigation strategies by examining diverse datasets to identify emerging risks. These perks offered by AI allow organizations to maintain resilience and make informed decisions.

AI-integrated document analysis automates the review of a large volume of documents. It detects inconsistencies, extracts relevant information, and assesses compliance using technologies like machine learning and natural language processing. Subsequently, this decreases regulatory exposure, improves compliance efficiency, and speeds up document review.

AI-powered regulatory change management tools ensure companies stay compliant by tracking regulatory developments. These tools analyze legislative updates, decode regulatory texts, and share their impact on business operations.

They foster proactive adoption of compliance policies by mitigating regulatory risks in the evolving regulatory landscape.

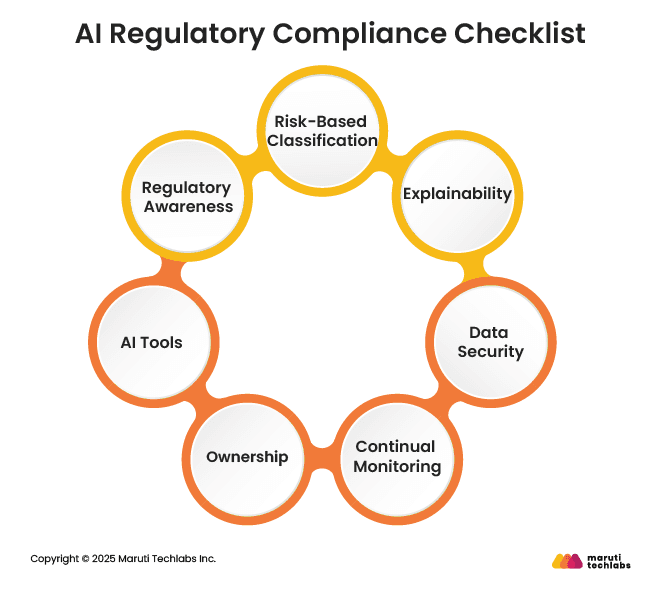

An AI compliance process isn’t something an organization wants to create on guesswork. Here’s a curated list of steps one should follow to meet global compliance standards.

Have you ranked your AI systems based on the risk they possess? For instance, it is used in finance, healthcare, or hiring.

Have you documented the logic your AI uses to make decisions? Can your team clearly understand and explain this logic?

Does your AI system adhere to regulations observed with HIPAA, GDPR, or the EU AI Act?

Do you regularly monitor your AI instances for compliance failures, abnormal behaviors, and performance drops?

Do your product, engineering, risk, and legal teams know their exact roles and responsibilities concerning your AI system?

Are you tracking compliance and managing audits using a regtech platform or regulatory compliance software?

Is your team up to date with the latest AI rules and regulations (ISO 42001, EU AI Act, China’s GenAI measures)?

As compliance requirements become more complex, automation tools are playing a crucial role in simplifying and streamlining the process. Here’s a list of top compliance tools that are empowering organizations to address compliance challenges effectively.

Centraleyes revolutionizes compliance with its AI-powered risk register. It automatically maps risks to controls across multiple frameworks, eliminating manual effort and ensuring accuracy.

The platform continuously updates scores, recommends remediation, and provides cross-framework visibility, vendor oversight, and audit-ready reports.

By unifying assessments, evidence, and integrations, Centraleyes empowers teams to manage compliance proactively. It efficiently streamlines risk management and scales programs with transparency, serving as a true partner in GRC, not another layer of complexity.

Now part of Archer, Compliance.ai simplifies and improves how organizations handle regulatory compliance. Its platform automatically tracks updates from multiple regulatory sources and links them to a company’s policies and controls.

With AI-powered dashboards and workflows, teams can quickly spot relevant changes, manage compliance tasks efficiently, and gain real-time insights. This innovative integration boosts productivity, reduces compliance risks, and helps legal and risk teams stay ahead of evolving regulations.

Now part of Equifax, Kount uses advanced AI to strengthen fraud detection and compliance. Its machine learning platform helps businesses monitor and manage risks across industries.

By combining decades of data with intelligent automation, Kount quickly screens global watchlists, including sanctions and PEPs. This approach saves time, improves accuracy, and ensures real-time compliance monitoring.

S&P Global uses advanced AI to make compliance management smarter and more efficient. Its Essential Intelligence® platform blends data, technology, and expertise to help organizations meet regulations and manage risk effectively.

AI-powered analytics and machine-readable data simplify monitoring and handling large information volumes. Tools like S&P Capital IQ Pro turn complex data into clear visuals and insights, helping businesses stay current with regulatory changes and strengthen their overall compliance strategy.

IBM uses its Watson AI technologies to automate and streamline workflows, promoting transparency and responsible data practices. With Watson's generative AI, organizations can quickly create detailed compliance documents like risk assessments and audit reports.

Machine learning algorithms power intelligent insights, helping teams understand regulations, link frameworks to controls, and take informed actions. This AI-driven approach improves efficiency, reduces risk, and helps businesses stay agile and compliant in an ever-changing regulatory environment.

Traditional compliance practices often rely heavily on manual processes, spreadsheets, and human judgment. This approach is time-consuming, error-prone, and struggles to keep up with the rapidly evolving regulatory landscape.

Organizations can face delays in identifying risks, missed updates, and increased operational costs, making compliance a constant challenge.

Artificial intelligence is changing this landscape by automating routine tasks, analyzing vast volumes of data quickly, and detecting potential compliance issues in real time.

With the support of Custom AI Development tailored to specific regulatory needs, AI can monitor regulatory changes, map them to internal policies, and provide actionable insights, allowing teams to focus on risk assessment and strategic decisions. AI’s ability to learn and adapt over time improves accuracy and reduces errors, making it more efficient and reliable.

At Maruti Techlabs, we offer Artificial Intelligence Services that have helped businesses harness the power of AI to streamline compliance processes, manage risks proactively, and stay ahead of evolving regulations.

Connect with us to explore how our experts can transform your compliance strategy today.

To understand where your organization stands in its AI adoption journey, try our AI Readiness Assessment Tool

— and take the first step toward smarter, AI-powered compliance management.

Compliance automation uses technology, including AI and software tools, to streamline regulatory processes.

It automates tasks like monitoring rules, tracking policy adherence, generating reports, and detecting violations. This reduces manual effort, improves accuracy, and helps organizations efficiently stay compliant with evolving regulations.

Expense compliance automation ensures that employee spending follows company policies and regulatory requirements. It automates expense reporting, verification, and approval workflows.

By using AI and automated systems, organizations can detect anomalies, prevent fraud, and maintain accurate records, saving time and minimizing errors in expense management.

Top trends include AI-powered monitoring, real-time risk alerts, integration with ERP systems, automated reporting, and predictive analytics.

Other trends are cloud-based compliance platforms, continuous auditing, and the use of machine learning to detect regulatory changes, helping businesses proactively manage compliance and reduce operational risks.

Tools like SAP Concur, Tipalti, Zoho Expense, and Coupa streamline billing compliance. They automate invoice processing, track regulatory requirements, verify transactions, and generate audit-ready reports.

AI and machine learning features in these tools enhance accuracy, prevent errors, and ensure adherence to internal and legal billing standards.