8 Best Practices for CTOs to Modernize Legacy Systems in Insurance

Over the past few years, modernizing legacy systems has become a common strategy among organizations. It has become evident that operations, marketing, and distribution processes are already transitioning to digital.

The insurance sector, in particular, has introduced numerous services and platforms to align with its competitors. However, evolving trends and consumer preferences propels insurers to practice a continual innovation curve.

A prime reason to introduce modernization to legacy applications is to compete effectively with startups in the insurance space. New startups don’t possess the limitations posed by legacy systems, providing users with a digital-first - anytime, anywhere convenience.

A World Retail Banking Report by Capgemini revealed that 95% of banking executives said legacy applications and core banking processes hinder their leveraging of data and customer-centric strategies. Additionally, 80% stated that poor data capabilities impact customer life cycle enhancements.

Insurance organizations constantly battle the perception of maintaining and continuing with legacy systems or opting for a complete digital makeover. To ease this confusion, we bring you this blog, which shares insights on the challenges, benefits, and best practices that insurers can employ when planning legacy app modernization.

Legacy systems are outdated hardware or software systems that organizations continue to use due to the substantial investment in developing these technologies or the challenges associated with replacing them.

Insurance companies haven’t historically been at the forefront of embracing emerging technologies. Additionally, their minimal investments in the technological space are fueled by following the ‘one-size fits all’ approach.

Compared to today’s latest technology, these applications are messy code mazes that are difficult to navigate, inherently slow, and costly to maintain. They are also incompatible with modern systems and vulnerable to cyber-attacks.

A significant concern with legacy systems is that they are created using old programming languages, which fewer programmers understand.For these reasons, insurance organizations seek efficient and secure legacy application modernization methods that don't compromise their business operations and core functionalities.

