In the last two articles, we went over the key challenges faced by the Insurance industry while assessing how AI can assist the Insurance industry in fraud detection and claims management. This article looks at the confluence of AI, Blockchain and IoT for effective claims managements and fraud detection in the Insurance space.

Over the years, for Insurance companies, detecting multiple frauds during the insurance claims management process has been a very taxing process coupled with the typical challenges and unpredictable patterns.

To gain illicit favors from an Insurance company, some individuals may try to be inventive and commit illegal activities under the name of insurance cover. It mainly includes pretended incidents, exaggerated presentation of fake damages, false cause of accidents and more.

It is, therefore, a vital practice to build detection models that maintain a perfect balance between loss prevention savings and investment of false alert detection. Artificial Intelligence, in the most practical way possible, helps in improving the scenario for the Insurance industry.

For instance, the use of machine learning and AI contributes to the following:

- The technology’s smart, case-specific analytics model improves predictive accuracy

- Minimizes the enormous impact of false alerts and the resultant loss

- Intelligently processes various data sets to sense misleading or false claims

Here, we aim to examine a little deeper into different possible situations within the Insurance world and how AI’s superior predictive performance and learning ability come to assist in issue resolutions.

Potential areas to address with AI:

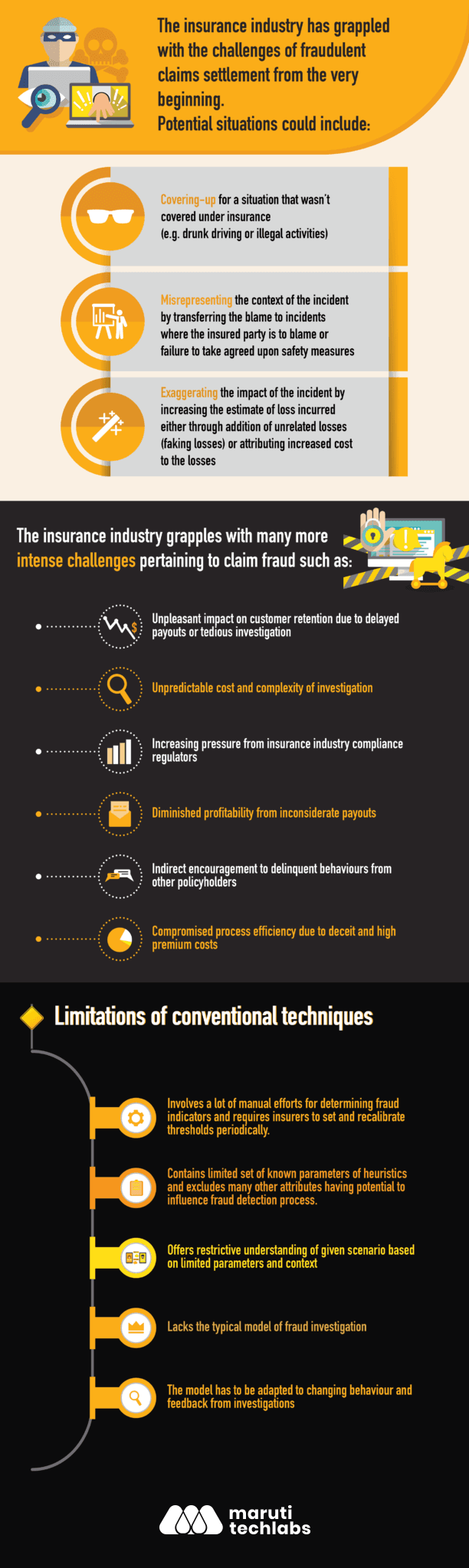

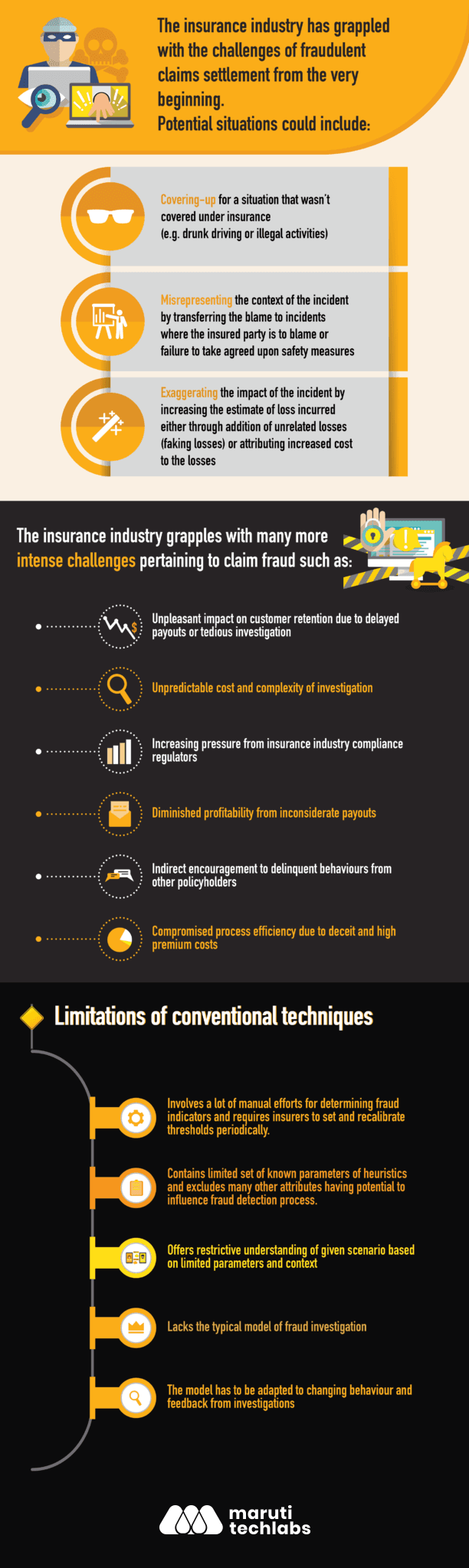

- Misrepresentation of incidents: Includes malpractices from the customer’s end like twisting the context of cover provided, holding accountable the nature of events instead of the irresponsible activities and/or blatant failure to take pre-explained safety measures.

- Soliciting excessive cover: In this scenario, insured individual attempts to cover-up the situation that was not covered in the policy such as driving under influence, reckless acts, and irresponsible behaviors, or illegal activities.

- Over-exaggerating the aftermath of incident: Customers solicit excessive favors by exaggerating the impact of the event and request the remittance for fake losses or increase cost against the damage incurred.

The insurance industry grapples with many more intense challenges pertaining to fraudulent claims such as:

- Unpleasant impact on customer retention due to delayed payouts or tedious investigation

- Diminished profitability from inconsiderate payouts

- Indirect encouragement to delinquent behaviors from other policyholders

- Compromised process efficiency due to deceit and high premium costs

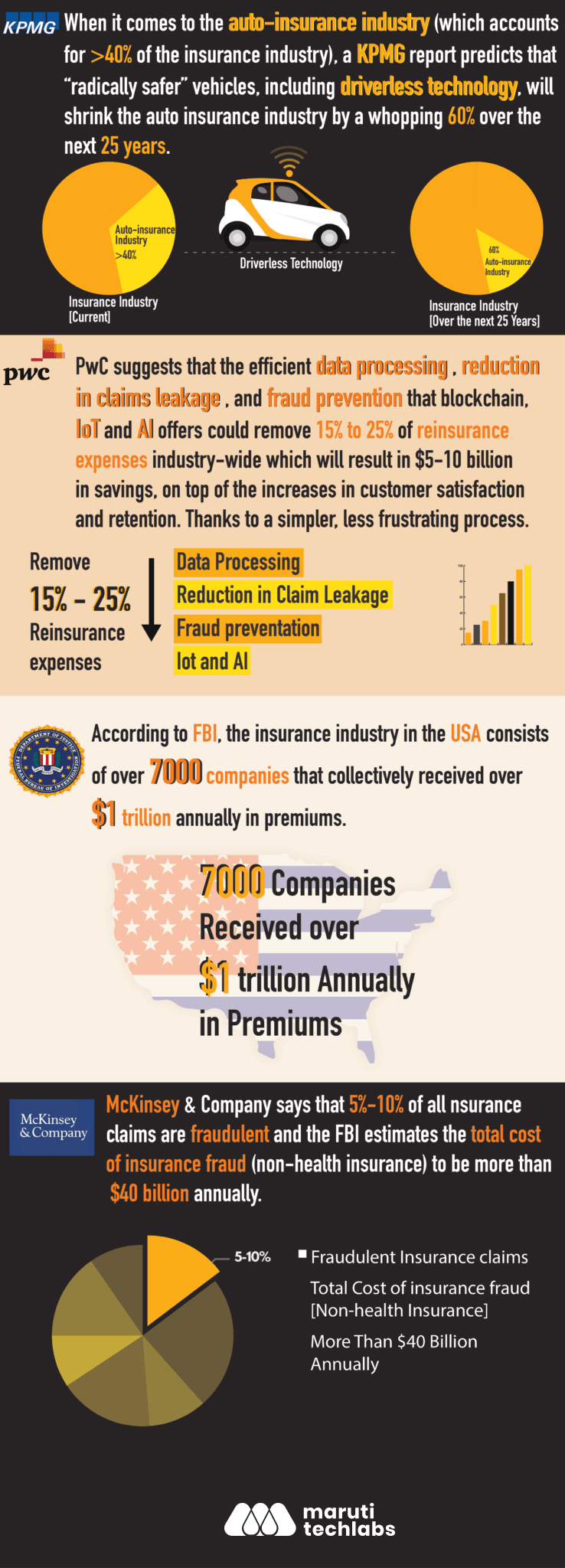

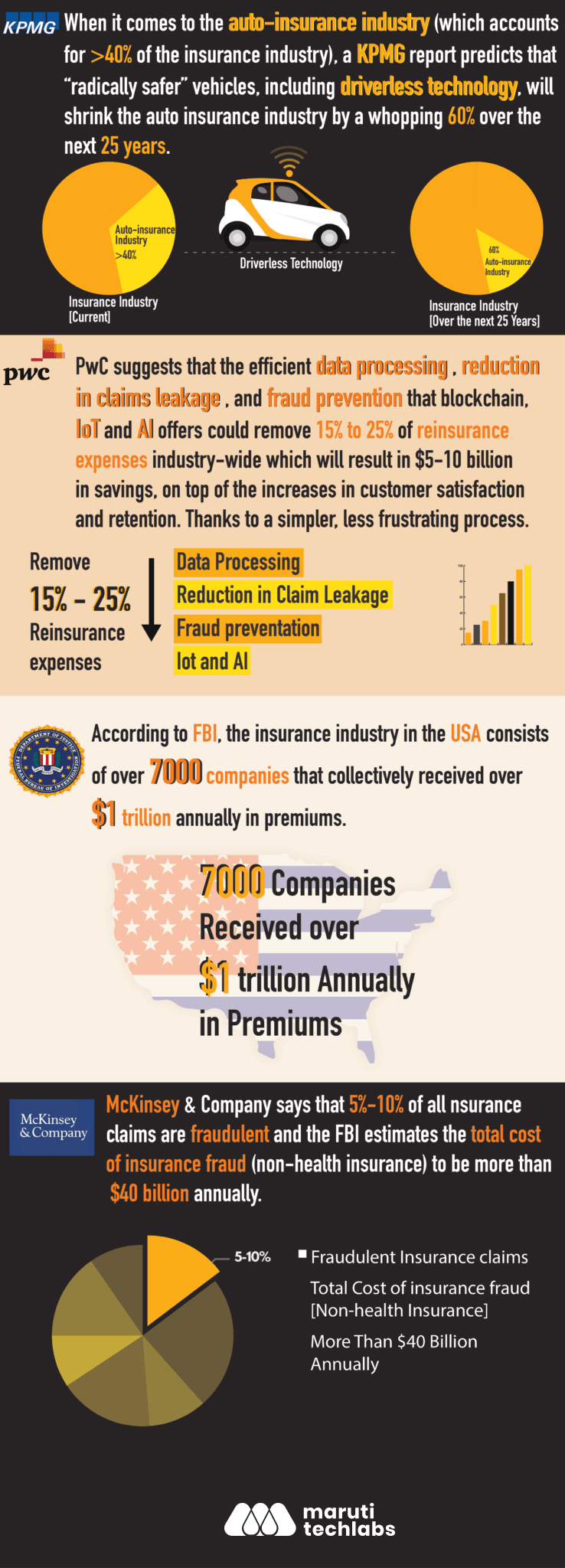

FBI reveals that over 700 insurance companies in the USA receive over $1 trillion annually in premiums, with the estimate of total cost of insurance fraud being more than $40 billion annually.

This goes to indicate how urgent it is to develop an intellectual capability to recognize potential frauds with higher accuracy and clear, clean cover claims rapidly.

Why depend on Machine Learning for Fraud Detection?

The traditional fraud detection techniques are limited in its reach and effect. Some of the traditional practices are –

- Heuristics for fraud indicators that help make decisions on fraud

- Defining specific rules that determine the need for further investigation

- The examination of scores and claims value to check the need for investigation

Limitations of conventional techniques –

- Involves a lot of manual efforts for determining fraud indicators and requires insurers to set and recalibrate thresholds periodically

- Contains a limited set of known parameters of heuristics and excludes many other attributes having the potential to influence the fraud detection process

- Offers a restrictive understanding of given scenario based on limited parameters and context

- Lacks the typical model of the fraud investigation

- The model has to be adapted to changing behavior and feedback from investigations

To meet these challenges of manual techniques, insurers have started turning to machine learning where the goal is to supply entire data sets to the AI algorithm without the relevance of different elements. Utilizing custom AI software development and machine learning, the system can develop an organized model based on identified frauds, which can then be leveraged to make wise decisions.

Blockchain and Insurance

Despite its touch-and-go start, Blockchain has been used by several industries on an experimental basis. When it comes to the InsurTech space, start-up companies especially have embarked on giving Blockchain models an optimistic go. Here’s what Blockchain is capable of doing for the Insurance giants:

- Creation of the new models Companies have started using Blockchain for a variety of verticals. For e.g., there is a new kind of travel insurance where travelers can insure their flight and, upon experiencing an official delay beyond a certain threshold, use the Ethereum-based cryptocurrency to enable instant payout.In 2015, InsurETH start-up blazed the trail in Ethereum-supported flight delay insurance and within 12 months, Etherisc became another start-up to develop a similar Blockchain-based product. In 2017, AXA, the French insurance giant started offering users a version of the blockchain-based solution, as well.Even though this is a small start, the impact is enormous nonetheless. Start-ups are the first ones to take the lead in this space and it is fairly evident that Blockchain technology is equipped to accelerate and sophisticate insurance process.

- Blockchain-enabled smart contracts Smart contracts aids in underwriting and claims management. If a person wishes to purchase a health policy and want to negotiate on premium rate, Blockchain can come up with the best possible solution. The person can give access to his health-related data including lifestyle habits, age, eating choices, exercise routine, employment type, and past and current medical records.This entire information will be uploaded and encrypted onto the insurer’s Blockchain which processes all the data for calculating a premium. The rate will be modified on a quarterly basis based on rules set in the smart contract and thus, Blockchain smartens health insurance premium process for both insurers and customers.

- Automating Claims Process According to the PWC report on benefit analysis, claims management will be at the top with the lowest barriers to implementation. Blockchain-based claims will process much faster than what brokers and insurers are engaged in currently by eliminating multiple manual verifications, duplications, and delay, ensuring easy availability of all the relevant data.According to a Deloitte report, with all of the customer’s health and medical information consolidated through Blockchain encryption, the process of life insurance, underwriting and applications will be accelerated to real-time completion.Although the revolutionary implementation of Blockchain will require existing insurers to adjust their processes and systems and invest significantly, forward-thinking newcomers believe that it will disrupt the insurance system for better.

Going from predictable behavior to actual behavior

The next decade of insurance market ought to adapt to the change that involves a tremendous shift from likely behavior to actual behavior of individuals when it comes to determining policy price. The move from the proxy to source data will redefine customer experience as well.

Wearables for better health plans

Consumers are also willing to support data analysis and accuracy with facial and biometric data. Troubadour Research and Consulting finds that almost half of consumers send data from their wearables to insurers for health insurance. Two recent start-ups BioBeats and Fitsense are handling wearables data of health insurance to personalize employee health plans.

AI interfaces for coverage personalization and customer onboarding

The three critical ways for AI technology to enhance insurance cover purchase experience are:

Chatbots: To truly personalize the conversation, chatbots can use advanced image recognition and social data. A survey by Accenture reveals that 68% of respondents depend on insurance bots in some segment of their business. Lemonade’s AI Jim and Geico’s Kate assist in settling claims whereas, the chatbot Next sells commercial insurance to personal trainers via Facebook Messenger.

Platforms: Custom platforms can automate personal identity verification and accelerate authentication for policy quotes. The life insurance start-up Lapetus started offering life insurance to people using merely a selfie. Lapetus can use facial analysis to determine risk scores without tedious medical process. The company follows SMILe (smoker indication and lifestyle estimation) approach to measure the effect of lifestyle habits like smoking cigarettes on lifespan.

Carriers: Through machine learning, customers can have customized coverage and receive fully online app-based insurance purchase experience. Customer delight is central to successful e-commerce. Allianz1 is a web interface in the Italian marketplace that provides most personalized experience to customers by allowing them to custom-make and mix their own insurance covers based on Allianz thirteen distinct business lines.

AI’s potential to settle claims faster and curb fraud cases

As covered above, customer satisfaction in the insurance industry depends on speed, experience, and efficiency. AI improves customer satisfaction by:

- Accelerating claim settlement: The rate at which claims are settled will be equivalent to customer delight. The time taken to pass claims will be an essential key to increasing customer retention as well.

AI definitely offers a competitive advantage and enhances performance metrics by increasing claim settlement speed. Lemonade’s AI Jim was incredible in settling a claim in merely three seconds. JD Power and Associates survey indicates how customers care a lot about the time to settle the claim.

AI is set to transform the insurance market ever so drastically. An Accenture survey back in 2017, found that 79% of insurance executives carry a positive belief that AI will revolutionize the information and interactions flowing between insurers and customers. - Controlling fraudulent activities: The significant decrease in fraudulent cases with intelligent solutions will bring terrific benefits to insurance companies in the long run.

To enable digital information flow between insurers and hospital in China, Zhong An leverages AI power to process a substantial mass of paper information of policyholders. On top of this, they use machine learning model to detect frauds, process hard copies and digitize information. Fraud detection is one substantial area where AI tech is rapidly adopted in the insurance domain. - The inevitable human touch: Despite the dominant role of modern technologies like AI, IoT, and Blockchain, it is important to cherish the pivotal role insurance agents play in the process. When consumers decide to protect their valuables, they do care to ensure they have a trustworthy human advisor to support and shepherd them down the path.

A survey published on Bizreport comes across the following facts:

- 60% of consumers resist interacting with AI for the fear that the technology might deny them an Insurance cover that a human agent might offer

- 72% of them said that they feel uncomfortable purchasing Insurance through a chatbot

- Nearly half of them emphasized on purchasing cover through human experience

Conclusion

Looking at the modern-day scenario, we can firmly conclude that in coming years, the confluence of Artificial Intelligence, IoT and Blockchain is going to make the Insurance industry automated, frictionless and highly controlled. Despite of being a newcomer, the way insurance companies have already begun embracing technologies; it is clear that Blockchain-based solutions are likely to be explored more in future to build custom products.

The process of buying insurance and filing a claim with a few right clicks is a compelling idea with boundless opportunities. As Michael LaRocca, CEO of State Auto Financial (STFC) had once suggested for fellow insurance executives, it is time we have to be ready for unexpected changes and feel its power, and those who lag behind in adopting it, may regress and lose their business.

It’s an exciting time for those working in the Insurance & InsurTech space. It is equally thrilling to see how technologies are cleverly disrupting the current traditional dynamics of the insurance system, making it more convenient, transparent and intelligent for both companies as well as consumers.

Partnering with a trusted expert in Custom AI Development can help insurers design intelligent, secure, and scalable systems that optimize claims management, reduce fraud, and enhance the customer experience.

Want to know how prepared your organization is to integrate AI, Blockchain, and IoT into your insurance operations? Try our AI Readiness Calculator to evaluate your current maturity and take the right steps toward digital transformation.