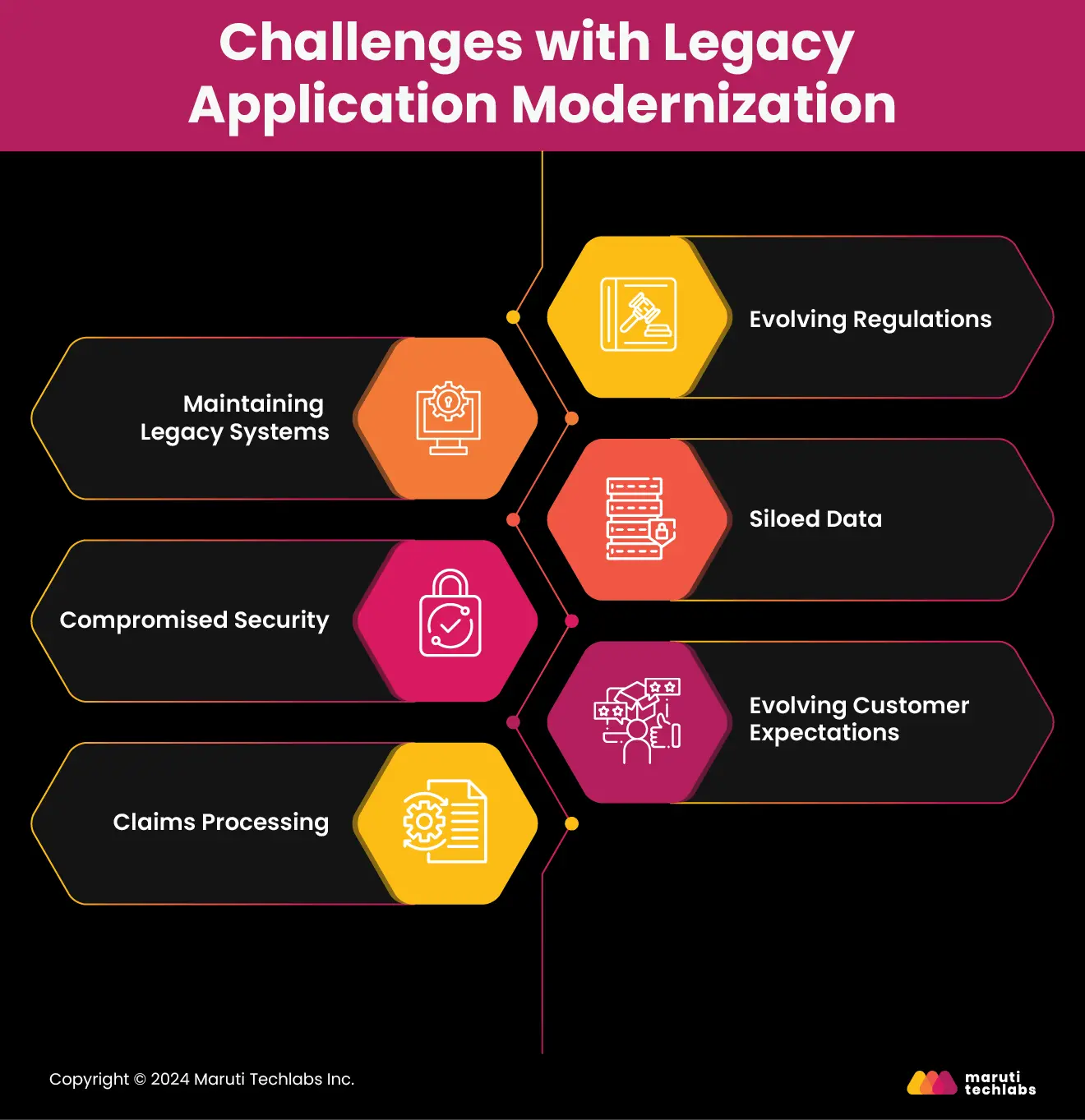

Let's begin by understanding insurers' most prominent challenges when planning legacy application modernization.

Many insurance organizations today are at a crossroads. Some try to keep their customers happy by offering a balance between their old systems while introducing new advancements per market demand. Others are considering revamping their legacy applications and processes to reinvent themselves as insurtech organizations. According to a survey by the EIS group, there was a 59% increase in investment in insurance companies' digital infrastructure in 2021. Here are some crucial challenges that insurers face with legacy application modernization.

Insurance organizations are experiencing a perpetual tide of transformation, which includes new capital requirements, educating customers about their digital investments, and factoring in the effects of climate change on risk assessments. Additionally, other regulatory priorities can change the fundamentals of insurance processes in the future.

The plethora of diverse regulations makes it challenging to ensure compliance, and there is an apparent lack of coordination between state, federal, and international agencies. Hence, insurers must adopt legacy application modernization to devise flexible systems incorporating immediate changes.

In response to the economic downturn post-COVID-19, insurers strategically reallocated resources by cutting costs while investing in areas such as enhancing customer experiences and restructuring business models.

Cost optimization and managing siloed data with legacy systems is arduous. Application modernization can aid this process. Subsequently, modern systems powered by microservices are easier and cheaper to maintain.

To achieve this, insurers can take an iterative rather than a complete rip-and-replace approach. This makes it easier for insurance companies to allocate resources more effectively while employing a budget-friendly approach.

Another looming problem with legacy systems is their incompatibility with modern systems. Sharing crucial information, like policy and claims details, with other devices or programs can become challenging. Modernizing this infrastructure can help foster active communication between different systems, offering seamless integration and accessibility.

Insurance organizations face data vulnerability due to the extensive data they handle. Cyber attackers today use sophisticated methods to weave a trap that one can easily fall prey to. Additionally, old IT systems pose an even greater risk by not shielding customer data with the latest cyber advancements.

Leveraging modernized infrastructure empowered with the latest cybersecurity tech adds layers of security and enables insurers to employ new security practices across the company.

Modern consumers are accustomed to the conveniences and enhanced customer experiences of technology, particularly in sectors like banking. This has raised their expectations for insurers to adopt a similarly tech-driven approach.

Catering to a massive user base with lightning-fast services using legacy systems is next to impossible. Insurance organizations need to equip their applications with microservices to stay competitive and fulfill consumer expectations. Microservices offer tiny and independent building blocks that can be rolled out, giving insurers the freedom to develop and deploy at their will.

Sharing quotes on the go with customers is a must for insurers as it accounts for more sales. However, offering quick quotes is difficult without investing in modern-day techs like artificial intelligence. Modernizing these processes with automation adds speed and digitization to claims processing. It directly contributes to customer satisfaction while exponentially boosting engagement.

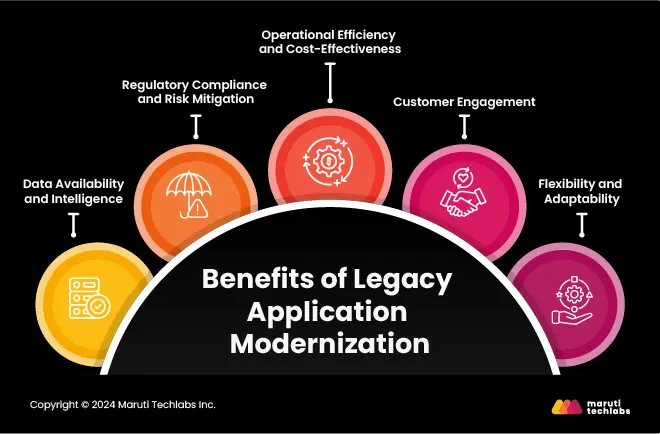

Insurers can unlock various benefits by leveraging the power of emerging technologies. Here are the top benefits presented by IT modernization in insurance.

Legacy systems are often slow, prone to maintenance, and difficult to work with. Upgrading them can initially seem costly, time-consuming, and effort-intensive but can yield exponential benefits moving forward. The advantages include simplified and automated processes, enhanced accuracy, no data duplication, and improved resource management. These gains subsequently offer significant financial savings in the long run.

The legacy system prohibits insurance organizations from presenting a frictionless end-to-end experience with no room for personalization. Modernizing includes leveraging techs such as artificial intelligence (AI), Machine Learning (ML), and data analytics to reap benefits such as learning customer behavior and preferences and efficient risk assessment. It also offers a personalized experience by learning user preferences, quicker claims processing, and increasing customer engagement and loyalty.

Like other industries, the insurance sector is constantly transforming to stay ahead in the evolving digital landscape. Legacy systems lack the capability and agility to adapt and offer exclusive digital experiences. Adopting emerging technologies gives insurers the flexibility and adaptability to address changing market demands and capitalize on new opportunities.

The insurance industry's dynamic regulatory landscape makes it difficult for legacy systems to stay updated. Upgrading modern technology ensures timely updation and incorporation of compliance structures and security measures. By employing constant regulatory compliance, monitoring, and adept risk management, insurers can better address legal and reputational hazards caused by non-compliance.

Unlike modern systems, legacy systems do not have a single centralized database to store all the data, making it difficult to share information within organizations. Application modernization creates intelligent systems where insurers can gather, analyze, and share data. This helps them make intelligible decisions using valuable information that identifies consumer trends.

Planning insurance legacy system modernization involves many strategies, but a few basic practices can ensure a successful upgrade. Let's briefly explore them.

Replacing legacy systems with the latest tech requires a strategic approach. This method must include intuitive learning and a smooth transition from old to new business methods. Insurers who are unsure where to begin can transform individual processes.

For instance, if you wish to enhance your underwriting performance, you should use artificial intelligence to automate administrative tasks.

Whether you want to introduce a big or a small change, its success rate depends on how your leaders endorse it. A survey from Prosci demonstrates that with strong support from the company's leaders, 76% of projects met expected objectives. However, this process is cumbersome for insurers. From stakeholders to end-users, they must consider everyone while upgrading old systems.

When planning to update the insurance legacy system, insurers must aim to transform business operations completely in the long run. Incorporating such massive changes in the tech infrastructure requires insurers to have a strategic bird's-eye view of executing these developments.

Insurance organizations that rely on legacy systems would need a systematic approach to modernization. Making significant developments at once would disrupt everyday business and prove extremely costly. Hence, a thorough plan should state which applications need immediate modernization and which can be modernized later.

Legacy applications are unique. While some may only require minor adjustments, others demand a complete overhaul to guarantee lasting benefits. Hence, insurers must evaluate particular applications separately when rehosting, re-platforming, or refactoring.

Even a slight alteration in some foundational systems can trigger a domino effect, leading to unprecedented disruptions. Overlooking these dependencies to fuel quick modernization can result in substantial system downtime and business loss. To make this a seamless transition journey for end-users, insurers must map all dependencies to avoid probable disturbances.

Consumer data is paramount to insurance companies. Hence, insurers need a clear strategy when moving data from on-premise to the cloud environment, such as planning the transfer of migrations, format, and organization on the cloud and data accuracy.

Although modernizing legacy networks can ease processes, it directly impacts employees' work. Therefore, insurers must frequently engage their workforce, set time frames for each functionality, and provide training or support for a successful transition.

Insurance companies must adapt to the digital landscape. This means updating processes to match changing consumer habits and market trends. Using modern infrastructure while leveraging valuable data stored in legacy systems is essential.

Modern infrastructure enables insurers to become more efficient, customer-centric, and innovative, allowing them to quickly adapt to changing consumer demands and market conditions. By integrating advanced technologies with existing data, insurers can gain deeper insights, make data-driven decisions, and thrive in a fast-evolving industry.

We at Maruti Techlabs understand the importance of legacy systems, which hold your business together and are the product of years of investment. Therefore, it's not possible to make sudden transitions.

We offer a customized enterprise application modernization approach to ease this process, catering to your unique business objectives and budgets. Through thorough planning, we ensure that all your data and essentials from the previous system are systematically migrated and organized into your new infrastructure.

Connect with us and start your digital transformation today.

While legacy systems may have benefited insurers in the past, today’s insurers have to adopt modern technologies and tools. Here’s how legacy systems pose numerous problems.

Legacy systems have a hard time offering the desired flexibility and processing speed. Modernizing outdated systems in insurance can streamline business operations and reduce the time and resources needed for tasks like: